AJ Gallagher

-

Scott Cobon resigned from Artex in September last year after 10 years of service.

-

Investor appetite for bonds is exerting pressure on traditional retro providers, according to Gallagher Re.

-

New issuance will be supported by new sponsors as well as over $13bn in maturities.

-

There have been few retro exits despite softening amid cat bond competition.

-

Non-loss impacted major property program rates were down by up to 20% at the renewal period.

-

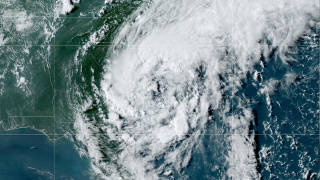

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The US accounted for 92% of all global insured losses for the period.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Redington provides services to UK pension funds, wealth managers and institutional investors.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

Growth was driven by increased earnings and capital inflows.

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Chief science officer Steve Bowen said it was still too early to provide precise insured-loss estimates.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The broker said it did not anticipate a slew of new entrants, with the possible exception of casualty start-ups.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

Sources said that Gallagher Re had ‘first mover’ advantage as the exclusive broker.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

The cat bond will provide coverage across multiple territories in Europe.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

Diversification in perils and regions can help the market grow.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

Retained earnings resulting from reduced loss activity also helped to boost ILS capital.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

This came as the broker earmarked “material softening” of minimum traditional rates on line.

-

Driscoll and Lubert have been promoted to presidents.

-

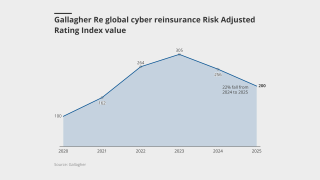

The vulnerability updates are the biggest driver of loss changes.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

The deal was brokered by Gallagher Re and provides US cyber insurance event protection.

-

The head of the ILS international team at Gallagher Securities Europe expects ILS issuance in the region to grow following rises in the European Central Bank rate.

-

-

Broker-dealers' year-ahead forecasts have undershot total final issuance in three of the last five years.

-

The firm’s reinsurance leader said over-subscriptions on cat reinsurance programmes have been driven by a psychological shift.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Artex hopes the rebrand will bring greater efficiency and a higher level of service to clients

-

Martin Ford joins the broker following a 26-year-stint at Gallagher Re, formerly Willis Re.

-

The senior retro/specialty broker spent 26 years at Willis Re, which was acquired by Gallagher in 2021.

-

Alexander will join after his competitive restrictions are up.

-

Climate change is causing an upward trend in losses, but it should not be conflated with the impact of seasonal variability, according to Gallagher Re.

-

The broker said that $100bn+ loss years have become the “new normal”.

-

Gallagher Re’s chief science officer warned that US SCS activity will keep rising.

-

Frontier’s employees, including director and co-founder Peter Brodsky and CEO Derek Winch, will remain in their current roles.

-

The broker’s half-year 2023 report said reinsurers’ RoE has surpassed the cost of capital for second year running.

-

The latest loss estimate is little changed from those in the reinsurance broker’s pre-landfall report Tuesday and aligns with estimates from Moody’s RMS pegging Idalia as a $6.3bn loss event.

-

Loss estimates from Aon, Gallagher Re, Swiss Re and Munich Re all point to a significant component of severe convective storm losses.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

The loss tally comes in 39% above the average for the 21st century.

-

The firm’s 1st View report on the July renewals also flagged that an oversupply of ILW capacity may bring down attachment points relative to early 2023.