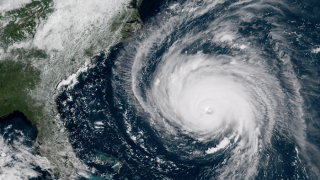

Hurricane

-

The capped increase compares with an 8.5 percent rise envisaged before the measures to curb assignment of benefits abuse.

-

The legislation increases loss adjustment expenses reimbursement from 5 percent to 10 percent.

-

The Florida-based insurer is looking to drop the rate increase for personal lines policyholders from 8.2 percent to 4.7 percent.

-

The insurer paid a rate on line of 11.25 percent for its new personal lines cover.

-

The Toronto-based firm had already been collaborating with Perils for the past two years.

-

The Florida Hurricane Catastrophe Fund (FHCF) is marketing its $1bn reinsurance programme but has indicated it is looking for flat risk-adjusted rates, according to sources.

-

Some of the largest Florida carriers increased their reinsurance limits at this renewal, but they were able to keep control of overall expenditure by opting for more Florida Hurricane Catastrophe Fund (FHCF) protection.

-

The state cat fund delayed its renewal to avoid clashing on the market with Florida insurers.

-

The reinsurer is looking to pay more rate to secure retro cover in a tightening market.

-

Timing is everything and, for the reinsurance market, this is especially true when it comes to losses.

-

The total is 7.8 percent more than Perils’ EUR740mn first estimate on 18 April.

-

The insurer bought $593mn of first-event private market reinsurance cover for 2019, slightly down on last year’s $599mn.