-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The industry has continued to build and innovate through a third strong year of performance.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

New catastrophe reinsurance Syndicate 2359 has an approved stamp capacity of £100mn.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The hedge fund had significant investment aims for the London market.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

The tech firm is building a joint stock company with insurers and investors.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

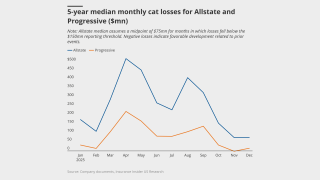

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Matthew Flynn joins from RenaissanceRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The measure could have landed insurers with extra tax on US business.

-

A group of Bermuda staff also left the broker.

-

David Baldwin joins from EIRS where he was a senior reinsurance consultant.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The headcount at the start-up now stands at around 40.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

AIG, HDI Global and others have settled, while Chubb’s fight continues.

-

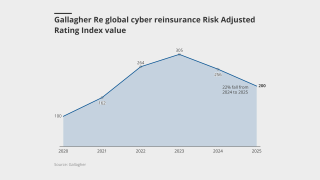

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

The announcement spurred a quick spike in stock market valuations.

-

Torrey Pines Re is split among three tranches of notes.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The executive will remain with the firm as a senior adviser to the CEO until mid-2026.

-

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

The model factors in the effects of climate change to date.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The deal is offering a multiple of 11.3x on the expected loss.

-

The bond offers a multiple of 11.3x based on a modelled expected loss of 0.93%.

-

The bond is offering a spread range of 950-1,050 basis points.

-

Portfolios of clients of varying size in the same region aggregate more risk.

-

Building better exposure datasets could draw a broader range of investors.

-

The insurer currently has $300mn of reinsurance limit from cyber cat bonds.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

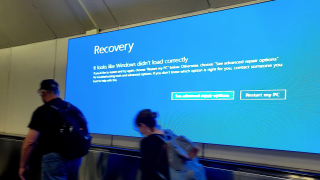

The July downtime will increase relevance, demand and innovation for the market.

-

The carrier estimates the total industry loss for the Microsoft/CrowdStrike outage at around $1bn-$2bn.

-

The broker said less than 1% of companies globally with cyber insurance were impacted.

-

The firm said losses could fall under $300mn if more favourable assumptions were applied.

-

The profile of the loss could provide comfort to investors around exposure diversification.

-

The event would represent a loss ratio impact of roughly 3%-10% on global cyber premiums of $15bn today.

-

The market is expected to seek additional exclusions around systemic events.

-

The weighted average direct financial loss for a Fortune 500 firm was $44mn.

-

Hannover Re's cyber bond pays on a parametric basis for each hour after an agreed waiting period.

-

The analyst estimated Beazley’s loss from the global outage at $80mn-$120mn.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

The event could unpack issues around accumulation risk and cloud services.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

The early May forecast is driven by factors including the El Niño Southern Oscillation.

-

State interference is likely to be required if an attack is large enough to trigger bonds now on the market, experts say.

-

The consortium will offer up to $50mn of per-program capacity.

-

The ILS market’s exposure could grow to $1.5bn by the time a major cyber cat event occurs.

-

The reinsurer said it hopes to grow the size of the $13.75mn deal over time.

-

Stefan Sperlich will lead the new unit as managing director.

-

Revenue, country and industry sector drive modelled output divergence.

-

-

Some $415mn of capacity entered the market last year.

-

The client lacked options in the conventional insurance market.

-

Envelop SPA 1925 was launched at the start of the year with Chris Baddeley as active underwriter, based in London.

-

The insurer said it has received 19,000 claims from affected policyholders so far, with nearly 65% of these coming from customers in Queensland.

-

The $50mn bond provides coverage against systemic cyber events in the US and District of Columbia.

-

George Mawdsley joins after more than 10 years at Securis, where he was tasked with structuring and origination of ILS risk.

-

The carrier has also extended the redemption period by three years, to 31 March 2029.

-

The transaction is the second cyber cat bond in 144A format to price and follows Axis’s Long Walk Re deal in November.

