-

Tom Gray spent the best part of a decade at Lancashire.

-

Reinsurers could use retained earnings to target growth and buy more retro.

-

The industry has continued to build and innovate through a third strong year of performance.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

The bond will provide protection against US wind with a PCS trigger.

-

The carrier will continue to write assumed retro in Bermuda.

-

The sidecar will support five programs providing specialty frequency coverages.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The firm’s ILS vehicles posted low single-digit growth in assets under management in Q2.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

The third-party capital manager is a new entrant to the retro space.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The Bermuda-based team is led by John Fletcher.

-

ILS offers efficient capital for underwriters, but casualty ILS transactions are complex.

-

The Altamont-backed broker has been building out its team since launching in 2023.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

Price guidance for the bond is 4.00%-4.50%.

-

The reinsurer has already dipped into the cat bond market with its Stabilitas Re retro deals.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

The firm announced CEO Trevor Carvey will retire and is returning to the UK from Bermuda.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

This will be the third cat bond issuance through Baltic Re PCC.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

The role oversees the $187bn Canadian pension plan’s ILS allocation.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The firm ceded $417mn of premiums to the sidecar in 2024.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Scrocca will be based in Bermuda on focus on underwriting and risk sourcing, among other things.

-

The deal is being issued through Lloyd’s London Bridge 2 PCC.

-

The bond will provide coverage for named storms in North Carolina.

-

The reinsurer has cut the cession rate to 33% from 40% last year.

-

Theokli joined the company in 2021 as a senior underwriter.

-

The reinsurer added two new tranches to its 2025 issuance.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

The index delivered a total return of 1.29% for the month of December.

-

The renewal marks the seventh issue of the retro vehicle.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

Recoletos Re DAC SPI takes its name from the Paseo de Recoletos boulevard in Madrid.

-

The firm said it benefited from favourable retro market conditions.

-

The firm has added three new retro partners during 2024.

-

Former ILS investors who left the space have looked again and re-allocated.

-

Management track record has been a factor in capital raising for 2025.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

Tyler left Gallagher Re earlier this year.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The reinsurer is planning to drop its cession rate from 40% to 30%-35%.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Post-Milton investor interest in ILS has yet to translate into dollars allocated.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

The ILS industry alumnus is understood to have two ILS investors lined up.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

The reinsurer said retro pricing had ‘moved slightly in our favour’ at 1 January.

-

The depth of the retro market recovery will be an influential factor in the pace of the cat market slowdown from here.

-

The investment firm said cat bond spreads that are elevated relative to historical levels continue to offer an attractive entry point for investors.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

The pricing on the deal has settled below initial guidance at 7.5%.

-

The firm said it would cut its K-cession ‘significantly below 2023 levels’ and buy ‘broadly similar towers of non-proportional retro’ at 1 January.

-

Sang Hun Park previously spent nine years at Allianz before joining Munich Re as a senior origination manager in August 2021.

-

The capital management platform remains active but January renewals were fronted by the balance sheet.

-

The carrier has increased its retro capacity by 56% to EUR1.34bn.

-

More retrocession capacity is likely to be deployed during 2023 as pricing holds up across the primary, reinsurance and retro markets, according to Conduit Re.

-

The intermediary recorded “one of the hardest reinsurance markets in living memory” as primary rate increases slowed.

-

The exit highlights increasingly difficult conditions in the retro and reinsurance markets.

-

The carrier has become the latest in a string of reinsurers unwilling to write retro at 1 January.

-

The RenRe vehicle, formerly a major retro writer, has been a reduced force this year.

-

It is understood that Ascot will continue to write worldwide retro business.

-

Hannover Re said that it expected its total gross Ian losses to be slightly below EUR400mn.

-

Fidelis and MS Reinsurance are among the ceding companies that have support from Ajit Jain’s unit.

-

The firm’s European regional treaty cover shrank 9% to $398m.

-

The firm assigned a neutral outlook overall to ILS but is strongly positive on many non-life risks as it seeks diversifying strategies that can withstand inflation.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

It noted that its aviation and marine books are covered by retro although its exposure is “not very material”.

-

It will offer components for buyers looking for indemnity, parametric or blended coverage.

-

The carrier took a net EUR838mn of cat losses in the full year.

-

The carrier’s whole-account XoL retro also shrank by a similar margin.

-

Greater participation of cat bond investors in the retro market has some advantages alongside the risks.

-

Retro renewals have made major progress in early January, but programme gaps remain at some levels, with reinsurers left carrying more risk net.

-

Some programs had to be restructured as rates hardened and capacity flowed away from cat risk in some cases.

-

The move comes amid limited availability of annual aggregate cover.

-

CyberCube forecast further capital market capacity will hit the cyber insurance market next year.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

The carrier is looking to raise annual aggregate protection from the new ILS deal.

