-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Mory Katz joined the broker earlier this year.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The investment bank had stopped offering ILS services last September.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The transaction is expected to close later this year.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Matthew Towsey has spent 14 years at Aon.

-

US events accounted for more than 90% of global insured losses.

-

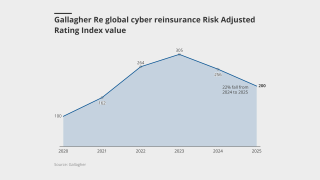

In the US, the index fell 6.7% year on year.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

Up to nine million acres of US land are considered likely to burn.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

Sykes has spent over 31 years with Aon, with the last 15 of those in Guernsey.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

The cat bond market surpassed $50bn by the end of Q1 2025.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

The broker has promoted Oriol Gaspa Rebull to global head of analytics strategy.

-

The firm also promoted Devin Inskeep to an expanded role as SVP, head of ratings and advisory.

-

Earlier today, Aon confirmed president Eric Andersen had stepped down from his role.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

The executive worked in investment banking before joining the reinsurance industry.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The executive spent a brief period at Wakam in a capital and reinsurance role.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Bolding will focus on aligning Gallagher Securities with Gallagher Re.

-

Derrick Easton has led Willis’s US ART team since joining the company in 2015.

-

Shreeve’s role will encompass the Aon Captive & Insurance Managers’ ILS business.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The broker also plans to hire from LSN Re and Aon Re, as part of a build-out of its team in the French capital.

-

Graeme Bell (pictured) will continue in his role as group legal officer.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

Paul Poschmann joins from Gallagher Re, where he was a divisional director.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker estimated ILS capital has reached $107bn.

-

The executive will play a key role in capital arrangements for Acrisure’s suite of underwriting units.

-

The reinsurance veteran joins from Artex Risk Solutions.

-

Magnani has served for more than 14 years in ILS broking roles.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The facility will also provide a dividend to clients for the first time.

-

Tyler left Gallagher Re earlier this year.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Roman Romeo was named CEO of Reinsurance Solutions in Bermuda in April this year.

-

Richard Pennay will become CEO of Aon Securities.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

AI’s ability to analyse vast datasets will help in matching risk to capital.

-

Growth was driven by strong returns and new investors entering the market.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The broker said the mid-year reinsurance renewals benefitted from “more than ample” capacity.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

He will report to Kelly Superczynski, Aon’s global head of capital advisory.

-

The practice aligns existing capabilities from Marsh Specialty and others.

-

The former Ledger director was joined by fellow ex-Ledger employees to “hit the ground running”.

-

Juniper Re Bermuda received preliminary approval from the BMA last month.

-

The RfP covers the CEA and/or the California Wildfire Fund.

-

Driscoll and Lubert have been promoted to presidents.

-

The ILS executive will head up structuring for the Americas.

-

The challenger broker is continuing to build out its presence on the island.

-

The hire has 20 years’ experience in asset management and corporate finance.

-

The client lacked options in the conventional insurance market.

-

He is succeeded by interim co-CEOs Andrew Wheeler and Russ McGuire.

-

The broker platform has managed nearly $100mn of capacity.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The head of the ILS international team at Gallagher Securities Europe expects ILS issuance in the region to grow following rises in the European Central Bank rate.

-

While it is too early to determine the total financial loss, the US Geological Survey believes there is a 64% likelihood it will reach into the billions of US dollars.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Top-layer cat risk is attracting additional capacity but reinsurers remain firm on attachment points, the broker said.

-

Bohm joins from Swiss Re Capital Markets, where he was head of structuring for the Americas.

-

Mark Shumway joins from Howden Capital Markets, where he has been managing director since 2020.

-

The leadership change follows Howden’s landmark acquisition of TigerRisk at the beginning of the year.

-

Nichols joins from Aeolus Capital Management, where he’d served as a portfolio manager after previously spending nearly a decade at Guy Carpenter.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

Skilton will be chair of the team with Wheeler and Murray heading up the global re specialty unit.

-

The specialty leader had worked at recent acquisition Willis Re since 1998.

-

Former retro broker Erik Manning is leading the initiative having joined BMS Re in January.