-

The 144A cyber cat bond deal has increased in size from an initial target of $75mn.

-

The year brought a degree of closure on the loss-hit years of 2017-2021, while the outlook remains changeable for ILS managers.

-

Chubb’s East Lane Re bond is the third cyber cat bond in 144A form to enter the market.

-

The $75mn Long Walk Re deal secured broad market support from ILS investors.

-

The business will service clients in the agriculture, renewable energy and construction industries.

-

The $75mn cat bond will cover systemic cyber events on a per-occurrence basis.

-

The $75mn cat bond is expected to close in late November.

-

The CCRIF has paid out $265mn since its inception in 2007.

-

Sources have raised concerns that cedant demand could outpace available capacity for cyber cat bonds.

-

Executives said geopolitical uncertainty, economic stagnation, cyber, cat events and inflation will drive demand on the Continent.

-

The US could be exposed to economic losses of $1.1tn in the event of a cyberattack, the highest of any country.

-

Cyber reinsurance has around $500mn of annual capacity currently supporting the space.

-

A number of players suggested that the cost components of first-party claims were up between 30%-50% on that seen during Ransomware Wave One.

-

Experts at the Trading Risk New York conference emphasised in-built cyber risk protections from defences to exclusions, as ILS managers grapple with understanding the peril.

-

The mortgage insurer last closed a similar deal more than two years ago.

-

-

The founding members include Munich Re, Gallagher Re, and BitSight.

-

The carrier describes reinsurers’ current strategy of dealing with cyber policies as "a game of whack-a-mole"

-

The broker studied the impact of 14 major cyber events in its attempt to dispel ILS manager fears of a ‘double whammy’ cyber event that would also impact financial markets.

-

A total of 10 events caused more than $1bn in losses each.

-

Tornados in the first six months of the year in the US were slightly above the 27-year average.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

The new SPA will write cyber reinsurance initially and could progress to writing insurance.

-

The cyber MGA can now serve clients in Italy, Spain, Ireland, Sweden and Denmark.

-

A Guy Carpenter report recently noted that risk models are converging for the most remote risk levels.

-

The broker named Matthew McCabe as MD of cyber broking with a brief to tackle complex cyber issues.

-

New language has been introduced by some insurers to limit exposures to cyber risks.

-

Analysis showed a modelled loss range of between $15.6bn and $33.4bn for a 1:200-year global loss event.

-

Guy Carpenter was the sole placing broker sourcing capacity for the tie-up.

-

In a discussion at Trading Risk’s London ILS 2023 conference, panellists compared the current cyber ILS market to the cat market in the 1990s.

-

Spectra has in-principle approval for a Bermuda broker license but believes cyber ILS solutions will be a game of “slow progress”.

-

Fort Lauderdale Hollywood airport was forced to close as a result of the flooding caused by the 25 inches of rain that fell on Wednesday and Thursday.

-

Lloyd’s has launched a fund on its new investment platform to enable the market to invest globally in assets themed around climate adaptation, mitigation and social inclusion.

-

The £50mn syndicate made most of its profits in aviation.

-

It is understood that the company has mandated Nomura to raise the risk capital.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Beazley executives spoke of further growth prospects in the class, after its results revealed a 79% combined ratio for its cyber division in 2022.

-

The issuance is replacing $400mn of cat bond coverage placed in early 2020.

-

Structures have been developed that would avoid “excessive capital trapping”.

-

The transactions would protect ceding (re)insurers against outages of the cloud.

-

The regulator examined carriers’ ability to model nat-cat and cyber events, with mixed results.

-

Beazley’s bond was hailed as a “great first step” but challenges remain, although others are already working on narrower cloud outage transactions.

-

The transaction is the first proportional deal for cyber risk in the capital markets.

-

The state is contending with flash flooding, mudslides, rockslides, power outages and high winds.

-

Beazley’s $45mn first-time cyber cat bond offered all-perils coverage, though some expected early deals to start with limited scope.

-

Landslides, avalanche risks and submerged highways are just some of the extreme consequences of the storms.

