Hurricane

-

Buckingham Research analyst Amit Kumar said reinsurers would pick up only $1.5bn to $2.0bn of claims from a $10bn industry loss for Hurricane Florence.

-

The National Hurricane Center predicted catastrophic freshwater flooding as the eye of the hurricane touched down at Wrightsville Beach.

-

A marked-down trade of the $500mn Floodsmart Re 2018-1 cat bond may have been cancelled.

-

The storm is expected to produce storm surges of up to 7 m in coastal areas, the Philippines government said.

-

Florence will cause between $3bn and $5bn in insured wind and storm surge losses, CoreLogic estimated.

-

North Carolina FB has just under 7% market share in North Carolina, the most among single-staters.

-

The analyst estimated the continental (re)insurers are each on course to take 5% of losses from the Category 2 hurricane heading for the Carolinas.

-

Flood risk concerns could mean more drain on the public purse to pay for damages via the NFIP.

-

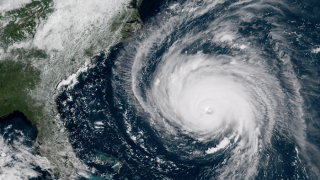

Hurricane Florence has weakened amid a growing consensus that the storm will linger near the shore, increasing the potential for flooding.

-

Category 4 Hurricane Florence continues to approach the Carolina coastline though may slow down by late Thursday, the NHC said.

-

Global reinsurance head Juergen Graeber said as several Japanese carriers bought aggregate cover, the recent typhoons would lead to “detailed discussions” with clients

-

RMS's Mohsen Rahnama has said if Florence hits Wilmington, North Carolina – a city with high insured exposures – as expected, then losses will be high.