-

The James River-Long Tail Re deal is the latest example of deal-specific investor capital.

-

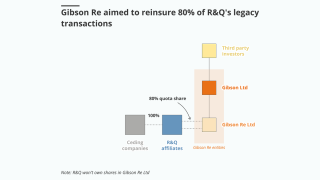

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

The deal economics take into account the investment return that Longtail Re can leverage.

-

The bond’s pricing for southern US storms landed at the upper bound of guidance.

-

The ILS manager claims that 777 Partners “double-pledged” collateral.

-

The parametric bond provides coverage for named storms.

-

Its Class 13 and 14 notes priced roughly at the midpoint of expectations.

-

Managers have tightened buffer terms and added extension spreads to enhance illiquid strategies.

-

The fund is a continuation vehicle for five of HSCM's life insurance interests.

-

The bond will provide protection against Japanese flood and quake events.

-

The bond will insure against named storms in eight US states.

-

The newly launched Marco Re will be led by Mark Elliott as CEO.