-

Cedants are grappling with rising rates while coverage narrows.

-

The city of Buffalo in New York state was worst impacted, but power was also knocked out in areas stretching from Maine to Seattle.

-

Scott Stephenson, former chairman, president and CEO of Verisk, will join CyberCube’s board after participating in the funding round.

-

CEO Rob Berkley said the company would likely participate in the space for one to three years if rates remain favorable.

-

A special session in December and prohibition of assignments of benefits have been cited on the Florida campaign trail.

-

The two ILS firms were among those participating in a $20mn fundraise for Elpha Secure Technology.

-

The storm, currently 285 miles south of Charleston, is expected to make landfall as a hurricane on Friday.

-

Georgia, Virginia and the Carolinas have declared a state of emergency as the storm moves north.

-

The storm has sped up considerably over the past six hours.

-

The storm is currently at Cat 4 strength but will weaken to Cat 3 as it approaches land.

-

The price for risk carrying is no longer insufficient, Munich Re's CEO said in a Monte Carlo briefing.

-

The carrier said geopolitical factors had given “new urgency” to the green transition.

-

The deal will bring cyber modelling and analytics to the risk transfer market.

-

ABIR reported that Bermudians posted a total loss ratio of 69.9% and a combined ratio of 100.1% last year.

-

Cyber risk ILS will grow slowly in the short-to-medium term, S&P Global Ratings has predicted.

-

The hydrogen industry is a key pillar of the energy transition, but securing insurance coverage is challenging.

-

New research estimates one in six chance of magnitude 7 or higher eruption this century.

-

Envelop anticipates that cyber ILS could hit $100mn of GWP within four years

-

The new recruit has worked for Argo, Allianz and the European Space Agency.

-

This is UPC’s latest attempt to downsize after offloading part of its personal lines business to HCI.

-

The pooled parametric insurance arrangement was trigged by localised drought.

-

Responsible investing in ILS requires “look-through data transparency”, the association says.

-

Guy Carpenter, Aon and Gallagher Re are each understood to be preparing to enter the nascent sector.

-

The follow-only vehicle initially launched in January with a more limited set of permissions.

-

Experts say cyber ILS offerings including cat bonds could be near, but concerns over structures, modelling and correlation persist.

-

The firm’s goal is to raise its own capital and partner with others.

-

The agency highlighted potential aviation losses from the war ranging from $6bn to $15bn.

-

The new firm says ESG criteria will be embedded into the products.

-

As part of the deal, ICEYE will provide Fermat with near real-time flood data for large-scale events.

-

Windstorm Nadia/Malik was one of several to strike the region this winter.

-

The company hired Ambac’s Scott Snyder as president of fronted programs.

-

The 2020s is the key decade for action to limit global warming and its impacts.

-

Cyber reinsurance premiums may exceed those of property cat by 2040.

-

The move reflects the firm’s growing interest in risks beyond nat cat.

-

The issuance will be the fifth time to market in FEMA’s cat bond series

-

This is the first natural catastrophe loss under the World Bank series of ILS deals since 2019.

-

Another pandemic outbreak came in fourth place, with 22% of respondents saying they were worried about further health and workforce issues and movement restrictions in 2022.

-

Some programs had to be restructured as rates hardened and capacity flowed away from cat risk in some cases.

-

As the renewal is expected to spill over into 2022, the two-speed market will put pressure on retro-reliant carriers.

-

The change in plan comes as Lloyd’s restricts cyber growth.

-

CyberCube forecast further capital market capacity will hit the cyber insurance market next year.

-

The firm’s estimate fell at the lower end of the range for historic Top 10 tornado events.

-

Aon’s Impact Forecast has suggested that only a limited portion of the loss will pass to reinsurers.

-

The Lloyd’s chief of markets also highlighted inflationary risks as a trend of which to be aware for syndicates.

-

The storm tore through north-western Europe in October, with major losses in France, Germany and Belgium.

-

The firm’s senior meteorologist noted activity was in line with expectations on major storms, if not all named storms.

