AJ Gallagher

-

Scott Cobon resigned from Artex in September last year after 10 years of service.

-

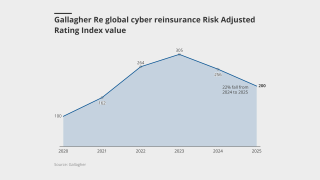

Investor appetite for bonds is exerting pressure on traditional retro providers, according to Gallagher Re.

-

New issuance will be supported by new sponsors as well as over $13bn in maturities.

-

There have been few retro exits despite softening amid cat bond competition.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

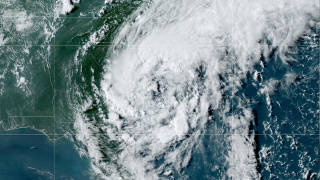

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The US accounted for 92% of all global insured losses for the period.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

Growth was driven by increased earnings and capital inflows.

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

The cat bond will provide coverage across multiple territories in Europe.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

Diversification in perils and regions can help the market grow.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.