Howden

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Richardson has been with the firm since 2015 and was most recently vice chair and chair of international.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

In 2024, MGA GWP reached approximately $20bn in Europe.

-

Property cat XoL rates were off by around 10% on average on a blended risk-adjusted basis.

-

The company is a wholly owned subsidiary of AmTrust Financial.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The acquisition expands its global employee benefits business to ~4,000 global employees.

-

The London D&F market will shoulder most of the losses.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

Paul Poschmann joins from Gallagher Re, where he was a divisional director.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

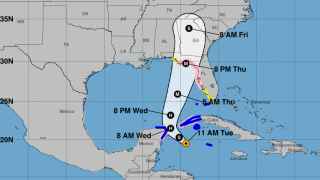

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

The executive has held senior alternative capital roles at Aon and Guy Carpenter.

-

The firms’ partnership preceded Japan's first ‘megaquake’ warning.

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

The broker is entering the Japanese market with a focus on ILS.

-

Sébastien Bamsey joins from JP Morgan, where he has worked for 18 years.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Diversification in perils and regions can help the market grow.

-

This follows the broker's rebrand in October last year.

-

Arm is based in Guernsey and has a Bermudan management licence.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

Improving the speed and efficiency of settlements is required to help the market grow.

-

Of $17bn that entered the market in the 15 months to 31 December, 40% was channelled into ILS vehicles.

-

The broker said global cat rates rose 3% in the 1 January reinsurance renewals.

-

The executives will look to bring the company’s full suite of products to clients.

-

The 30-strong segment will combine reinsurance and capital markets with data, analytics and technology.

-

She joins after over four years at Securis, where she was head of investor relations and business development.

-

European and Bermudian reinsurers are expected to be the most favorably affected by the current environment.

-

Radford joins after spending two years at Aon’s Capital Advisory business.

-

The broking firm’s (re)insurance market update said growth in alternative capital is a now a permanent feature of the market.

-

The broker said that capital levels should stabilise at previous levels, given a normal second half.

-

Some cedants paid more than 40% increases depending on Florida concentration and Hurricane Ian losses.

-

Minesh Jani will report to Bradley Maltese, CEO of international and global specialties.

-

The intermediary recorded “one of the hardest reinsurance markets in living memory” as primary rate increases slowed.

-

Tension is emerging at the reinsurance level over the retrenchment from all-perils coverage, which previously offered ‘sleep-easy protection’.

-

The correlation between a good ESG score and low loss ratio is strongest in property insurance, the report shows.

-

David Howden said insurance protection made the global north more able to respond to catastrophes.

-

The product protects firms buying carbon credits from third-party negligence and fraud.

-

Bowood managing director Stephen Greener will chair the entity, which is to place $6bn in GWP.

-

The appointment to the ILS unit follows news of Howden’s move to buy TigerRisk.

-

The broker said the developments could have “huge implications” for capacity, pricing and the market cycle.

-

Mary O’Connor joins from KPMG, where she was acting CEO.

-

After securing a $1.6bn deal to acquire TigerRisk, Howden said the transaction will create a “much-needed fourth global player” in reinsurance.

-

Sources indicated talks have been conducted using an adjusted Ebitda figure for TigerRisk of around $85mn-$90mn, which is far higher than previously thought.

-

A takeover would boost Howden’s burgeoning reinsurance portfolio.