-

Theo Norris has joined Gallagher Re as a dedicated cyber ILS broker, moving from his Aon Securities role as acting ILS assistant vice president.

-

Maya Bundt referred to cyber security threats as the “dark side” of proliferating digitalisation.

-

The executive said there was a strong case for meaningful rate increases in reinsurance.

-

The reinsurer aims to become carbon-neutral in operations by 2030, whilst its reinsurance target date is 2050.

-

AM Best sees accumulating cyber risk in the US property market downgrading 18 US property carriers, considering Best’s Capital Adequacy Ratio.

-

The city’s pension fund recorded a 3% return from its ILS portfolio in 2020.

-

The storm has dumped more than nine inches of rain on the city of Houston and risks further damage to Ida-hit properties.

-

In its renewal season update, the carrier said Bernd, Ida, Uri and the pandemic would force up pricing across lines and regions.

-

The 13th named storm of the season made landfall in the Florida Panhandle on Wednesday.

-

It is not so much the size of the hit, as the regularity of moderate cat events that is worrying risk-takers.

-

It recognised the debate surrounding the “plausibility” of such scenarios.

-

At least 22 people have been killed, with 3,000 power outages reported in Humphreys County as of Monday morning.

-

The hurricane made landfall near Tulum, registering a 986mb pressure reading.

-

While the total number of hurricanes has not changed significantly, the global proportion of major hurricanes has increased over the past 40 years.

-

The tropical depression looks set to hit the Sunshine State in the early hours of Saturday morning.

-

NHC says the weather system is likely to threaten Florida by the weekend.

-

The German insurance association called the low-pressure system Bernd ‘one of the most devastating in recent history’.

-

The deaths were reported in the town of Bad Neuenahr-Ahrweiler, south of Bonn and west of the Rhine river.

-

The storm was the earliest named E storm, forming nearly six weeks earlier than average.

-

A spell of tornadoes, rain and hailstorms across the continent drove the loss activity.

-

It hit north of Tampa, and storm surge warnings for wider Gulf Coast were discontinued.

-

It was upgraded to a category one hurricane by the National Hurricane Centre last night before being downgraded in a public advisory at 2am (EDT).

-

It said the current threat posed by Tropical Storm Elsa was an example of storms being more likely to hit America’s Eastern Seaboard this season.

-

The rebrand follows a last-minute acquisition of the firm by Aquiline-owned Lloyd’s syndicate ERS, in December of last year.

-

Executives including AIG CEO Peter Zaffino, Aon CEO Greg Case and Munich Re CEO Joachim Wenning have joined the task force, chaired by Lloyd’s.

-

The reinsurer’s analysis of 20 research groups’ predictions points to a busier season than usual.

-

As new modelling tools emerge, we look at the benchmarks that ILS managers believe are appropriate for long-term stress tests and the shorter-term challenges.

-

Funding from the UK and Germany will support early action and the managing of disaster risks in less wealthy countries.

-

As providers manage their targets by premium dollars, and rising rates have boosted quota share income, this is leading to reinsurers hitting capacity earlier than expected.

-

The platform has backing from ILS firm HSCM, although cyber paper was provided by HDI.

-

Named storm predictions held stable from the agency’s April update at 17, up from an average of 14.

-

The ILS vehicle has support from four key providers and will be launched alongside a broader offering including K&R, fine art and other specialty risks.

-

The agency projects four major hurricanes and anticipates overall activity around a third higher than long-term norms.

-

Andrew Siffert said the weakness of the Fujita method for rating hurricane speeds was that it was partly based on damage caused.

-

This week the administration pledged extra money for a programme supporting catastrophe-resilient infrastructure.

-

The official US forecaster said it did not expect activity to reach last year’s historic peaks.

-

The monthly tally came in 14% lower than the $632mn reported a year ago.

-

Severe and winter weather losses in the US hit $21.4bn during January-April, equity research analysts estimate.

-

The region braces for a potential Category 1 landfall.

-

The company also procured approximately $180mn of incremental limit for earthquakes.

