-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

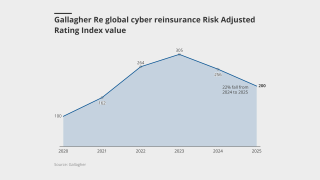

The industry has continued to build and innovate through a third strong year of performance.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

New catastrophe reinsurance Syndicate 2359 has an approved stamp capacity of £100mn.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The hedge fund had significant investment aims for the London market.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The tech firm is building a joint stock company with insurers and investors.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The headcount at the start-up now stands at around 40.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

AIG, HDI Global and others have settled, while Chubb’s fight continues.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The announcement spurred a quick spike in stock market valuations.

-

Torrey Pines Re is split among three tranches of notes.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

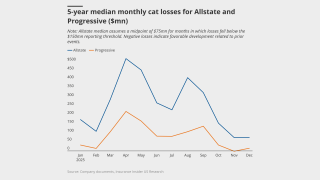

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

The model factors in the effects of climate change to date.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The deal is offering a multiple of 11.3x on the expected loss.

-

The bond offers a multiple of 11.3x based on a modelled expected loss of 0.93%.

-

The bond is offering a spread range of 950-1,050 basis points.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Building better exposure datasets could draw a broader range of investors.

-

The insurer currently has $300mn of reinsurance limit from cyber cat bonds.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

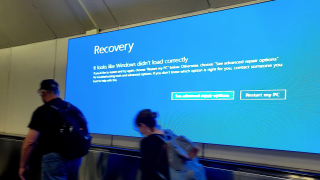

The July downtime will increase relevance, demand and innovation for the market.

-

The carrier estimates the total industry loss for the Microsoft/CrowdStrike outage at around $1bn-$2bn.

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The profile of the loss could provide comfort to investors around exposure diversification.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The market is expected to seek additional exclusions around systemic events.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

Hannover Re's cyber bond pays on a parametric basis for each hour after an agreed waiting period.

-

The analyst estimated Beazley’s loss from the global outage at $80mn-$120mn.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

The event could unpack issues around accumulation risk and cloud services.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

The early May forecast is driven by factors including the El Niño Southern Oscillation.

-

State interference is likely to be required if an attack is large enough to trigger bonds now on the market, experts say.

-

The consortium will offer up to $50mn of per-program capacity.

-

The ILS market’s exposure could grow to $1.5bn by the time a major cyber cat event occurs.

-

The reinsurer said it hopes to grow the size of the $13.75mn deal over time.

-

Stefan Sperlich will lead the new unit as managing director.

-

Revenue, country and industry sector drive modelled output divergence.

-

-

Some $415mn of capacity entered the market last year.

-

The client lacked options in the conventional insurance market.

-

Envelop SPA 1925 was launched at the start of the year with Chris Baddeley as active underwriter, based in London.

-

The insurer said it has received 19,000 claims from affected policyholders so far, with nearly 65% of these coming from customers in Queensland.

-

The $50mn bond provides coverage against systemic cyber events in the US and District of Columbia.

-

George Mawdsley joins after more than 10 years at Securis, where he was tasked with structuring and origination of ILS risk.

-

The carrier has also extended the redemption period by three years, to 31 March 2029.

-

The transaction is the second cyber cat bond in 144A format to price and follows Axis’s Long Walk Re deal in November.

-

The 144A cyber cat bond deal has increased in size from an initial target of $75mn.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Chubb’s East Lane Re bond is the third cyber cat bond in 144A form to enter the market.

-

The $75mn Long Walk Re deal secured broad market support from ILS investors.

-

The business will service clients in the agriculture, renewable energy and construction industries.

-

The $75mn cat bond will cover systemic cyber events on a per-occurrence basis.

-

The $75mn cat bond is expected to close in late November.

-

The CCRIF has paid out $265mn since its inception in 2007.

-

Sources have raised concerns that cedant demand could outpace available capacity for cyber cat bonds.

