-

The three-year instrument provides cover for US named storms and earthquakes and European windstorms.

-

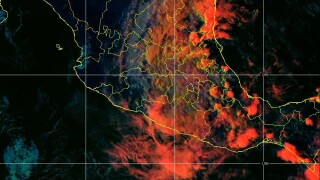

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

Carriers have been dealing with elevated storm activity this year, whilst additional purchases to match inflating values had largely been parked in 2023.

-

The first edition of the vehicle has generated fee income of $29mn to date.

-

The forecast reflects property damage and BI losses to residential, commercial, industrial and automobile lines.

-

The $75mn cat bond will cover systemic cyber events on a per-occurrence basis.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The move reflects years of weak profitability caused by high cost inflation and cat losses.

-

The $75mn cat bond is expected to close in late November.

-

The pool was launched in July 2022 and is backed by a A$10bn government guarantee.

-

The estimate includes wind damage, as well as damage to property, automobiles, agriculture and direct BI.

-

The bond will provide cover for windstorm, hailstorm, flood and quake.