-

The deal will be fronted by Hannover Re but will provide coverage to the state backed carrier.

-

Most damage to private and commercial property was covered, but agriculture losses were uninsured.

-

The yardstick will allow insurers and financial institutions to assess companies’ transition plans against the 2015 Paris Agreement.

-

The initial loss figure was A$1.23bn, with a second report putting the loss at around A$1.3bn.

-

The carrier racks up losses from Uri and Filomena as well as deterioration on Laura and Sally.

-

The asset manager’s survey finds increased investor appetite for opportunistic debt and equities, and private assets.

-

The move comes ahead of the COP26 climate summit in Glasgow in November.

-

The weather and nat cat analyst is expecting four major hurricanes this year.

-

Property losses make up 96% of claims.

-

Cat bond market exuberance seems to be mismatched against overall ILS sentiment.

-

Analyst Philip Kett estimates US winter weather losses at $15.3bn.

-

The forecaster sees only a 25% chance that the enhanced activity will reach the “hyperactive” levels seen in 2020.

-

States most impacted include Alabama, Mississippi, Texas, Georgia, and Tennessee.

-

The industry association reports 37,858 claims lodged so far.

-

Researchers at Colorado State University (CSU) are expecting an above-average hurricane season for 2021, including up to 17 named storms.

-

The data company describes the first quarter as benign.

-

The reinsurer finds secondary perils accounted for over 70% of natural catastrophe claims.

-

The industry association reports that about 29,213 claims have been received so far.

-

Environmental, social and governance concerns are of growing importance to the ILS industry, but work remains to be done on building a consensus about concrete goals.

-

The state-backed carrier has instructed broker Guy Carpenter to renew a slightly smaller initial programme than the $2.1bn it placed last year, but will consider options for additional cover.

-

The models will be available in June initially for North Atlantic hurricane, Europe inland flood and Europe windstorm.

-

The Insurance Council of Australia says carriers have already received 5,000 claims.

-

Schools, state agencies and Covid-19 vaccination hubs were closed as a precaution.

-

A survey from the Bermuda Monetary Authority found almost 60% of P&C insurers have not changed their business strategy in response to climate change.

-

The reinsurer’s ceded major losses were down 2% year-on-year, despite its net retained cat losses spiking by two-thirds to EUR1.6bn.

-

Ageing infrastructure is a more obvious culprit for the high insured losses, BMS’s Andrew Siffert said.

-

The modelling firm said its study aimed to help insurers “plan for the worst and hope for the best”.

-

Markdowns have wiped more than $220mn off the value of $1.6bn of aggregate cat bonds benefitting major US insurers after the Texas Big Freeze.

-

Policyholders have filed some 730 claims after fires hit hills outside the western city.

-

The modeller said it is “likely” that the number of claims could exceed the high of Hurricane Harvey in 2017.

-

A weakening La Nina and warm sea temperatures in the tropics raise the specter of elevated catastrophes for the rest of the year.

-

Some pointed to low average costs to fix burst pipe claims, while others warned that BI could drive up losses.

-

Aggregate cat bonds and quota shares may be exposed although the loss would typically be expected to skew to the traditional binders and insurance market.

-

The ratings agency says it will continue to monitor whether the cat event could affect the rating outlook for any entity.

-

The veteran risk modeller says claims will be driven by the combination of anomalous temperatures that are well below average in a region unprepared for such a sudden freeze.

-

The nature of the event means that more losses may take time to emerge.

-

In a note to clients seen by this publication, the risk modelling firm says the event may break records for insured winter storm losses.

-

The carrier also expects to report $23.4mn of reserve strengthening in its results on 25 February.

-

The climate forecaster claims that the underlying assumption may be faulty.

-

The last loss tally was 1.7% ahead of an August 2020 estimate for the storm, which exacerbated floods caused by EUR1.57bn event Ciara.

-

The loss estimate for the February 2020 event is up 3% on an August assessment.

-

The European (re)insurance supervisor said correlation to financial market risk made the idea a challenging one while reinsurance appetite is also very limited.

