Revenue and industry sector remain among the top drivers of divergence in cyber cat model outputs, according to Guy Carpenter’s latest study of vendor models.

The latest analysis also found that distinction in coverages results in divergence, but to a lesser degree.

Guy Carpenter has updated its original June 2023 analysis of cyber cat models offered by CyberCube, Guidewire Cyence and Moody’s RMS, after all three released updates to their methodologies and parameters.

The broker’s analysis of the three platforms last year produced a modelled loss in the range $15.6bn-$33.4bn for a 1-in-200 year global loss event, and $5.5bn-$24.4bn for a 1-in-50 year event.

The latest study did not provide updated figures, but noted that while there was some consistency over time in model divergence, modelled losses were not necessarily converging.

“Ultimately, the three model vendors have established their own methodologies and views of cyber risk,” the broker said.

Guy Carpenter aimed to re-examine variability across models, taking the scope of its earlier work and expanding it to include model divergence in the tail and technological information.

The outcome was to reaffirm revenue as the key driver of annual average loss (AAL) variability, with its close ties to cyber risks like business interruption and data restoration.

Small and micro-risk categories showed an elevated level of model divergence compared to the previous report. The reasons for this included CyberCube updating its footprint module based on new technology dependencies data. Meanwhile, Guidewire Cyence’s modelled losses for SMEs decreased significantly, based on research and market feedback.

Country of domicile became the second most impactful driver of model divergence.

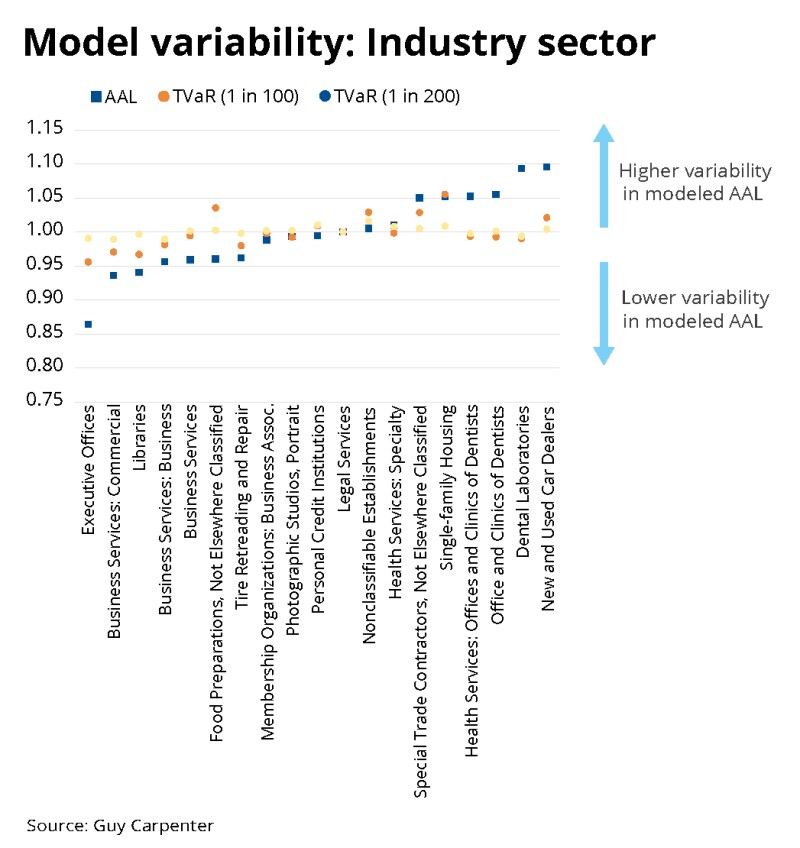

Industry sector moved from second to third most significant driver of AAL variability, with the latest data revealing healthcare as the top sectoral target for cyber attacks.

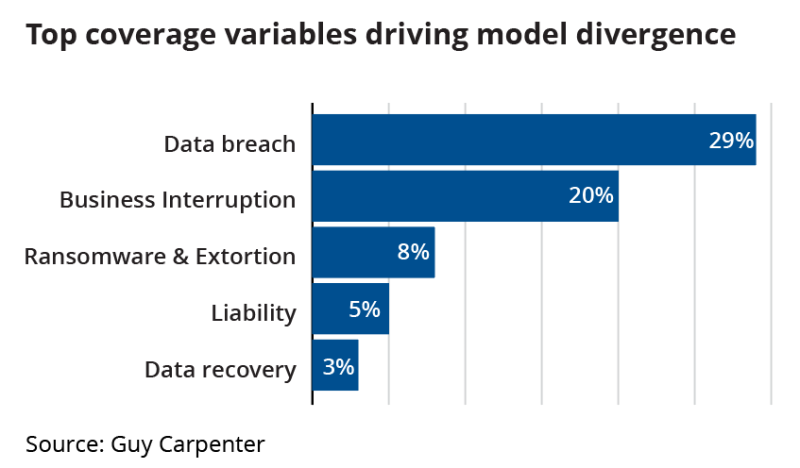

On coverage, Guy Carpenter found that some are more impactful than others when driving divergence in the modelling.

Ransomware, meanwhile, did not emerge as a large driver of divergence, despite being a big concern for cyber underwriters.

The model providers have heightened their focus on ransomware as a risk, and their views on the risk have better aligned as a result, Guy Carpenter said.

Guy Carpenter noted also that the updated models had moved away from data theft and breaches, and increased their focus on granularity in ransomware and cloud outage.

The cyber perils with the most impact continue to change. As of now, attritional losses from frequency ransomware are a focus for large aggregation events.

Tail events were adjusted significantly across the vendor models in their latest updates, which were not considered in Guy Carpenter’s prior study beyond their impact on AAL.

Refocusing the lens: An updated look at cyber model divergence noted that future periodic review of models is needed to better understand the impacts on divergence of the vendor models’ changing views.