Hurricane

-

The company also has $100mn for US hurricane events.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

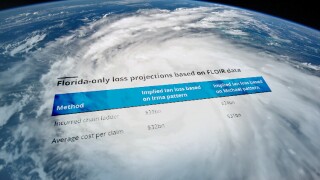

The revision is significantly lower than the $4.5bn October estimate.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

Several Florida start-ups are poised to begin writing business this year.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

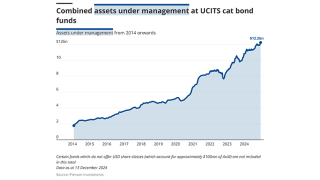

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

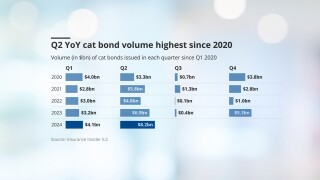

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Total economic losses were $368bn, 14% above the 21st century average.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The company no longer has any exposure to reinsurance contracts.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

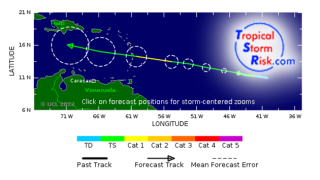

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

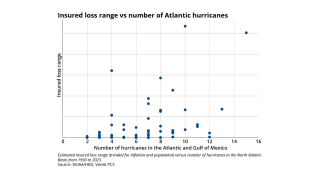

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The model factors in the effects of climate change to date.

-

A total of $2.1bn in Fema money has been approved for the state.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The Florida carrier reported a 103.5% combined ratio in Q3.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The carrier is looking at a $600-$900mn hit from Debby, Helene, Milton.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Earlier this week, RMS estimated insured losses for Helene and Milton at $35bn-$55bn.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The company incurred $563mn of total cat losses related to the storm.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

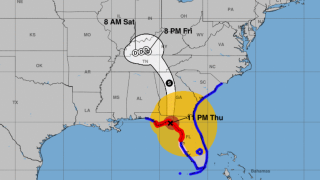

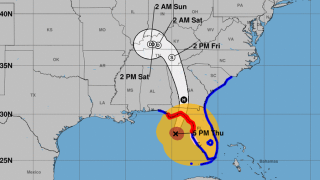

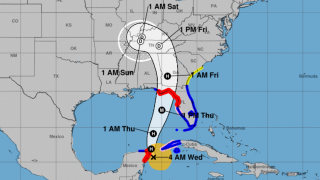

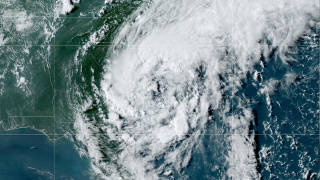

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

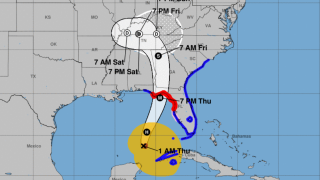

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The pre-landfall figures are not an official loss estimate from the modeller.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

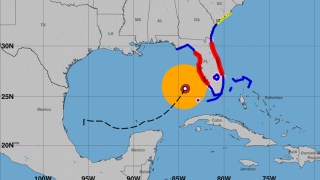

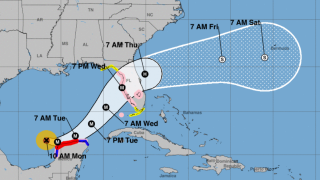

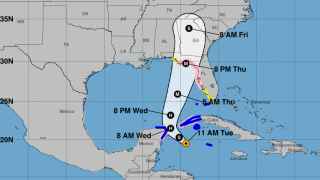

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The government-backed scheme has greater take-up in areas in Milton’s path.

-

Restrengthening to Category 5 is still possible, Siffert warns.

-

Earlier this week, Moody’s RMS Event Response estimated the event would cost $8bn-$14bn.

-

Prior forecasts indicated a more northward track towards Tampa Bay and St Petersburg.

-

The storm is now predicted to make landfall south of Tampa Bay.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Destructive storm surge is expected along Florida’s West Coast on Wednesday.

-

Moody’s also predicts losses to the NFIP at potentially more than $2bn.

-

The storm is packing maximum sustained winds of 175mph.

-

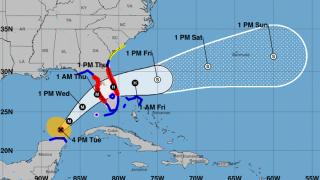

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The NFIP’s losses are estimated at $4.5bn-$6.5bn.

-

Experts have raised concerns over significant rainfall, record-setting storm surge and lingering Hurricane Helene debris.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Rising sea levels and ocean warming were likely factors in Helene’s strength.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

Key floods this year outside of the US include the Rio Grande do Sul.

-

The biggest limitation to growth is supply, given ILS capital “reticence” after the 2016-22 years.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Moody’s described Hurricane Helene as “like Idalia but worse”.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

The ratings agency expects insured losses of around $5bn for Helene.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

The NFIP has a higher take-up rate in Tampa Bay, which experienced record coastal storm surge.

