-

TigerRisk Capital Markets & Advisory acted as exclusive structuring and placement agent for the reinsurance sidecar.

-

The incoming president for insurance also highlighted the role Nephila could play in the transition to net zero.

-

The former analyst at Aeolus joins the growing number of ILS experts to join the firm.

-

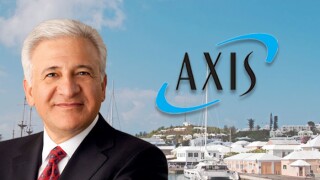

The outgoing CEO will step down in May and spend six months as a strategic adviser to the company.

-

Senate Bill 2A addresses key concerns in the Florida property market, including one-way attorney fees and assignment of benefits, the ratings agency said.

-

Tristan Abend has been with the Axa XL Reinsurance team for 10 years.

-

The move comes amid a general cutback from reinsurers’ in their cat risk appetite.

-

The update is a slight increase to November’s 114bn yen estimate.

-

The announcement comes on the helm of both houses of the Florida legislature passing the proposed overhaul of the state's property insurance market.

-

Tension is emerging at the reinsurance level over the retrenchment from all-perils coverage, which previously offered ‘sleep-easy protection’.

-

The legislature met for a special session this week, discussing key concerns in the state's property insurance market.

-

RenRe, Fontana’s owner, said earlier this year that it was considering getting a rating for the casualty and specialty sidecar.