-

Executives said geopolitical uncertainty, economic stagnation, cyber, cat events and inflation will drive demand on the Continent.

-

The US could be exposed to economic losses of $1.1tn in the event of a cyberattack, the highest of any country.

-

Cyber reinsurance has around $500mn of annual capacity currently supporting the space.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

Experts at the Trading Risk New York conference emphasised in-built cyber risk protections from defences to exclusions, as ILS managers grapple with understanding the peril.

-

The mortgage insurer last closed a similar deal more than two years ago.

-

-

The founding members include Munich Re, Gallagher Re, and BitSight.

-

The carrier describes reinsurers’ current strategy of dealing with cyber policies as "a game of whack-a-mole"

-

The broker studied the impact of 14 major cyber events in its attempt to dispel ILS manager fears of a ‘double whammy’ cyber event that would also impact financial markets.

-

A total of 10 events caused more than $1bn in losses each.

-

Tornados in the first six months of the year in the US were slightly above the 27-year average.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

The new SPA will write cyber reinsurance initially and could progress to writing insurance.

-

The cyber MGA can now serve clients in Italy, Spain, Ireland, Sweden and Denmark.

-

A Guy Carpenter report recently noted that risk models are converging for the most remote risk levels.

-

The broker named Matthew McCabe as MD of cyber broking with a brief to tackle complex cyber issues.

-

New language has been introduced by some insurers to limit exposures to cyber risks.

-

Analysis showed a modelled loss range of between $15.6bn and $33.4bn for a 1:200-year global loss event.

-

Guy Carpenter was the sole placing broker sourcing capacity for the tie-up.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

Spectra has in-principle approval for a Bermuda broker license but believes cyber ILS solutions will be a game of “slow progress”.

-

Fort Lauderdale Hollywood airport was forced to close as a result of the flooding caused by the 25 inches of rain that fell on Wednesday and Thursday.

-

Lloyd’s has launched a fund on its new investment platform to enable the market to invest globally in assets themed around climate adaptation, mitigation and social inclusion.

-

The £50mn syndicate made most of its profits in aviation.

-

It is understood that the company has mandated Nomura to raise the risk capital.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Beazley executives spoke of further growth prospects in the class, after its results revealed a 79% combined ratio for its cyber division in 2022.

-

The issuance is replacing $400mn of cat bond coverage placed in early 2020.

-

Structures have been developed that would avoid “excessive capital trapping”.

-

The transactions would protect ceding (re)insurers against outages of the cloud.

-

The regulator examined carriers’ ability to model nat-cat and cyber events, with mixed results.

-

Beazley’s bond was hailed as a “great first step” but challenges remain, although others are already working on narrower cloud outage transactions.

-

The transaction is the first proportional deal for cyber risk in the capital markets.

-

The state is contending with flash flooding, mudslides, rockslides, power outages and high winds.

-

Beazley’s $45mn first-time cyber cat bond offered all-perils coverage, though some expected early deals to start with limited scope.

-

Landslides, avalanche risks and submerged highways are just some of the extreme consequences of the storms.

-

Cedants are grappling with rising rates while coverage narrows.

-

The city of Buffalo in New York state was worst impacted, but power was also knocked out in areas stretching from Maine to Seattle.

-

Scott Stephenson, former chairman, president and CEO of Verisk, will join CyberCube’s board after participating in the funding round.

-

CEO Rob Berkley said the company would likely participate in the space for one to three years if rates remain favorable.

-

A special session in December and prohibition of assignments of benefits have been cited on the Florida campaign trail.

-

The two ILS firms were among those participating in a $20mn fundraise for Elpha Secure Technology.

-

The storm, currently 285 miles south of Charleston, is expected to make landfall as a hurricane on Friday.

-

Georgia, Virginia and the Carolinas have declared a state of emergency as the storm moves north.

-

The storm has sped up considerably over the past six hours.

-

The storm is currently at Cat 4 strength but will weaken to Cat 3 as it approaches land.