-

Helene is expected to become a post-tropical low later today.

-

More than one million Floridians are without power after the storm hit.

-

Additional strengthening is expected before Helene makes landfall in Florida tonight.

-

Only three storms have impacted a larger area than Helene since 1998.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

TSR predicts Atlanta, Georgia, could face Cat 1 windspeeds as the storm moves further inland.

-

The storm is expected to make landfall in Florida’s Big Bend coast on Thursday evening.

-

Helene is currently a Category 1, but rapid strengthening is anticipated over the next day.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

A hurricane warning is in effect from the Anclote River to Mexico Beach, Florida.

-

A storm surge warning is in effect from Flamingo to Indian Pass.

-

The storm could become a major hurricane by Thursday.

-

The system is forming in the same area as 2022’s Hurricane Ian.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

Moody’s also predicts losses to the NFIP at less than $200mn.

-

The estimate is like others in the market, suggesting a relatively small loss from the event.

-

The hurricane has led to a “surge” in insurance claims related to floods, according to the IBC.

-

The ratings agency said companies focused on growing business in Gulf Coast states, however, would face a “key test” as claims materialised.

-

A sub-$3bn industry insured loss event would be similar to estimates for hurricanes Beryl and Debby.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The sponsor has kept $25mn of principal in extension for any further loss development.

-

The storm is expected to weaken to a post-tropical cyclone later tonight.

-

Kin’s reinsurance structuring means the bond’s losses will be kept to a minimum.

-

‘Life-threatening’ storm surge and hurricane-force winds expected for the state, according to the NHC.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Most of the ILS capital was attracted to the cat bond market.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

The broker said it expects strong ILS capital inflows to continue.

-

-

Returns were down on 2023, which benefited from favourable Ian loss development.

-

The storm made landfall on Saturday as a Category 1 hurricane.

-

Ernesto’s maximum sustained winds have reached 100 mph.

-

-

Flights cancelled as typhoon ramps up to Cat 4.

-

Ernesto is expected to track past Bermuda on Saturday with hurricane conditions.

-

Moody’s also predicts losses to the NFIP at less than $300mn.

-

Both groups continue to call for a highly active season, however.

-

Several bonds suffered declines in value from February to July.

-

Subsidiaries Core and Typtap have applied to participate in the November Citizens policies assumption.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The loss is based on modelled outputs, as opposed to an initial loss estimate.

-

The board of directors has voted for a 10% rate hike.

-

Its forecast for intense hurricanes is unchanged at six.

-

The NHC has said there is potential for “historic heavy rainfall” across southeast Georgia and South Carolina.

-

The ‘life threatening’ hurricane has potential for “historic heavy rainfall” in the southeastern United States.

-

The carrier purchased an additional $150mn of cover.

-

The modeller said 3 million homes were without power at its peak.

-

The figure is well above the historical average of $39bn for this century.

-

The biggest losses were from wind damage after the storm’s Texas landfall.

-

Relentless focus on annual outcomes provides a packaging that doesn’t fit the purpose.

-

Uncertainty around the quantum remains due to policy deductible variation.

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

Industry losses of $800mn-$1.2bn are expected from Beryl's impact in Texas.

-

Hurricane Beryl was a “harbinger of a hyperactive season,” CSU said.

-

Secondary market activity and hedging would be likely if a Beryl-sized storm tracked toward the US.

-

Houston mayor John Whitmire said: “We woke up this morning on the dirty side of a dirty hurricane.”

-

Beryl has been downgraded to a tropical storm but is still life-threatening, with news media reporting two deaths so far.

-

Availability of ILS has so far fulfilled investor demand.

-

The latest Insider ILS Outstanding Contributor for the year said 2011 was an under-appreciated turning point for the market.

-

According to BMS, Hurricane Beryl is likely to be a retained event for most insurance carriers.

-

Insured losses could be less than $1bn if current NHC forecasts are accurate.

-

The forecast comes following the earliest Category 5 storm on record.

-

The parametric trigger on the World Bank deal specifies storm pressure of 955mb or lower but its initial reported landfall was at 975mb.

-

Hurricane Beryl is expected to strengthen again after hitting the Yucatan Peninsula.

-

The parametric structure would have paid out at slightly lower storm pressure.

-

The storm destroyed housing in St Vincent and the Grenadines and Grenada.

-

The storm is predicted to hit the Caymans tonight or early Thursday.

-

Recent modelling predicts a strong probability of direct landfall in Jamaica.

-

Grenada and St Vincent were spared the full brunt of the storm.

-

Hurricane conditions are expected in Jamaica on Wednesday, according to the NHC.

-

-

Cat bond spreads stabilised as maturities brought capital to deploy into the market, after an earlier spike.

-

Grenada and St Vincent and the Grenadines are under the most threat from the storm.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

Tropical Storm Alberto, the first named storm of this year’s Atlantic hurricane season, made landfall this morning over Mexico and Texas, bringing heavy winds and gusty rains, according to the US National Hurricane Center (NHC).

