Hurricane

-

The company also has $100mn for US hurricane events.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

Several Florida start-ups are poised to begin writing business this year.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

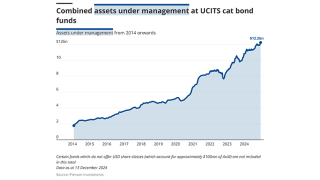

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Total economic losses were $368bn, 14% above the 21st century average.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The company no longer has any exposure to reinsurance contracts.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The model factors in the effects of climate change to date.

-

A total of $2.1bn in Fema money has been approved for the state.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The Florida carrier reported a 103.5% combined ratio in Q3.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The carrier is looking at a $600-$900mn hit from Debby, Helene, Milton.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Earlier this week, RMS estimated insured losses for Helene and Milton at $35bn-$55bn.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The company incurred $563mn of total cat losses related to the storm.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

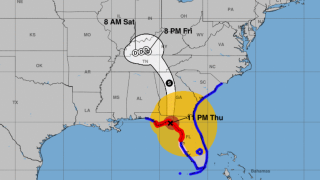

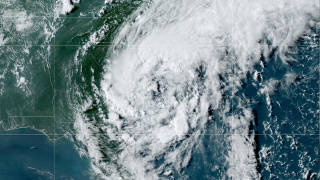

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

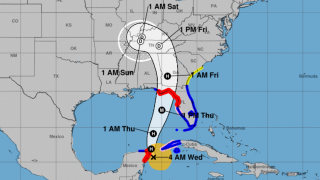

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The pre-landfall figures are not an official loss estimate from the modeller.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

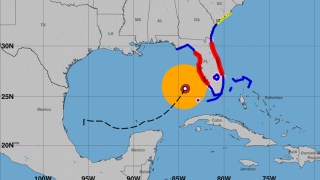

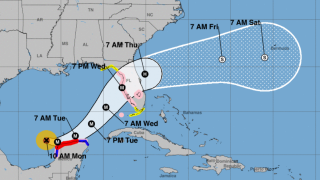

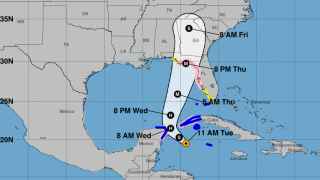

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The government-backed scheme has greater take-up in areas in Milton’s path.

-

Restrengthening to Category 5 is still possible, Siffert warns.

-

Earlier this week, Moody’s RMS Event Response estimated the event would cost $8bn-$14bn.

-

Prior forecasts indicated a more northward track towards Tampa Bay and St Petersburg.

-

The storm is now predicted to make landfall south of Tampa Bay.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Destructive storm surge is expected along Florida’s West Coast on Wednesday.

-

Moody’s also predicts losses to the NFIP at potentially more than $2bn.

-

The storm is packing maximum sustained winds of 175mph.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The NFIP’s losses are estimated at $4.5bn-$6.5bn.

-

Experts have raised concerns over significant rainfall, record-setting storm surge and lingering Hurricane Helene debris.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Rising sea levels and ocean warming were likely factors in Helene’s strength.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

Key floods this year outside of the US include the Rio Grande do Sul.

-

The biggest limitation to growth is supply, given ILS capital “reticence” after the 2016-22 years.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Moody’s described Hurricane Helene as “like Idalia but worse”.

-

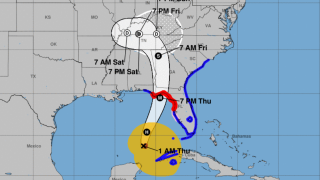

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

The ratings agency expects insured losses of around $5bn for Helene.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

The NFIP has a higher take-up rate in Tampa Bay, which experienced record coastal storm surge.

-

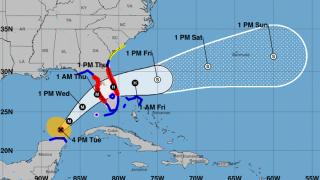

Helene is expected to become a post-tropical low later today.

-

More than one million Floridians are without power after the storm hit.

-

Additional strengthening is expected before Helene makes landfall in Florida tonight.

-

Only three storms have impacted a larger area than Helene since 1998.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

TSR predicts Atlanta, Georgia, could face Cat 1 windspeeds as the storm moves further inland.

-

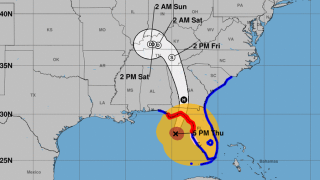

The storm is expected to make landfall in Florida’s Big Bend coast on Thursday evening.

-

Helene is currently a Category 1, but rapid strengthening is anticipated over the next day.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

A hurricane warning is in effect from the Anclote River to Mexico Beach, Florida.

-

A storm surge warning is in effect from Flamingo to Indian Pass.

-

The storm could become a major hurricane by Thursday.

-

The system is forming in the same area as 2022’s Hurricane Ian.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Moody’s also predicts losses to the NFIP at less than $200mn.

-

The estimate is like others in the market, suggesting a relatively small loss from the event.

-

The hurricane has led to a “surge” in insurance claims related to floods, according to the IBC.

-

The ratings agency said companies focused on growing business in Gulf Coast states, however, would face a “key test” as claims materialised.

-

A sub-$3bn industry insured loss event would be similar to estimates for hurricanes Beryl and Debby.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The sponsor has kept $25mn of principal in extension for any further loss development.

-

The storm is expected to weaken to a post-tropical cyclone later tonight.

-

Kin’s reinsurance structuring means the bond’s losses will be kept to a minimum.

-

‘Life-threatening’ storm surge and hurricane-force winds expected for the state, according to the NHC.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Most of the ILS capital was attracted to the cat bond market.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The broker said it expects strong ILS capital inflows to continue.

-

-

Returns were down on 2023, which benefited from favourable Ian loss development.

-

The storm made landfall on Saturday as a Category 1 hurricane.

-

Ernesto’s maximum sustained winds have reached 100 mph.

-

-

Flights cancelled as typhoon ramps up to Cat 4.

-

Ernesto is expected to track past Bermuda on Saturday with hurricane conditions.

-

Moody’s also predicts losses to the NFIP at less than $300mn.

-

Both groups continue to call for a highly active season, however.

-

Several bonds suffered declines in value from February to July.

-

Subsidiaries Core and Typtap have applied to participate in the November Citizens policies assumption.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The loss is based on modelled outputs, as opposed to an initial loss estimate.

-

The board of directors has voted for a 10% rate hike.

-

Its forecast for intense hurricanes is unchanged at six.

-

The NHC has said there is potential for “historic heavy rainfall” across southeast Georgia and South Carolina.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

The carrier purchased an additional $150mn of cover.

-

The modeller said 3 million homes were without power at its peak.

-

The figure is well above the historical average of $39bn for this century.

-

The biggest losses were from wind damage after the storm’s Texas landfall.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Uncertainty around the quantum remains due to policy deductible variation.

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

Industry losses of $800mn-$1.2bn are expected from Beryl's impact in Texas.

-

Hurricane Beryl was a “harbinger of a hyperactive season,” CSU said.

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

Houston mayor John Whitmire said: “We woke up this morning on the dirty side of a dirty hurricane.”

-

Beryl has been downgraded to a tropical storm but is still life-threatening, with news media reporting two deaths so far.