-

Minesh Jani will report to Bradley Maltese, CEO of international and global specialties.

-

Bay Risk will become part of Gallagher Re’s Global Programmes practice group, led by Andrew Moss.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

Their view that “investors have never had it so good” speaks of a market in an upbeat mood as of January.

-

The outgoing McGill and Partners head of structured solutions will become CEO of Augment after fulfilling his contact at McGill.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

The broker is looking to solve the severe capacity crunch for its clients as rising demand meets falling supply.

-

Paul Shedden joins from Sompo International, where he was head of portfolio design, pricing and analytics – global insurance.

-

Jason Bolding adds to the growing team recently joined by Alexandre Delacroix and Keshav Gupta.

-

The CEO said the (re)insurance industry is not doing enough to meet the climate challenge ahead.

-

The broker said it would help clients to think creatively and act quickly in accessing capital.

-

The broker said some reinsurers were planning for significant growth in property catastrophe as demand is expected to pick up pace.

-

The former Gallagher Re broker is the second departure from the firm in Bermuda since the Willis Re sale.

-

The appointment to the ILS unit follows news of Howden’s move to buy TigerRisk.

-

The property reinsurance underwriter had joined Axis Re’s London team three years ago.

-

The rate-on-line index rise is the steepest uplift in 16 years.

-

Its total risk transfer programme is sized at just over $9bn, down $400mn from year-end 2021.

-

The scope of McCann’s new role spans across various property segments, including retrocession.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

The intermediary’s reinsurance solutions business has appointed Joanna Parsons as it looks to expand its capital advisory unit.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

The broker said its capital markets unit would be “fully aligned with the broking and analytics teams.

-

The state insurer expects to face a 29% increase in its premium rates, driven by exposure growth.

-

TigerRisk Partners has added two new brokers to its delegated authority business, including entering the Australian market as it appointed Simon Chandler as head of reinsurance broking programmes and binders.

-

The broker’s appointment of Jim Fiore follows his decision last year to leave QBE after nearly 30 years at the carrier.

-

Michael Fitzgerald has also been promoted to head of the firm’s North Carolina office.

-

The broker and ratings agency AM Best said total deployed capital grew 2.7% in 2021.

-

At Lockton Re, Cheney spent the last 18 months as senior broker and co-leader of its property practice.

-

European loss experience drove the firm’s index back in line with 2014 levels.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Madison Dearborn has increased its shareholding, while HPS has reinvested.

-

The BMS meteorologist said early data indicated “truly historic outbreak”, and that similar events typically cost the industry in the low-single digit billions of dollars.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

The target firm deals in engineering, energy, P&C and specie.

-

The partnership seeks to help response and recovery organisations manage the “entire lifecycle” of a catastrophe.

-

Insured losses from severe weather events in the US are on course to exceed $20bn, following the second highest October tornado tally on record, according to a report from Aon.

-

The broker said that weather-related losses had become more severe in the past decade because of climate change.

-

Lockton Re has hired James Boon from Aon to work as a senior broker in the expansive non-marine retrocession and property specialty division.

-

The broking group has hired Sussex Capital’s Adam Champion and investment banker Niall Baird for the new venture.

-

Howden said passing risks onto governments would degrade the value of the insurance industry.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

The company has also confirmed that new recruit Tim Ronda will join as president later this month.

-

The former Aon US reinsurance president will join the challenger broker in just two weeks.

-

Tim Ronda was president of Aon’s US reinsurance business and was recently given a new global leadership role.

-

The Willis solution is designed to help companies access insurance as they transition to a low-carbon business model.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

He spent more than seven years as vice president of the firm’s capital markets and advisory division.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

The broker must ensure it is “leaving no stone unturned” in its search for capital, according to president and CEO of North America Pete Chandler.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

BMS Re seeks to consolidate its presence in key areas such as Florida, Los Angeles, North Carolina and the greater Boston area.

-

The reinsurance broker will work in tandem with wider Marsh McLennan companies to provide an integrated service.

-

The new broker will sit within Steve Hearn’s capital solutions division.

-

The facility is the second in South America for the firm, which established a local presence in Argentina in 2016.