-

Alberto is the first named storm of this year’s hurricane season.

-

A degree of pricing volatility was evident in the market this week.

-

The firm is the sole provider to offer index services in the US.

-

The research body initially warned of an active storm season in April.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

This compares to the 2023-2024 tower which covered losses up to $2.83bn.

-

The firm now predicts six major hurricanes and 24 tropical storms.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

Forecasters have warned that a number of meteorological factors could make this year the most active on record.

-

The company increased its full year 2024 adjusted net income guidance.

-

Most years since 2014 have seen at least one named storm before 1 June.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The outlook calls for an 85% chance of an above-normal season.

-

The program includes all perils coverage and third-event protection.

-

Cession ratios declined at three of the four publicly listed Floridians.

-

The company plans to reduce its quota share to 20% from 40%.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

First event tower for the Northeast exhausts at $1.1bn, at $1.3bn for Southeast and $750mn in Hawaii.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

State interference is likely to be required if an attack is large enough to trigger bonds now on the market, experts say.

-

Panellists at the Insurance Insider ILS conference say forecasts can push capital to “the edges” of the market.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

Researchers expect 15-20 named storms to form in the Atlantic Basin.

-

Insured loss for Q1 was 10% higher than the decadal average of $18bn.

-

Tropical Storm Risk (TSR) has updated its forecast for North Atlantic hurricane activity, predicting a "hyper-active season" in 2024, with activity being around 70% above the 1991-2020 climate norm.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

The carrier closed its Sussex Diversified Fund in October last year.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

Sources are expecting multi-billion new limit to be placed.

-

Some $415mn of capacity entered the market last year.

-

Estimates were revised from $845mn to $740mn.

-

Exposure updates played a greater role than expected.

-

Sources said preparations for a 2024 IPO were halted, but work could resume later this year.

-

The vast majority of 2023 recoveries were from events in prior years.

-

The vulnerability updates are the biggest driver of loss changes.

-

The notes were further marked down after a year-end Ian loss update.

-

The bond is trading at 70c-75c in the dollar in the secondary market.

-

The carrier booked a reserve charge of $392mn for casualty insurance.

-

The manager’s conservative strategy posted returns of 7.61%.

-

-

The Bermudian said its third-party vehicles were “sufficiently capitalised”.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

2023 was the fourth consecutive year insured cat losses surpassed $100bn.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

The independent manager’s post-Ian growth has helped it more than double from prior estimated assets under management.

-

The Swiss Re Total Return Index climbed month-over-month throughout the year, to more than regain ground lost after Hurricane Ian in September 2022.

-

The year was characterised by several severe and costly thunderstorms.

-

The performance continues an unbroken run of positive monthly returns in 2023.

-

New and returning sponsors, diversifying European wind risks and early placement of US hurricane coverage all helped new issuance to smash market expectations.

-

The Florida Building Code was introduced following the impacts of Hurricane Andrew.

-

Next year will see North Atlantic hurricane activity about 30% above the 1991-2020 30-year norm, according to Tropical Storm Risk.

-

Losses from severe thunderstorms have increased by 7% annually in the last 30 years, according to the Swiss Re Institute.

-

ILS managers are still waiting for hard market growth.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

The hurricane season featured 20 named storms, seven hurricanes, three intense hurricanes and an ACE index of 146, according to Tropical Storm Risk.

-

The business will service clients in the agriculture, renewable energy and construction industries.

-

Google DeepMind developers recently said in a peer-reviewed paper that the model "marks a turning point in weather forecasting”.

-

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

Carriers have been dealing with elevated storm activity this year, whilst additional purchases to match inflating values had largely been parked in 2023.

-

The forecast reflects property damage and BI losses to residential, commercial, industrial and automobile lines.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The group’s ceded large losses reached 17% of gross losses, up from 11% a year ago.

-

“That’s one of the things we're monitoring ... but I think there are positive signs in the marketplace that litigation is down,” Garateix told analysts on the company’s third-quarter earnings call.

-

ILS Advisers Index returns 1.23% in August, taking YTD gains to 10.75%.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

The carrier returned $369mn of capital to third-party investors in Q3 from investors in the Upsilon and Vermeer vehicles.

-

Up-to-date building codes could reduce the amount insurers pay in the Caribbean by 18%, according to the risk modeller.

-

Verisk said the majority of the insured losses can be attributed to wind damage.

-

The ratings agency also said economic and insured losses caused by Otis have reached $16bn.

-

More than three-quarters of local exposure is ceded to highly rated reinsurers through excess of loss protection, according to the rating agency.

-

The firm entered new aggregate excess of loss reinsurance contracts in 2023 that have multiple layers of coverage.

-

The Floridian insurer’s loss from the hurricane was within its reinsurance retentions.

-

The 2020 bond provides $125mn of parametric, per occurrence coverage.

-

Investors will have to wait for official Verisk data before knowing if the bond will trigger.

-

The CCRIF has paid out $265mn since its inception in 2007.

-

The fund had taken major losses on cat-related investments, including through Southeast primary carriers Weston and Southern Fidelity.