-

The price for risk carrying is no longer insufficient, Munich Re's CEO said in a Monte Carlo briefing.

-

The carrier said geopolitical factors had given “new urgency” to the green transition.

-

The deal will bring cyber modelling and analytics to the risk transfer market.

-

ABIR reported that Bermudians posted a total loss ratio of 69.9% and a combined ratio of 100.1% last year.

-

Cyber risk ILS will grow slowly in the short-to-medium term, S&P Global Ratings has predicted.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

New research estimates one in six chance of magnitude 7 or higher eruption this century.

-

Envelop anticipates that cyber ILS could hit $100mn of GWP within four years

-

The new recruit has worked for Argo, Allianz and the European Space Agency.

-

This is UPC’s latest attempt to downsize after offloading part of its personal lines business to HCI.

-

The pooled parametric insurance arrangement was trigged by localised drought.

-

Responsible investing in ILS requires “look-through data transparency”, the association says.

-

Guy Carpenter, Aon and Gallagher Re are each understood to be preparing to enter the nascent sector.

-

The follow-only vehicle initially launched in January with a more limited set of permissions.

-

Experts say cyber ILS offerings including cat bonds could be near, but concerns over structures, modelling and correlation persist.

-

The firm’s goal is to raise its own capital and partner with others.

-

The agency highlighted potential aviation losses from the war ranging from $6bn to $15bn.

-

The new firm says ESG criteria will be embedded into the products.

-

As part of the deal, ICEYE will provide Fermat with near real-time flood data for large-scale events.

-

Windstorm Nadia/Malik was one of several to strike the region this winter.

-

The company hired Ambac’s Scott Snyder as president of fronted programs.

-

The 2020s is the key decade for action to limit global warming and its impacts.

-

Cyber reinsurance premiums may exceed those of property cat by 2040.

-

The move reflects the firm’s growing interest in risks beyond nat cat.

-

The issuance will be the fifth time to market in FEMA’s cat bond series

-

This is the first natural catastrophe loss under the World Bank series of ILS deals since 2019.

-

Another pandemic outbreak came in fourth place, with 22% of respondents saying they were worried about further health and workforce issues and movement restrictions in 2022.

-

Some programs had to be restructured as rates hardened and capacity flowed away from cat risk in some cases.

-

As the renewal is expected to spill over into 2022, the two-speed market will put pressure on retro-reliant carriers.

-

The change in plan comes as Lloyd’s restricts cyber growth.

-

CyberCube forecast further capital market capacity will hit the cyber insurance market next year.

-

The firm’s estimate fell at the lower end of the range for historic Top 10 tornado events.

-

Aon’s Impact Forecast has suggested that only a limited portion of the loss will pass to reinsurers.

-

The Lloyd’s chief of markets also highlighted inflationary risks as a trend of which to be aware for syndicates.

-

The storm tore through north-western Europe in October, with major losses in France, Germany and Belgium.

-

The firm’s senior meteorologist noted activity was in line with expectations on major storms, if not all named storms.

-

Theo Norris has joined Gallagher Re as a dedicated cyber ILS broker, moving from his Aon Securities role as acting ILS assistant vice president.

-

Maya Bundt referred to cyber security threats as the “dark side” of proliferating digitalisation.

-

The executive said there was a strong case for meaningful rate increases in reinsurance.

-

The reinsurer aims to become carbon-neutral in operations by 2030, whilst its reinsurance target date is 2050.

-

AM Best sees accumulating cyber risk in the US property market downgrading 18 US property carriers, considering Best’s Capital Adequacy Ratio.

-

The city’s pension fund recorded a 3% return from its ILS portfolio in 2020.

-

The storm has dumped more than nine inches of rain on the city of Houston and risks further damage to Ida-hit properties.

-

In its renewal season update, the carrier said Bernd, Ida, Uri and the pandemic would force up pricing across lines and regions.

-

The 13th named storm of the season made landfall in the Florida Panhandle on Wednesday.

