-

The carrier’s equivalent bond placed last March secured $550mn of limit.

-

The carrier becomes the first syndicate to use the new London Bridge structure.

-

Alun Thomas will report to Bermuda CEO Chris Bonard.

-

M&G investments has committed the capital through its Catalyst private assets strategy.

-

The WR Berkley vehicle takes a 30% share of its reinsurance placements.

-

The manager’s life & alternative credit segment invested in the reverse mortgage specialist.

-

The insurance conglomerate initially committed $50mn to Elementum funds.

-

A canvass of Lloyd’s market executives generated an expected combined ratio of 92%-93% for 2022.

-

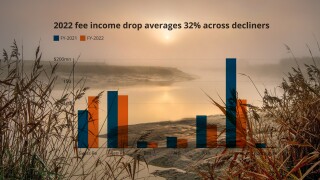

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

The reinsurer reported risk-adjusted prices up 2.3% based on conservative inflation and other assumptions.

-

After threatening a swathe of downgrades of Floridian carriers last year, the ratings agency has signaled a positive reception of reforms.

-

The company’s Syndicate 2988 exited direct property business.