-

These figures mark an improvement from August, which was impacted by losses from Hurricane Idalia.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

Lidia has now largely dissipated after making landfall in Mexico.

-

The storm made landfall on Tuesday night in the Mexican state of Jalisco.

-

Additional strengthening is possible before Lidia makes landfall on Mexico’s West-Central Coast, according to the most recent update from the National Hurricane Center.

-

The fund is on course for its strongest year of returns since inception in 2014.

-

Experts at the Trading Risk New York conference emphasised in-built cyber risk protections from defences to exclusions, as ILS managers grapple with understanding the peril.

-

Losses from the Maui wildfire include a modest amount of reinsurance recoveries from the Per Risk reinsurance program, while losses from Hurricane Idalia were fully retained.

-

The Dutch pension fund giant amended several mandates in 2022 and has posted a 6.3% return from ILS in the first half of 2023.

-

Private ILS outperformed cat bonds in August, as hurricane season earnings began to kick up a gear.

-

Experts agreed that investment in understanding wildfire risk had come a long way in recent years.

-

A challenge facing the industry in the years to come is the question of how can it move through a rotation of its investor base to capture the growth opportunities that have arisen.

-

The Elementum executive told Trading Risk New York that “appropriate returns” over time were the key to a sustainable ILS market.

-

Inver Re used data from the National Oceanic and Atmospheric Administration (NOAA) to model the impacts of global warming for a Category 1 hurricane making landfall in Florida.

-

According to the National Hurricane Center, Lee made landfall at Long Island, Nova Scotia, on Saturday.

-

With winds speeds around 80mph, Lee is now a Category 1 hurricane but is still expected to be ‘a large and dangerous storm' by the time it reaches New England and Canada.

-

Slow weakening is forecast during the next few days, but Lee is likely to remain a large and dangerous hurricane into the weekend, the update noted.

-

The insurance company had set out plans last summer to expand its market share in Florida.

-

Tropical Storm Lee is set to strengthen to an “extremely dangerous” Category 4 hurricane by the end of the week, although there are no coastal watches or warnings in place as yet.

-

The National Flood Insurance Programme could face a loss of around $500mn from the hurricane, according to the estimate.

-

The analytics firm said that the majority of insured losses will be attributable to wind.

-

The Florida hurricane season still has three months to run in a predicted above-average year.

-

Outside the cat bond segment, Aon said it was observing rising sidecar interest, putting volumes at $7.1bn from $6.4bn the prior year.

-

Karen Clark & Company said the majority of insured losses will incur from US wind and storm surge damage, apart from just under $5mn which was attributed to winds across the Caribbean.

-

Hurricane Idalia is still live, but the storm’s track reassured market participants that it will be a relatively minor loss.

-

Idalia might add further aggregate erosion to several cat bonds covering various perils over an annual risk period, it stated.

-

Moody’s said most losses from Idalia are likely to arise from homeowners and commercial property lines.

-

The figure – which is not a loss estimate – would be consistent with early views of a sub-$10bn insured loss.

-

With Hurricane Idalia’s landfall underway loss estimates are uncertain, but sources noted that the storm’s trajectory shows it taking the best path to impact minimal insured values in Florida.

-

The storm will weaken further, but remain a hurricane as it passes through Georgia and the Carolinas.

-

The update projections for wind only show a 20% likelihood of losses approaching $11.7bn.

-

More than 800,000 houses could be affected by the hurricane’s storm surge.

-

Parts of Tampa, as well as Georgia and the Carolinas, now face dangerous conditions.

-

Idalia is likely to be a hurricane while moving across southern Georgia and possibly when it reaches the coast of Georgia, according to the latest NHC update.

-

The forecaster also added a tropical storm watch for parts of North Carolina.

-

If the storm steers clear of Tampa, reinsurers will be well placed for minimal losses, but a retention loss is a further blow for weak Floridians.

-

Hurricane Idalia will reach Jacksonville but will have weakened by then

-

The storm is set to become an “extremely dangerous major hurricane” by landfall on Wednesday.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

A major hurricane in any section of Florida that extends into the Southeast states is likely a “multi-billion-dollar” insurance industry event, according to the broker.

-

The storm is now forecast to become a major hurricane by Tuesday night. This morning’s advisory update had estimated that Idalia would reach major hurricane status by early Wednesday.

-

Idalia is forecast to become a hurricane later today and a dangerous major hurricane over the northeastern Gulf of Mexico by early Wednesday.

-

For insurers, the Golden State is one of the last places they want to face disputes or lawsuits with consumers.

-

Swiss Re Capital Markets said there was a ‘strong chance’ of a record-breaking year in size and number of new bonds.

-

Data from the NHC shows that maximum sustained winds are near 65mph, with higher gusts.

-

The Cat-4 storm is likely to weaken as it approaches the California coast.

-

The storm could cause between three to 10 inches of rainfall across portions of the Baja California Peninsula through Sunday night, with possible flash flooding from late Friday into late Sunday.

