-

The carrier posted a small loss in the first half of 2021, the agency noted.

-

Surpassing the $30bn threshold will trigger more occurrence covers, as another painful year looms for aggregate writers.

-

The new generation of vehicles is driven by a lively legacy market and innovations in structuring deals for long-tail risk.

-

One of the ongoing trends within the ILS market over past years has been an increasing demand from existing investors to look for something different within their portfolio.

-

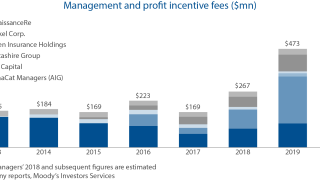

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

Retro rates were in some cases falling by mid-year, ahead of the recent losses.

-

The portfolio has no active client relationships and was underwritten from 1969 onwards.

-

Hannover Re CEO Jean-Jacques Henchoz told Trading Risk there was a “question mark” about whether demand would carry over into next year.

-

Just a few months into 2021, the first natural-disaster headlines of the year are already occupying the minds of ILS insurance risk-takers. The snowstorms that brought freezing conditions to Texas will be a challenging event to evaluate for a number of reasons.

-

Outside the US, two Indian cyclones are expected to have caused more than $4.5bn of economic losses.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

Initially, negotiations are likely to be led by risk takers but there could be a case to model a future role for service providers.