-

The retro renewals are barely underway, as a challenging fundraising environment and queries over loss experience has delayed the typical pace of progress.

-

The insurer said its plan was to fully transition the book to the fund.

-

The CFO said today’s favourable nine-month numbers were due to a sustained effort to improve P&C underwriting discipline.

-

Surpassing the $30bn threshold will trigger more occurrence covers, as another painful year looms for aggregate writers.

-

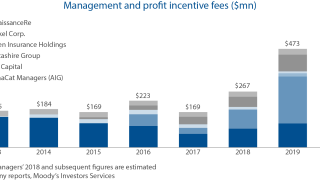

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

Retro rates were in some cases falling by mid-year, ahead of the recent losses.

-

Hannover Re CEO Jean-Jacques Henchoz told Trading Risk there was a “question mark” about whether demand would carry over into next year.

-

Outside the US, two Indian cyclones are expected to have caused more than $4.5bn of economic losses.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

Initially, negotiations are likely to be led by risk takers but there could be a case to model a future role for service providers.

-

There is little sign of retro demand returning after buyers cut back in January.

-

-

The start-up's new hire was a founding member of the leadership team at Fosun-owned Peak Re.

-

The former Bermuda Brokers and JLT Re broker says ILW appetite is expected to remain strong after benefitting from pandemic trading activity.

-

The executive will take up the Hong Kong-based post on 1 September.

-

The carrier last year said its K sidecar would pick up Covid claims over time.

-

One swallow doesn't make a summer, but what do two retro "cashback" transactions portend for hurricane season?

-

Simon Moore has joined Lockton Re as a senior broker in the company’s non-marine retro and property specialty team, based in London.

-

Hannover Re and Fidelis provided significant capacity on the Munich Re-led programme.

-

ARPC said the move improves the pool’s capital strength.

-

ARPC said the move improves the pool’s capital strength.

-

The reinsurer was chasing a high 15% net return target but said lower demand and capital trapping made this unachievable

-

The Bermuda-based broker is believed to be heading to Corant along with other hires.

-

Some markets on the programme have pushed back on the inclusion of event cancellation exposures.

-

A new mandate from an institutional investor has seeded the strategy.

-

The capital supports the MGA’s excess retro portfolio.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

The broker forecast that this hard market may be more akin to the “discriminate and relatively short-lived" phase following 2005.

-

Aggregate retro capacity has “reduced enormously” but rate increases were less severe than some had feared, the Willis Re international chairman said.

-

Capacity was constrained but some ILS funds were able to grow, while cat bonds also propped up supply.

-

New capacity and fewer problems with trapping contributed to a smoother renewal than some had expected.

-

This is the carrier’s first public cat bond after a private deal done through Guy Carp’s Cerulean platform in 2019.

-

The executive will lead the retrocession and property specialty segments.

-

If the fundraise closes, the business will operate as a “permanent capital” monoline retrocessionaire.

-

Pessimism around trapped capital is growing, but low reported losses may mitigate the issue.

-

Scor sought higher-priced agg cover, but Munich Re achieved below-average uplift on its occurrence treaty.

-

Retro deals make up a third of this year's volumes, versus a quarter in 2019.

-

Investors from the ILS boom era are also those who've had the least luck, so fundraising remains a slog.

-

Covid-19 may have been the biggest talking point in the (re)insurance markets this year but arguably, the pandemic is being overtaken by several other factors – ILS market dynamics amongst them.

-

RenRe thinks the major cat losses of Q3 will cause the property cat market to harden throughout 2021.

-

The carrier says higher retro renewal costs will act as a counterweight to rising rates.

-

Hannover Re's K sidecar includes exposure to the aviation market, but overall ILS participation in such risks is limited.

-

The move marks the company’s fifth round of share redemptions since going into run-off.

-

If reinsurers prevail in limiting insurers from aggregating BI claims, this will shield retro markets.

-

Total insured losses are well up on 2019, but the severity of individual blazes is not likely to impact reinsurers extensively.

-

Retro structural change will provide a lot of the gains in 2021, with trapping negotiations complicating the mix.

-

Collateralised capacity will retain an important role in the retro niche.

-

The carrier's Ada Re vehicle will join its Turing Re sidecar, but its capacity is not known.

-

The CEOs of Aon Reinsurance Solutions, Willis Re and TigerRisk predict limited rate gains, but up to $10bn of incoming capital.

-

A much harder retro market is driving reinsurance price increases.

-

Having fuelled up on retro to grow, some carriers may need to focus on managing net exposures.

-

The retro space is expected to move towards named peril covers as rates approach post-Hurricane Katrina levels.

-

The market is also interested in more liquid cat bonds, the reinsurer said at a press conference on Monday.

-

The release from side pockets will be paid to the company in October.