-

The development in reconstruction costs and contingent BI claims may put the ultimate sum beyond current estimates.

-

Loss estimates from Aon, Gallagher Re, Swiss Re and Munich Re all point to a significant component of severe convective storm losses.

-

The latest estimates peg the fires as the second largest loss event in the state’s history, second only to Hurricane Iniki in 1992.

-

Most forecasters now predict above-average storm activity for the Atlantic as a result of record-high sea-surface temperatures.

-

Thursday’s update pegs the likelihood of near-normal activity at just 25%, a decline from the 40% chance outlined in May's outlook.

-

Tens of thousands of people have been evacuated from the island, and nearly 14,000 Maui residents remain without power.

-

The company has forecast a more intense season than originally predicted in May.

-

The asset manager cited a strong pricing environment and increased capacity from unlocking trapped capital.

-

The carrier said a greater number than usual of North Atlantic storms are possible despite El Niño conditions.

-

The firm had earlier noted that the cat bond coverage would kick in if the PCS industry loss number reached $48bn.

-

Insurance Insider has gathered data on geographical areas prone to cat events, which are outside of southeastern US states, that keep weather experts awake at night.

-

The first quarter of 2023 has already gone down as the costliest on record for the peril in the US.

-

The insurer also added $100mn to its northeast cat treaty as it posted $1.48bn of cat losses in the second quarter.

-

The update is due to warm sea-surface temperatures in the tropical Atlantic and the exceptional development of two named storms in June.

-

In its update, CSU now predicts 18 named storms, including the four that have already formed, nine hurricanes and four major hurricanes.

-

The coverage is designed to reduce the island’s obligation to the US Federal Emergency Management Agency.

-

-

ILW limit of around $1bn could change hands depending on where the Hurricane Ian industry loss number settles.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

The broker estimated global reinsurance capital rose by $30bn over the first quarter, with a 7% uplift in alternative capital and a 5% recovery to traditional equity.

-

The $49.4bn number remains below a critical ILW threshold.

-

There has never been a named storm to form in the eastern tropical Atlantic this early in the season.

-

The broker said the risk from wildfire is also set to increase substantially.

-

The National Hurricane Centre said the Lesser Antilles, Puerto Rico and the Virgin Islands must be vigilant.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

Most forecasters predict below-average activity in the region – but opposing weather phenomena mean uncertainty is higher than usual.

-

The bills place additional requirements on insurers in the state and expand consumer protections.

-

In its update, CSU now anticipates 14 named storms, seven hurricanes and three major hurricanes.

-

Some cedants paid more than 40% increases depending on Florida concentration and Hurricane Ian losses.

-

Even clean accounts in the admitted space are seeing rate increases of 15% year on year, while loss-hit accounts in Florida were slapped with a 100% rate increase for June 1.

-

The forecaster is predicting 13 named storms, six hurricanes of which two are expected to be Category 3 or above.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.

-

This year’s program – sealed with a panel of 78 reinsurers – includes $875mn of multi-year ILS capacity providing diversifying collateralized reinsurance capital.

-

The forecaster is predicting there could be as many as 14 hurricanes in the North Atlantic between June and November.

-

The US National Oceanic and Atmospheric Administration (NOAA) has forecast “near-normal" hurricane activity in the Atlantic this year.

-

The board also approved a PLA 2023 line of credit, which provides up to $1.25bn in liquidity.

-

The deal priced 50 basis points below guidance.

-

Citizens’ board is slated to meet on May 16 at 13:30 ET to discuss the reinsurance and risk transfer program.

-

The firm has posted a combined ratio of 75.4% for 2022.

-

Welcome to the 2023 Trading Risk Awards, where the best and brightest in the ILS market are recognised for their achievements from the past year – and what a year it was.

-

The CFO said cedants ‘recognise the new supply-demand reality’ as it benefitted from an early release of Hurricane Ian reserves.

-

The carrier’s combined ratio totaled 100%, up 2.1 points from Q1 2022, reflecting a higher net loss ratio, partially offset by a lower net expense ratio.

-

The withdrawal from the aviation reinsurance class announced yesterday represented ~$10mn of non-renewed premium.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

The impact of recent tort reforms is already being felt in the Sunshine State, the CEO said.

-

The carrier contended with 10 events over the month, with 75% of its losses stemming from three wind events.

-

On March 31, the National Weather Service counted 618 storm reports and 104 tornado reports, both records for the year to date.

-

Colorado State University anticipates a “near-average” probability for major hurricanes – Category 3, 4, and 5 – making landfall along the continental US coastline and in the Caribbean.

-

The forecast included two intense hurricanes, six hurricanes and 12 tropical storms.

-

The newly developed scale will run from AR-1 to AR-5, with AR-5 being the most intense, to mirror measurements of hurricane events.

-

The InsurTech has moved its pricing for the instrument to the top of its initial range.

-

The AP2 fund noted currency-hedging effects, turbulent financial markets and Hurricane Ian as factors in its alternatives segment loss for the 2022 year.

-

The reinsurance recoverables from Lorenz investors were up by 56% to $921mn in the 2022 year.