-

The final loss estimate fell by 2.5% as Perils said similar-sized losses could recur every three years.

-

The Australian carrier has also modestly increased its reserves for Covid-19 BI claims.

-

The deal follows an agreement the reinsurance broker reached in December to partner with auction platform Tremor Technologies.

-

The event was the third Australian hailstorm event of 2020 reported by the data aggregator.

-

The industry should expect similar losses in any given year, BMS vice president Andrew Siffert said.

-

The broker’s figure is 40% higher than its annual average for the 21st century, with the bulk of losses coming from the US.

-

Storms tore through four states in January last year with hailstones up to 6cm in size.

-

The uplift in insured losses would be much lower due to underinsurance for storm surge and flooding damage.

-

Cat losses will cost up to $80mn, down from last year’s $140mn, as the carrier indicated underlying results continued to improve in Q4.

-

Citizens projected it would cede $94mn in storm losses to reinsurers but has cut this to $62mn.

-

The move comes as environmental policies move up the list of investor priorities.

-

Losses were relatively evenly divided between the two events.

-

The 12 Days of ILS Christmas

-

Claims arose from events including Hurricane Delta, Hurricane Zeta and Tropical Storm Eta.

-

Natural catastrophe losses were up 40% year-on-year to $76bn, 7% above the 10-year average.

-

Aon’s Impact Forecasting put total insured losses across various events including Hurricane Eta at $1.2bn or more.

-

The permitted growth has accelerated from a 7% increase moving from 2019 to 2020.

-

Suncorp, IAG and QBE reinsurers could face significant recoveries after a landmark court ruling.

-

The carrier’s annual catastrophe losses ticked up to $2.9bn in October.

-

The cyber insurance sector is set to grow to $20bn by 2025, the broker said.

-

This third payment will be the largest yet received by Central American country.

-

Nearly 80% of respondents said underwriting capacity decreased in the quarter.

-

The storm becomes the 30th tropical cyclone to form in this year's Atlantic hurricane season.

-

A paper in the journal Nature argues that climate change is fuelling the problem.

-

The storm caused flooding and storm surges along Florida’s Gulf Coast

-

Purchasing the analytics firm will help Willis meet growing demand for climate change services.

-

The storm struck a state park area around 135 miles north of Tampa.

-

A hurricane watch is in effect for a 150-mile stretch on either side of Tampa.

-

The storm is set to weaken to a tropical depression before making landfall.

-

The last-resort carrier met its retention after Hurricane Laura, but expects over $128mn in total insured losses from the 2020 storm season.

-

Rapid growth of the cyber market suggests an increasing role for ILS, panellists said at Trading Risk Live.

-

Forecasts show Eta affecting the southern tip of Florida as it turns in the Gulf of Mexico.

-

The storm battered Central America as a hurricane last week, causing widespread damage and at least 57 deaths.

-

Forecasters warned that the storm’s course remains relatively uncertain at this stage.

-

Further cat losses could be covered under activated aggregate reinsurance deals protecting IAG and QBE.

-

Zurich-based manager Plenum said a partial loss of the $150mn Philippines wind bond seems likely.

-

That figure compares to pre-landfall loss estimates in the low-single-digit billions.

-

The storm has also struck areas of Alabama still struggling to recover from Hurricane Sally after its Category 2 landfall in Louisiana yesterday.

-

New Orleans may fall outside the strongest winds but the storm's possible track has drawn closer to the urban centre.

-

The storm has gained strength after earlier forecasts put it at a Cat 1 landfall strike.

-

The storm is predicted to hit “at or near” hurricane strength before continuing northwest.

-

Forecasts point to landfall on the Louisiana/Mississippi border, bringing rain and possible flash flooding.

-

The storm is forecast to bring heavy rainfall and possible flash flooding when it arrives in the US early on Wednesday morning local time.

-

The East Troublesome and Cameron Peak fires are two of the largest blazes in the state, with fears they could merge.

-

Around 95% of the loss was property damage, mainly residential.

-

Claims forecasts have so far fallen in line with loss expectations well below $5bn.

