-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

While rates have “definitely come down,” they were coming off a high base, Rachel Turk said.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Mory Katz joined the broker earlier this year.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive has worked at Aon for almost two decades.

-

The facility will initially focus on US, Bermudian and European business.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The investment bank had stopped offering ILS services last September.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The transaction is expected to close later this year.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

George Cantlay will also assume the additional position of president of the Bermuda business.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

Matthew Towsey has spent 14 years at Aon.

-

US events accounted for more than 90% of global insured losses.

-

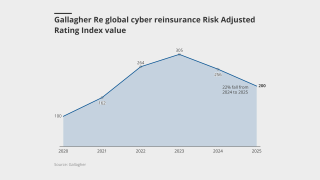

In the US, the index fell 6.7% year on year.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

John Kulik will work within Ledger’s broking team, Ledger Investing.

-

The documents figure in a potential criminal case against a CCB employee.

-

The Bermuda-based team is led by John Fletcher.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Lyon joins the reinsurance broker from law firm Skadden, Arps, Slate, Meagher & Flom.

-

Up to nine million acres of US land are considered likely to burn.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

As with 2024, pricing pressure has been most acute on top layers.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

Commutations need to be optimal for the sponsor and the investor to avoid sponsors taking back chunky risks.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

Insured losses were the second highest on record for the first quarter.

-

Sykes has spent over 31 years with Aon, with the last 15 of those in Guernsey.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.