-

The retro renewals are barely underway, as a challenging fundraising environment and queries over loss experience has delayed the typical pace of progress.

-

The insurer said its plan was to fully transition the book to the fund.

-

The CFO said today’s favourable nine-month numbers were due to a sustained effort to improve P&C underwriting discipline.

-

Surpassing the $30bn threshold will trigger more occurrence covers, as another painful year looms for aggregate writers.

-

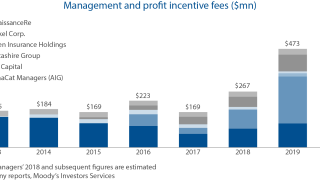

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

Retro rates were in some cases falling by mid-year, ahead of the recent losses.

-

Hannover Re CEO Jean-Jacques Henchoz told Trading Risk there was a “question mark” about whether demand would carry over into next year.

-

Outside the US, two Indian cyclones are expected to have caused more than $4.5bn of economic losses.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

Initially, negotiations are likely to be led by risk takers but there could be a case to model a future role for service providers.

-

There is little sign of retro demand returning after buyers cut back in January.

-