-

Frederick Streeton will join in September from Liberty Mutual Group, where he was head of underwriting strategy for the its global risk solutions business.

-

Trading Risk reported last year that the Aon executive had resigned to join Lockton.

-

The AJ Gallagher CEO said rate increases are providing tailwinds while the M&A pipeline remains strong.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The model uses research and technology to provide insurers with a more in-depth view of risk when submitting risk filings in Florida.

-

Davies most recently served as head of global Re specialty Bermuda for the firm’s reinsurance division.

-

The executive will take on the role of chairman of retro, property specialty, Bermuda and market capital.

-

The company said the funds raised would kick-start its effort to become a full-stack insurer.

-

The new finance chief arrives from cyber InsurTech Resilience, where he was CFO, having previously spent 23 years at JLT.

-

The executive had previously been the head of third-party capital at Axis.

-

The transaction will create London’s largest independent specialty and wholesale broking business.

-

He is expected to join the firm’s property reinsurance broking team after his gardening leave ends.

-

The reinsurance broker is looking to recover over £10mn and impose an injunction to ensure the return of confidential information.

-

Around 15 producing brokers are on the move, with a number from the non-marine specialties team.

-

The broker says the ILS alliance will "meaningfully increase" its capacity in three segments.

-

Marcus Foley joins the Bermuda office, while Tim Radford will work in London.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

The executive’s hire continues a run of talent that has joined BMS in the past year.

-

Along with its reinsurance platform, the company plans to help brokers hold in-house auctions.

-

The intermediary cited Convex and Vantage among new entrants adding capacity to the market at the renewal.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

The move is part of a wider expansion in BMS’s reinsurance broking capabilities.

-

By year-end some bonds were trading at above-par levels that put implied spreads 15%-28% lower than mid-year when the deals were issued.

-

The new capacity for the sidecar first launched in 2019 will be invested solely in EBRD bonds.

-

The new classification will allow the carrier to increase GWP and third-party risk.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

Slew of maturities and competitive pricing environment make the cat bond market attractive for sponsors, brokers say

-

Centeno has three decades of insurance experience and focuses on D&O, M&A and tax liability cover.

-

Tougher positioning by reinsurers at the 1.1 renewal accelerated the practice of placing business at differentiated terms, Irvan said.

-

The deal “may reduce choice” for cedants in choosing reinsurance brokers, the EC said.

-

The Lloyd’s CEO said it was not for business to set the tone on climate, as the Corporation laid out its first ESG report.

-

With a low initial expected loss of 0.25%, the notes offer a substantial 11.6x multiple.

-

The pact is Tremor’s first integration with a global broker.

-

The broker will operate as Acrisure Re and Acrisure London Wholesale.

-

Former president Widdicombe has taken the role of chairman, as planned, but won’t serve on any board committee.

-

The $100mn+ Bonanza deal is the Floridian’s third foray into the cat bond market

-

The busy storm season, Covid-19 uncertainty and a hardening market are driving demand.

-

The cyber insurance sector is set to grow to $20bn by 2025, the broker said.

-

Nearly 80% of respondents said underwriting capacity decreased in the quarter.

-

Purchasing the analytics firm will help Willis meet growing demand for climate change services.

-

The new hire comes after a slew of senior appointments made by the start-up in recent months.

-

The exec was speaking after the broker was acquired by Cinven and GIC in a multi-hundred million deal.

-

Industry veteran Payne was most recently at Credit Suisse Lloyd’s syndicate Arcus.

-

The division brings together carriers and MGAs, while providing capital advisory, analysis and modelling support.

-

BMS plans to expand into the retro sector but will avoid being drawn into bidding "frenzy".

-

The CEOs of Aon Reinsurance Solutions, Willis Re and TigerRisk predict limited rate gains, but up to $10bn of incoming capital.

-

Piccolomini and South pick up Advisory, while Clarke will head up global placement.

-

Lawrence Po-Ba was hired by the firm to source capital solutions for Lloyd’s syndicates in May.

-

The broker specialises in North American P&C and transportation risks on a facultative and binding authority basis.

-

Storm surge losses are expected to remain under $500mn.

-

The companies claim “overwhelming” investor support at meetings today.