-

Reserve releases connected to 2017 events helped the segment deliver a 95.6% combined ratio.

-

The bond is seeking coverage for Florida named storm.

-

The cat bond market is thought likely to receive an outsized portion of any capital inflows.

-

Investors have been experiencing inflows while new volumes in Q1 were lower than expected.

-

The company also expects the overall decrease in loss expenses due to the recent Florida legislation to be on the lower end of 25%-40%.

-

CEO Locke Burt said Florida reforms would be “transformational” and that investors had become more receptive to cat risk owing to higher rates.

-

The reinsurer retained EUR321.9mn of Hurricane Ian losses on its own book.

-

The state-backed carrier’s policy count is projected to hit a record high of 1.6 million by year-end.

-

The division is deploying its own capital to make up for the lack of wider reinsurance and ILS capacity.

-

The insurer reported an underwriting profit for Q4.

-

Higher rates and reserve releases connected to Hurricane Ian boosted results.

-

The Florida insurer recognised a major increase in Ian losses in Q4, rendering its personal lines carrier insolvent.

-

The asset manager said this year’s conditions were the most attractive in ILS history.

-

A canvass of Lloyd’s market executives generated an expected combined ratio of 92%-93% for 2022.

-

The Chicago-based InsurTech placed its debut cat bond in April 2022 in a private deal.

-

The carrier reported a Q4 combined ratio of 101.4%, an improvement of 30 points year-on-year, driven by a 27-point reduction in its loss ratio.

-

The biggest increases came from North American hurricane and earthquake coverage, where retentions rose from $350mn to $600mn.

-

The reinsurer reported risk-adjusted prices up 2.3% based on conservative inflation and other assumptions.

-

Kin has ceded 97% of its $175mn expected gross loss and loss adjustment expenses from hurricanes Ian and Nicole to reinsurers, the carrier has said.

-

Ron DeSantis has also announced proposals to modernize Florida’s "bad faith" law, in the latest set of reforms he described as the most “comprehensive in decades”.

-

The firm will exhaust its personal lines reinsurance coverage on the storm, pushing its personal lines carrier into insolvency, with commercial claims doubling.

-

Lancashire recorded a net loss from Hurricane Ian of $163.3mn during the year, at the lower end of its projected range.

-

The reinsurer noted “buoyant” conditions in the cat bond and private reinsurance segments.

-

The multipliers on the A and B notes reflect the lack of losses from Hurricane Ian to FloodSmart Re bonds.

-

The attempt to increase the supply of insurance in the state has been submitted for governor approval.

-

Lawmakers are taking action to attract more property insurers into the state.

-

Following rate increases at 1 January, projected fund returns for 2023 are up several points year on year, with a boost also from higher Treasury rates.

-

Pure cat bond funds outperformed the sub-group which includes private ILS for the year.

-

Early evidence is leading the (re)insurance market to hope the storm can avoid the development curve of its 2017 predecessor Hurricane Irma.

-

An imbalance of capital supply and demand led to strong increases to spreads at issuance for index-linked and indemnity bonds.

-

Following recent hurricanes, more than 610,000 residential property claims were filed in the state.

-

The firm’s flood solution will be available to layer on top of existing parametric hurricane wind policies.

-

The broker found that the insured-loss figure for 2022 was nearly 60% higher than the annual average over the 21st century.

-

The regulator examined carriers’ ability to model nat-cat and cyber events, with mixed results.

-

Louisiana governor John Bel Edwards, state insurance commissioner Jim Donelon, and legislative leadership are in discussions about a potential special session.

-

This takes its ex-Florida cat losses since the start of its reinsurance annual risk period in April above $2bn.

-

The federal flood program expects ultimate losses to reach between $3.5bn and $5.3bn.

-

Lane Financial said that the cat bond market is suggesting that the early markdowns were an overreaction.

-

The low-risk group of funds outperformed the high-risk funds in the month and year.

-

Natural disasters in North America destroyed assets worth around $150bn, of which roughly $90bn were insured.

-

The increase mainly stemmed from an influx of personal property claims.

-

The index has recorded gains over the previous two months following sharp falls in September due to Hurricane Ian.

-

The asset manager’s reinsurance funds shrank 17% in its fiscal year to end October to reach $2.6bn.

-

Just over a month ago, Floir reported claims relating to Hurricane Ian worth $10.3bn.

-

The update to the October figure implies the ultimate number will comfortably breach the $50bn mark.

-

The updated loss and allocated loss adjustment expenses in the property segment from the hurricane is now $1bn.

-

On Tuesday, the bill passed in the State Senate 27-13, and today's passage in the House represented an 84-33 party line split.

-

Florida has been seeking legislative reform amid a breakdown of the functionality of its insurance market.

-

The bill under discussion tackles key concerns like eliminating one-way attorney fees and getting rid of the state’s controversial assignment of benefits right.

-

As Trading Risk welcomed ILS market leaders to its Monte Carlo roundtable, there were already headwinds challenging the asset class even before the late September landfall of Hurricane Ian in Florida.

