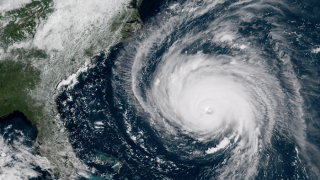

Hurricane

-

Quota share and aggregate retro remain the most disrupted pockets of the market ahead of the January renewals, as underlying reinsurance looks flatter.

-

Last year’s feast has repeated on the market as Irma losses deteriorated, while fresh wildfires have caught out those who loaded up on liability exposure.

-

Regulators are currently investigating the beleaguered retro manager’s loss reserving.

-

Eden Re provided $300mn of retro support for Munich Re in 2018 across a couple of debt issuances.

-

The insurer said the range is consistent with industry insured losses of up to $20bn from the recent blazes.

-

Hurricane Michael and the California wildfires have trapped a significant portion of retro capacity, the analysts said.

-

News of the steep C share loss follows the revelation of regulatory probes in the US and Bermuda.

-

The reinsurer’s Sigma report says just over half of economic losses were insured, as in 2017.

-

Tropical Storm Risk has projected 12 tropical storms, five hurricanes and two major hurricanes for the 2019 storm season.

-

The losses relate to Hurricane Michael and the 2018 California wildfires, the Sompo International subsidiary said.

-

The Event-Linked Bond Fund’s net assets reached $373.2mn at 30 September, up from $259.5mn at the same point last year.

-

Steep reserve deterioration may reduce confidence in the fund’s reserving process, Jefferies analyst said in a recent note.