-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

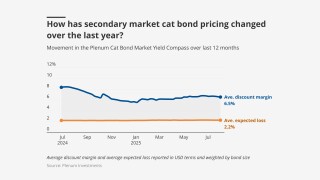

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The forecast has increased since the early July update due to several additional factors.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.