-

The new arrival will be an executive committee member and report directly to president and CEO Peter Hearn.

-

Retro specialist Richard Wheeler will head the unit, which will focus on sourcing third-party capacity.

-

The platform allows brokers to manage reinsurance deals from offers to execution.

-

Following two decades at Aon Benfield, he will join Lockton sometime next year after his gardening leave.

-

The broker also confirms the appointment of James Goodwin as head of power and mining.

-

José Manuel González becomes CEO of Howden Broking Group, with Rugge-Price named chair.

-

The executive director of treaty could depart in October, sources suggested.

-

Cat programmes have been completed this year, but a heavy hurricane season could shake up the market, the broker said.

-

The leadership shake-up comes after Gallagher completed its purchase of the company in January.

-

The investment hit to the industry has nearly been erased, while capital raising is approaching the scale set by the class of 2005 start-ups.

-

His departure marks the fifth senior retro broker to leave Aon in recent weeks.

-

Staff will receive an additional 5 percent of the withheld amount on top of the salary they agreed to forgo.

-

People moves in the ILS marketplace.

-

LiquidX is a trade finance and trade credit insurance exchange that has executed more than $21bn in trades since 2016.

-

Covid-19 claims could make the year the most expensive on record, the broker warns.

-

The restructure of finances also brings CDPQ in as debt provider and lines up a £300mn+ M&A war chest.

-

Jeremy Lee had been at Aon and Benfield for over 22 years.

-

New names being discussed by sources include KKR, Madison Dearborn, Carlyle and Cinven.

-

The scheme could see claimants in different sectors offered pence per pound of limit purchased.

-

The former Everest Re CEO will join the firm after a major US hiring spree.

-

Former Securis executive Lawrence Po-Ba will focus on sourcing capital solutions for Lloyd’s syndicates.

-

Renewals could help cat bond spreads return to pre-Covid levels, the broker added.

-

The deal will “capitalise on a dynamic competitive landscape and continue our strong growth trajectory”, Rod Fox says.

-

Establishing federal backing would allow insurers to cede risk to central government.

-

The company's CEO said the platform aims “to make the traditional broker business model a thing of the past”.

-

With up to $4.5bn of anticipated volume in the works, ILS broker-dealers are waiting to see how multi-strategy sellers will impact the primary market.

-

The policy would have likely paid out due to the coronavirus crisis.

-

But the merger will still create opportunities for rival brokers to claim market share.

-

Having a $20bn-revenue organisation would create the ability to invest more heavily in new solutions, including tech.

-

The broker said it was considering next steps for the wholesale arm to maximise its growth.

-

The former Aon retro broker was previously CEO of the UK arm at Fidelis.

-

The deal covered Turkish earthquake risk.

-

Aetna Life achieved its lowest coupon ever on the Class A tranche.

-

ILS broker-dealers’ forecast cat bond issuance will range from $8bn to $11bn this year, reclaiming ground lost in 2019 when annual volumes plummeted more than 40 percent year on year.

-

Intermediaries called the renewal “asymmetric” and “divergent” as rates began to move up after a pressured few years.

-

Alternative capital made up $60mn of the capacity Tremor priced last year, the company announced.

-

The broker’s 1st View report highlighted diverging reinsurer tactics and segmented renewal outcomes.

-

The start-up broker said in an update that it is on track to hit $250mn of premium flow next year.

-

We have written a bit about how certain (re)insurance business lines, such as retro, are struggling for capacity right now, but another noteworthy development is that some types of structures are also requiring major efforts to shore them up.

-

Deal pricing mirrors that of Covea’s traditional reinsurance contracts, according to the broker.

-

John Turner will report to Ed Bermuda CEO Chris Bonard in his new role.

-

The executive will be taking up the position of chief property officer for US reinsurance.

-

Aon’s plan to launch an auction platform in time for 1 January 2020 suggests a struggle is underway in the reinsurance space for the position of auction technology market leader.

-

Some 15 percent of cat bonds on risk will mature in Q2 next year.

-

The CEO was speaking as Aon launched a new auction platform in Monte Carlo.

-

David Priebe has been promoted from the role of vice chairman.

