Hurricane

-

The company also has $100mn for US hurricane events.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

Several Florida start-ups are poised to begin writing business this year.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

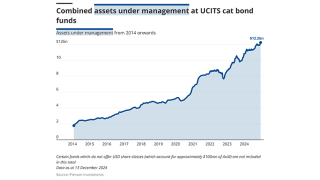

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

-

The industry loss number has increased threefold from an initial $5bn pick.

-

Total economic losses were $368bn, 14% above the 21st century average.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The company no longer has any exposure to reinsurance contracts.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The model factors in the effects of climate change to date.

-

A total of $2.1bn in Fema money has been approved for the state.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The Florida carrier reported a 103.5% combined ratio in Q3.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The carrier is looking at a $600-$900mn hit from Debby, Helene, Milton.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.