-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Mory Katz joined the broker earlier this year.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The investment bank had stopped offering ILS services last September.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The transaction is expected to close later this year.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Matthew Towsey has spent 14 years at Aon.

-

US events accounted for more than 90% of global insured losses.

-

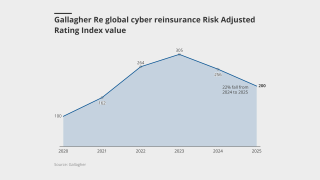

In the US, the index fell 6.7% year on year.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

Up to nine million acres of US land are considered likely to burn.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

Sykes has spent over 31 years with Aon, with the last 15 of those in Guernsey.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

The cat bond market surpassed $50bn by the end of Q1 2025.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

The executive worked in investment banking before joining the reinsurance industry.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

Derrick Easton has led Willis’s US ART team since joining the company in 2015.

-

Shreeve’s role will encompass the Aon Captive & Insurance Managers’ ILS business.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The broker also plans to hire from LSN Re and Aon Re, as part of a build-out of its team in the French capital.

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Paul Poschmann joins from Gallagher Re, where he was a divisional director.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker estimated ILS capital has reached $107bn.

-

The executive will play a key role in capital arrangements for Acrisure’s suite of underwriting units.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

Magnani has served for more than 14 years in ILS broking roles.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The facility will also provide a dividend to clients for the first time.

-

Tyler left Gallagher Re earlier this year.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Roman Romeo was named CEO of Reinsurance Solutions in Bermuda in April this year.

-

Richard Pennay will become CEO of Aon Securities.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

AI’s ability to analyse vast datasets will help in matching risk to capital.

-

Growth was driven by strong returns and new investors entering the market.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The broker said the mid-year reinsurance renewals benefitted from “more than ample” capacity.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

He will report to Kelly Superczynski, Aon’s global head of capital advisory.

-

The practice aligns existing capabilities from Marsh Specialty and others.

-

The former Ledger director was joined by fellow ex-Ledger employees to “hit the ground running”.

-

Juniper Re Bermuda received preliminary approval from the BMA last month.

-

The RfP covers the CEA and/or the California Wildfire Fund.

-

Driscoll and Lubert have been promoted to presidents.

-

The ILS executive will head up structuring for the Americas.

-

The challenger broker is continuing to build out its presence on the island.

-

The hire has 20 years’ experience in asset management and corporate finance.

-

The client lacked options in the conventional insurance market.

-

He is succeeded by interim co-CEOs Andrew Wheeler and Russ McGuire.

-

The broker platform has managed nearly $100mn of capacity.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The head of the ILS international team at Gallagher Securities Europe expects ILS issuance in the region to grow following rises in the European Central Bank rate.

-

While it is too early to determine the total financial loss, the US Geological Survey believes there is a 64% likelihood it will reach into the billions of US dollars.