-

-

Citizens will be ineligible for the coverage, which will attract premiums ranging from rates-on-line of 50-65%.

-

The state’s House of Representatives will vote this week on whether to put the call to the US President and US Congress.

-

The state’s legislature has published its reform bill to be debated in the special session this week with wide-ranging reforms to tackle high litigation costs.

-

Hurricane Ian’s legacy will undoubtedly lead to some shake-ups in the ILS sector, with ongoing progression outside cat and ESG strategies likely to be a focus.

-

Swiss Re said a loss-heavy 2022 adds to a continuation of elevated cat losses that started in 2017, after a benign period from 2012 to 2016.

-

The upcoming special session, which will take place from December 12 to 16, will need to consider how to make Florida attractive to national insurers and reinsurers.

-

In late August, UPC signaled that it will pull out of personal lines in Florida, Texas, Louisiana and New York.

-

The modelling firm noted a shift towards stronger hurricanes making landfall.

-

The Bermuda Monetary Authority expects carriers on the island to take a 25% share of the total industry loss.

-

The forecast included three intense hurricanes, six hurricanes and 13 tropical storms.

-

Fidelis chairman Richard Brindle said a shift towards named cat perils and away from complex structures is underway, but that carriers need more unity between inwards and outwards teams to navigate the harder market.

-

The modeler warned that climate change was increasing the chances of $20bn, $30bn and $40bn loss events.

-

The state’s lawmakers will meet on December 12-16 to address the challenges facing its troubled property insurance market.

-

The reinsurer emphasised the need for improved secondary peril models including predictive capabilities.

-

The year 2005, which featured the devastating Hurricane Katrina, remains the most expensive storm season.

-

2022 was a near-average season in terms of the number of storms, but featured an unusually quiet start in August, followed by two Florida hurricanes, including one of the US’s most expensive.

-

Frontier Advisors said sentiment continues to be challenged by performance.

-

The pay-out figure has nearly doubled over the last two weeks.

-

The Canadian investment fund now owns almost 3.8 million shares of the personal lines insurer, compared to 281,773 in Q2.

-

Initial loss estimates for the last quarter show lower hits to equity than observed after hurricanes Harvey, Irma and Maria five years ago.

-

The two insurers are believed to provide in excess of 20% of the cat MGA’s capacity.

-

The market share for the storm of 3%-5% is below syndicates’ historical average for US wind events.

-

Most claims so far have been for damage to residential property.

-

The CEO emphasized that the estimate is a modeled estimate and does not include litigation or inflationary pressures.

-

The modeller also said that losses to the National Flood Insurance Program will likely remain under $300mn.

-

The new loss pick takes into account litigation and inflation costs, as well as claims activity to date.

-

Most ILS firms are marking the Ian loss as a $50bn+ event, although there are exceptions.

-

The manager received a mandate from a new investor who had taken the call to come in ahead of Hurricane Ian.

-

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

The bonds had been heavily marked down initially.

-

According to the latest reports, around 110,000 customers have been left without power in Florida as Nicole makes its way across the state.

-

Hurricane Ian losses at United Insurance Holdings (UPC) Insurance have nearly reached the top of its personal lines reinsurance tower, company executives said on its earnings call.

-

Overall, the carrier posted $408mn of cat and man-made losses in Q3, up from $333mn a year earlier, of which $297mn related to Hurricane Ida and the European floods.

-

Over $20mn, the company's reinsurance cover is roughly 40 cents on the dollar, depending on the severity of the storm.

-

The Category 1 storm’s landfall on the east coast of Florida would be a “manageable” cat event that hurts primary carriers more than their reinsurers, he said.

-

The reinsurer flagged changes will be made to its retro programme in 2023 after cutting its cat book and as the retro market has hardened.

-

The company is confident it has sufficient additional reinsurance capacity should claims begin to develop outside of initial expectations.

-

The Floridian's net loss ratio jumped nearly 18 points to 97.6%, driven by a $40mn retention from Ian and slightly lower net earned premium than the prior-year quarter.

-

The carrier has reduced its full-year projected consolidated result for reinsurance and expects a worse P&C combined ratio.

-

The NHC has warned of a large storm with hazards extending across the state.

-

The sector’s performance was better overall compared with September 2017.

-

The storm will hit a state already devastated by Hurricane Ian, which has eroded the capital of local carriers.

-

FloodSmart Re bonds recovered by a few points in October after initial steep write-downs following Ian.

-

Considering Hurricane Ian's impact, rate hardening will only accelerate, CEO Alex Maloney said.

-

Gross written premium grew across all business lines, with P&C reinsurance reporting a 37.5% increase.

-

The combined ratio for Hannover Re’s structured reinsurance and ILS fronting business came in just better than target at 98.2%.

-

The reinsurer raised $122mn in Q3, including $100mn for PGGM joint venture Vermeer and $22mn in its cat bond fund.

-

The reinsurer manager described Q3 net inflows as “broadly stable”.

-

The company’s third-party assets dropped $178mn during Q3 to $4.2bn.