-

The executive left Aeolus last year having been with the fund manager since 2009.

-

The former JLT Re analytics head will be running Hyperion X Analytics, a joint venture between Hyperion X and Hyperion group.

-

Chris Beazley’s role has been expanded to include head of reinsurance for MS Amlin after his departure.

-

The organisation’s latest data showed a further acceleration in rate rises as the line strengthened for the eighth consecutive quarter.

-

The law creating the $21bn fund to be administered by the California Earthquake Authority was passed in July.

-

CAC Specialty aims to bring structured finance solutions with insurance broking capabilities.

-

Conan Ward was chairman of the broker’s US and Bermuda specialty business.

-

CEO John Carolin described the introduction of the system as a “pivotal moment” for B3i.

-

The London market association warns of “significant” costs in the event of no deal.

-

Carrie Kelley has also worked at Bowring Marsh Bermuda, Guy Carpenter Bermuda and Marsh USA in Chicago.

-

The platform, led by Chris Bonard, was initially announced by Ed Broking back in December.

-

The reinsurance broker’s CEO James Kent also said the ILS market reaction to HIM loss creep has varied widely.

-

The executive will move back to broking after nearly two years at Axis Capital.

-

This comes as Lockton has also been on a recruitment drive to boost its reinsurance division.

-

The deal valued BMS at £500mn and is expected to close in the third quarter.

-

The insurer placed less coastal aggregate cover than originally planned.

-

Mills joins from Hampden Agencies and will report to managing partner Neville Ching.

-

Rising Jebi losses will contribute to a squeeze on capacity.

-

The start-up went live in May with the name McGill & Partners.

-

Brad Melvin and Bruce Selby Bennett have been given new roles at the broker.

-

Insurer adjusts programme to seek slightly more aggregate and less “sliver” reinsurance cover.

-

Everest Re and RenaissanceRe have given their support to the initiative.

-

The Tampa-based broking start-up was launched last year by Ted Blanch.

-

Bredahl resigned as CEO of Third Point Re this month having held the role since 2017.

-

The 25-year Aon veteran has taken on the role of US vice chairman of reinsurance solutions.

-

The former chairman of JLT Re, Ross Howard, is to retire from the business later this year.

-

The broker stated that significant further capital may be deployed at a later stage to support expansion.

-

The aggregated 2018 results of 23 carriers showed a significant improvement in underwriting profit.

-

Chris Demuth was previously a vice president at JLT Capital Markets.

-

He will be replaced in the role by partners Jarad Madea and Stephen Fromm.

-

The relationship between Florida insurers and their reinsurers is obviously going through a rough patch. It makes you wonder whether the role of brokers this year might be akin to that of marriage counsellors.

-

Kevin Feldman joins from Guy Carpenter, where he was a managing director.

-

What does it say about the insurance market that for every new fund or facility that is launched as a passive or index tracker-style initiative, it seems that another existing one is unwound?

-

The division will be led by former Guy Carpenter executives.

-

Irish regulations required an early announcement from the firm that it had considered a deal.

-

A deal would take the combined entity to the top spot by (re)insurance broking business revenue.

-

-

A new boutique (re)insurance broker set up by former Aon president Steve McGill is looking to launch in the second quarter, sister publication The Insurance Insider reported.

-

The CEO also predicted that (re)insurance conglomerates will take the lead on developing ILS platforms rather than sole insurers.

-

The UK regulator said it had no significant worries about market competition but that areas for improvement remain.

-

Hurricane Michael generated a larger loss for the carrier than 2017’s Irma.

-

The broker said new capital inflows to the sector also reduced from the levels seen last year.

-

The JLT index is below levels recorded in 2016 and around 30 percent below 2013 benchmarks.

-

ILS broker-dealers expect 2019 cat bond issuance to range from $7bn to above $10bn.

-

The reinsurance broker said it was difficult to measure how much capital had been trapped or lost.

-

The broker said deployable ILS capacity could become more broadly constrained, but equally there were signs capital could increase.

-

The insurer is exploring using the vehicle for a quota share as well as access to the firm’s Syndicate 5623.

-

Rick Pagnani was most recently CEO of Everest Re’s Mt Logan vehicle.

