-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The industry has continued to build and innovate through a third strong year of performance.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Investor interest is warming up following a colder spell over the past several years.

-

The award of the mandates marks the California public pension plan’s entry into ILS.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

The funds will combine credit and ILS holdings.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The allocation is around 3% of the fund’s total assets.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The facility will initially focus on US, Bermudian and European business.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

The resource was developed by leading ILS managers and investors.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

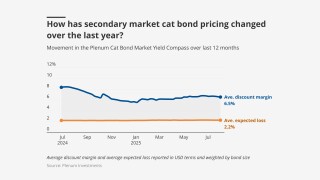

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

Investors are drawing lessons from life deals to find new routes into insurance markets.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

Canio spent over 19 years with PGGM, with nine of those managing ILS.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Former ILS lead Matt Holland left the company in May.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

The Cayman Islands-domiciled SPI now has four institutional backers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Michael Hamer recognised for his work with investors and on reporting frameworks.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

The pensions scheme’s existing ILS holdings to Aeolus and HSCM are in run-off.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

The fund lists Twelve, Swiss Re and Cambridge Associates as managers.

-

Investors eyeing private ILS include opportunistic allocators keeping watch on storm season.

-

The pension plan noted in June 2024 that it was exploring new options in ILS.

-

The man is alleged to have conspired with others to falsify LOCs and collateral letters.

-

The investment is a response to shifts in stock-bond correlations.

-

A total $225mn of fresh limit entered the market across two deals.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The Swiss pension fund has not disclosed an ILS allocation before.

-

The pension plan has been allocating to ILS since 2005.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform is based in Bermuda and will focus on strategic capital partnerships.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

This year’s ceremony will include the inaugural Women in ILS Award presentation.

-

An allocation to insurance could “feel like a nice, calm port in the storm” amid wider market volatility.