-

AIG’s Q3 net cat losses of $600mn included $450mn from Hurricane Ian.

-

The ILS platform has dipped to $7.8bn in assets under management, as ILS revenues were down 44% after the sale of Velocity.

-

The company’s combined ratio edged up by 0.3 points despite a two-point reduction in expenses and a 3.4-point reduction in cats.

-

A 3.9-point decline in the casualty and specialty segment offset a 2.5-point deterioration in the company’s property business.

-

The Gulf Coast state is keen to distance itself from Florida’s insurance woes but is resistant to some underlying changes.

-

Around $100mn of the facility was funded at close, with the remaining funds available in two tranches as the company reaches certain agreed-upon milestones.

-

The executive added that while the Florida market has seen benefits from recent legislation, the major issue remaining is one-way attorney fees.

-

The carrier said it was “insulated from open market pricing dynamics” for its 2023-24 reinsurance.

-

The Floridian's loss ratio increased 42.8 points, reflecting $111mn of retained Hurricane Ian losses and a higher attritional initial accident year loss pick.

-

CEO Andrade said the hardening property cat market was a “tremendous opportunity” for the Bermudian.

-

The Bermudian’s operating loss per share, however, grew nearly four times from the prior-year quarter to $5.28 per share.

-

The projected Ian loss is $2.2bn higher than the state reinsurer took from Hurricane Irma in 2017.

-

Former Ariel Re executive Edouard von Herberstein was one of the founding team at HSCM and is leaving to pursue other opportunities.

-

Nearly two-thirds of the Florida claims are homeowners and business claims (272,465), and the remaining are personal automobile claims (151,892).

-

The Residential Re transaction is being offered with significantly higher spreads than a year ago in a sign of repricing benchmarks after Hurricane Ian.

-

For larger top-end ILW triggers, cedants may have to be pragmatic on rolling over capital.

-

The homeowners’ InsurTech reported that it has received approximately 6,800 claims associated with Hurricane Ian to date.

-

A special session in December and prohibition of assignments of benefits have been cited on the Florida campaign trail.

-

The reinsurer said it will be “significantly more challenging” to hit EUR3.3bn 2022 profit target.

-

The estimate anticipates a full retention loss of $12.5mn from Hurricane Ian.

-

The insurer said the estimate represents a 13.9-point impact on its Q3 combined ratio based on earned premiums.

-

The firm’s insurance business recorded $100mn of Ian-related losses while the reinsurance unit booked $60mn.

-

The insurer took $28mn in net Hurricane Ian losses and warned inflationary pressures surpassed expectations in general in Q3.

-

More than half of insured losses came from Nova Scotia.

-

The estimate is driven by $540mn of losses attributable to Hurricane Ian.

-

The reinsurer attributed $600mn to Hurricane Ian, based on an estimate that the total insured industry losses would come to approximately $55bn.

-

Many homeowners are likely to see a significant portion of uninsured water damage despite roughly 30%-45% having NFIP coverage in certain areas.

-

The firm’s capital and risk solutions segment has been growing its reinsurance business this year.

-

Arch’s estimate is commensurate with a range of expected insured losses across the global P&C industry of $50bn to $60bn.

-

Preliminary total economic losses this year through Q3, including an initial view of Hurricane Ian based on publicly available estimates, were $227bn.

-

The outcomes were better than the Swiss Re global cat bond index decline after the major hurricane.

-

Lower-attaching Florida ILWs had been more in demand at this year’s mid-year renewals.

-

The carrier is likely to book a Q3 net loss of $500mn for the storm.

-

The analysts said market pricing indicators suggested a hard market was going to set in, requiring increases of 20%-30%.

-

The federal flood insurance program’s claims count has stepped up from 25,000 a fortnight ago.

-

The modelling firm is applying a 1.8x factor to residential losses from the storm to account for anticipated legal action against insurers and demand surge.

-

Major questions confront the industry after Hurricane Ian, but no matter the answers, certain outcomes are inevitable.

-

The state-backed insurer's claims tally was just over 47,000 this morning.

-

The reinsurance segment is heading for a hard market regardless of whether the loss is $40bn or $60bn, but the swing will exacerbate trapital and influence the reload, Convergence conference panellists suggested.

-

The carrier’s property business retained $175mn of losses net of reinsurance related to the Hurricane.

-

So far, the company has received nearly 12,000 claims associated with the storm.

-

The insurer has received roughly 19,000 claims to date and estimates it will receive 27,000 to 30,000 claims.

-

The company estimates its overall gross loss to be approximately $1bn, below its $3bn overall reinsurance tower.

-

The Florida carrier suggested that Ian will not exhaust the state’s reinsurance Cat Fund.

-

Buyers are more open than ever to different sources of capacity, but the timing of entry will not be on the industry’s terms.

-

The risk modeler estimated the NFIP could take $10bn additional losses from storm surge and inland flooding.

-

The state insurance body received reports of 375,293 claims as of 6 October.

-

The carrier has under 3% market share in Florida homeowners’ business in 2021.