-

Looking ahead to the rest of the year and 2020, how likely is it that the industry will hold to its resolutions?

-

As less ILS capital was available at 1 January, retro rates rose by up to 35 percent on loss-hit deals, the broker said in its 1st View report.

-

The global property reinsurance professional will be joining the start-up broker as executive vice president.

-

The corporate finance adviser has held roles at Deutsche Bank, Citigroup and Morgan Stanley.

-

BGC Partners has agreed to buy Lloyd's broker Ed Broking from private equity house Lightyear Capital, adding to its previous acquisition of London market intermediary Besso.

-

Coin Re will aim to reduce the cost of insurance by aggressively reducing reinsurance costs, Blanch said.

-

Terms of the deal were not disclosed.

-

Former Aon broker Jonathan Hughes will join the firm's retrocession team, reporting to head of retro Alex Bridges.

-

Edward Torres was most recently director of capital markets at PartnerRe but left after the company reworked its ILS offering.

-

Appetite for last-minute cover appears muted ahead of Hurricane Michael’s landfall in Florida.

-

The company is moving away from market-facing collateralised reinsurance funds, head of alternative capital Dan Brookman told this publication.

-

The new platform connects holders of long-tail insurance risks with investment funds.

-

Willis Towers Watson may look to push its G360 broker facility into a delegated authority platform, sister publication The Insurance Insider reported.

-

Broker distribution facilities have made a comeback in recent years as intermediaries seek new ways to streamline operations and boost fee income.

-

JLT CEO Dominic Burke said acquirer MMC valued the entrepreneurial culture at the firm.

-

-

The 2017 hurricanes have deteriorated less steeply than events in previous years, JLT Re said.

-

Human behaviour now has a smaller role in determining pricing, according to the broker's president and global head of casualty.

-

Former Guy Carpenter executive Peter Stubbings will take over as of head of ReSpecialty in 2019 as Bob Bisset moves to the role of UK growth leader.

-

Tremor’s auction technology matches capacity to bidders to achieve the lowest overall rate.

-

Bob Petrilli will join the firm after leading the North American unit at Swiss Re Corporate Solutions.

-

Wholesale broker Ryan Specialty Group (RSG) has set up a new reinsurance managing general underwriter (MGU) and a new property catastrophe facility

-

The team is part of Aon's reinsurance solutions unit.

-

In its 1st View report the broker said the impetus for risk-adjusted rate increases had stalled at the June and July renewals.

-

The executive previously worked for Deutsche Bank's asset management division but left when the bank closed down its $100mn ILS fund last year.

-

The deal provides an unnamed cedant with one-year cover for a Floridian book of business.

-

Willis Towers Watson has invested in a platform designed to support new managing general agencies (MGAs), sister publication The Insurance Insider reported.

-

Is the industry ready to accept new attempts to create live trading platforms?

-

Former Aspen Re chairman Brian Boornazian has been appointed CEO and president of RyanRe.

-

The Lloyd’s broker has announced the launch of Agile Risk Advisory which aims to use big data analytics to support ILS transactions.

-

The executive has been appointed CEO of reinsurance solutions for the big three broker.

-

TigerRisk said that the platform could handle more customised ILS issuances as well as standardised transactions.

-

Early-range forecasts for an above-average season may be reduced.

-

The broker will join the firm's reinsurance team in an expansion drive.

-

Reinsurance broker RFIB said it plans to expand its MGA and captive management business amid a rebrand of its holding company.

-

Richard Carver is to join Guy Carpenter as managing director and senior broker in its UK non-marine division.

-

John English will take over as CEO of the broker’s captive management operation, replacing Peter Mullen.

-

Aon Benfield and Aon Risk Solutions are to become simply ‘Aon’ as the firm integrates its different parts.

-

The ILS unit now reports to Willis Re deputy chairman Mark Hvidsten.

-

Guy Carpenter has promoted John Fletcher, the head of its retrocessional practice in Bermuda, to take over as chairman of the office.

-

Peter Stubbings has resigned from his role as Guy Carpenter Bermuda CEO and is set to join the retro team at Aon Benfield, sister publication The Insurance Insider reported.