-

It is not so much the size of the hit, as the regularity of moderate cat events that is worrying risk-takers.

-

It recognised the debate surrounding the “plausibility” of such scenarios.

-

At least 22 people have been killed, with 3,000 power outages reported in Humphreys County as of Monday morning.

-

The hurricane made landfall near Tulum, registering a 986mb pressure reading.

-

While the total number of hurricanes has not changed significantly, the global proportion of major hurricanes has increased over the past 40 years.

-

The tropical depression looks set to hit the Sunshine State in the early hours of Saturday morning.

-

NHC says the weather system is likely to threaten Florida by the weekend.

-

The German insurance association called the low-pressure system Bernd ‘one of the most devastating in recent history’.

-

The deaths were reported in the town of Bad Neuenahr-Ahrweiler, south of Bonn and west of the Rhine river.

-

The storm was the earliest named E storm, forming nearly six weeks earlier than average.

-

A spell of tornadoes, rain and hailstorms across the continent drove the loss activity.

-

It hit north of Tampa, and storm surge warnings for wider Gulf Coast were discontinued.

-

It was upgraded to a category one hurricane by the National Hurricane Centre last night before being downgraded in a public advisory at 2am (EDT).

-

It said the current threat posed by Tropical Storm Elsa was an example of storms being more likely to hit America’s Eastern Seaboard this season.

-

The rebrand follows a last-minute acquisition of the firm by Aquiline-owned Lloyd’s syndicate ERS, in December of last year.

-

Executives including AIG CEO Peter Zaffino, Aon CEO Greg Case and Munich Re CEO Joachim Wenning have joined the task force, chaired by Lloyd’s.

-

The reinsurer’s analysis of 20 research groups’ predictions points to a busier season than usual.

-

As new modelling tools emerge, we look at the benchmarks that ILS managers believe are appropriate for long-term stress tests and the shorter-term challenges.

-

Funding from the UK and Germany will support early action and the managing of disaster risks in less wealthy countries.

-

As providers manage their targets by premium dollars, and rising rates have boosted quota share income, this is leading to reinsurers hitting capacity earlier than expected.

-

The platform has backing from ILS firm HSCM, although cyber paper was provided by HDI.

-

Named storm predictions held stable from the agency’s April update at 17, up from an average of 14.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

The agency projects four major hurricanes and anticipates overall activity around a third higher than long-term norms.

-

Andrew Siffert said the weakness of the Fujita method for rating hurricane speeds was that it was partly based on damage caused.

-

This week the administration pledged extra money for a programme supporting catastrophe-resilient infrastructure.

-

The official US forecaster said it did not expect activity to reach last year’s historic peaks.

-

The monthly tally came in 14% lower than the $632mn reported a year ago.

-

Severe and winter weather losses in the US hit $21.4bn during January-April, equity research analysts estimate.

-

The region braces for a potential Category 1 landfall.

-

The company also procured approximately $180mn of incremental limit for earthquakes.

-

The deal will be fronted by Hannover Re but will provide coverage to the state backed carrier.

-

Most damage to private and commercial property was covered, but agriculture losses were uninsured.

-

The yardstick will allow insurers and financial institutions to assess companies’ transition plans against the 2015 Paris Agreement.

-

The initial loss figure was A$1.23bn, with a second report putting the loss at around A$1.3bn.

-

The carrier racks up losses from Uri and Filomena as well as deterioration on Laura and Sally.

-

The asset manager’s survey finds increased investor appetite for opportunistic debt and equities, and private assets.

-

The move comes ahead of the COP26 climate summit in Glasgow in November.

-

The weather and nat cat analyst is expecting four major hurricanes this year.

-

Property losses make up 96% of claims.

-

Cat bond market exuberance seems to be mismatched against overall ILS sentiment.

-

Analyst Philip Kett estimates US winter weather losses at $15.3bn.

-

The forecaster sees only a 25% chance that the enhanced activity will reach the “hyperactive” levels seen in 2020.