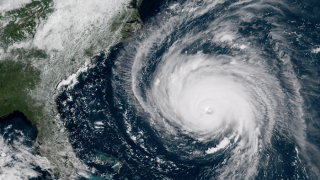

Hurricane

-

Retro and reinsurance partners will pick up $142mn of Axis Capital's $779mn of gross HIMM losses, with the bulk of recoveries due to retrocession on the firm's reinsurance book, the firm reported in its third quarter results.

-

Catastrophe losses added 9.0 points to the (re)insurer’s combined ratio as Hurricane Florence and Typhoon Jebi pushed up losses, mainly impacting its reinsurance division.

-

The firm’s insurance division took the bulk of its losses.

-

The storm weakened to a tropical depression early Wednesday, with sustained winds of 25 mph.

-

The initial figures put the National Flood Insurance Program’s reinsurance clear of triggering for the second time in two years.

-

The reinsurer reported EUR177mn of losses from named Q3 disaster events.

-

The insurer took a further $450mn cat losses net, led by $161mn from Hurricane Florence.

-

The firm's latest figure for the storm is up from a $25.7bn estimate reported by this publication in June.

-

The latest NHC advisory update has put the hurricane at a level that will not be strong enough to trigger the Mexico's 2017 MultiCat cat bond.

-

The initial estimate has come in at half its current Hurricane Irma gross loss.

-

The storm remains at a strength that would lead to a 50 percent payout of the $110mn Pacific hurricane cat bond protecting Fonden, although it may weaken before landfall.

-

The insurer's reinsurance cover is expected to be only lightly impacted if losses reach the top end of its estimate.