-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

The $100mn note was unchanged in size.

-

Management track record has been a factor in capital raising for 2025.

-

Robert Salzmann has been with the Swiss Re insurer for a decade.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

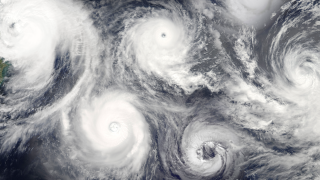

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The ruling indicated it was unlikely all claims would be dismissed, as defendants had requested.

-

The fund will invest in listed and private transactions.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.