-

The modelling firm estimated $950mn would come from US losses, with $300mn in Mexico.

-

A report by the reinsurance broker says that just over $3bn of insured losses occurred in Iowa.

-

The NHC emphasised uncertainty over the intensity outlook for the storm's Gulf Coast landfall.

-

The storm is currently expected to make landfall as a Cat 2 hurricane.

-

The storm is equivalent to a Category 1 hurricane.

-

Transparency and offering users the ability to adjust models would help advance the industry, panellists said.

-

States of emergency have been declared as far east at Florida.

-

Violent waves and a storm surge of as much as 9-13 feet above normal tide levels will likely cause damage across the coastline.

-

The storm is forecast to reach Mexico on Wednesday and hurricane warnings are in effect.

-

The 25th named storm of the year may become the 10th named storm to impact the US this year.

-

The backstop vehicle expands its offer beyond the 22 Caribbean and Central American states it currently services.

-

The president and CEO urges wordings precision to avoid cyber-related litigation.

-

EMC and Church Mutual turn back to reinsurers after devastating wind losses.

-

Structures damaged or destroyed include the Meadowood Napa Valley resort and Medieval-style winery Castello di Amorosa.

-

All three fires are prompting evacuation orders in Napa and Sonoma counties.

-

Climate variations will likely spur demand for ILS capital to help reinsurers manage peak US hurricane exposure, the manager said.

-

The National Flood Insurance Program is expected to take $400mn-$800mn of losses.

-

Rain and storm warnings are in effect for the provincial capital city of Halifax.

-

The Canadian Hurricane Centre described Teddy as a “very large and powerful storm”.

-

The NHC expects “significant flash and urban flooding” to continue.

-

The deal follows an earlier fronting agreement supported by Markel, Nephila and RenaissanceRe.

-

July rains and typhoons Maysak and Haishen severely damaged Kyushu region, the body said.

-

The Pensacola Bay Bridge was recently rebuilt in a $430mn investment project.

-

Major reinsurance carriers like Munich Re, Hannover Re and MS Amlin are significant providers to some of the state's regional carriers, analysis suggests.

-

The storm is expected to move across southeastern Alabama before hitting central Georgia on Thursday.

-

Life-threatening storm surge is already occurring along the coastline from Alabama to the Florida Panhandle, including Pensacola Bay and southern portions of Mobile Bay.

-

Severe convective storms account for almost 60% of insured losses, the company said.

-

The storm is expected to cause “historic life-threatening” flash flooding, according to data from the National Hurricane Center.

-

Micro-insurance and parametric products show promise in extending cover, speakers said.

-

The storm has not intensified as much as feared, but hurricane warnings remain in effect for New Orleans.

-

The US National Weather Service issued a critical fire weather warning for parts of Idaho, Montana, California, Nevada and Oregon on Monday.

-

The NHC has put a hurricane warning in place for Lake Maurepas including the city suburbs.

-

Wind and hail-related property damage is expected to be covered, but a “sizable portion” of crop losses may not be.

-

Record heat, dry conditions and strong winds have helped wildfires spread, Aon said.

-

Still some way off Category 1 intensity, Paulette is expected to reach the Leeward Islands on Thursday night.

-

The bulk of the payout – $7.2mn – relates to excess rainfall cover.

-

The typhoon was far less destructive than early forecasts suggested, according to claims-adjusting firm Sedgwick.

-

EMEA cat rates have failed to reprice while US and Japan markets have been more reactive, the firm noted.

-

The storm brought record amounts of rainfall to southern Japan, with authorities warning of landslides.

-

An “excessive heat watch” is in effect for coastal, inland and foothill regions, Cal Fire has warned.

-

The National Hurricane Center has warned of storm surge and hurricane conditions in the country.

-

The typhoon, which is expected to make landfall on the peninsula on Thursday, is being compared to the devastating Typhoon Maemi in 2003.

-

The storm, which is heading for Belize, is also expected to bring “dangerous” surges, according to the NHC.

-

The storm is forecast to make landfall in the Korean peninsula within 36 hours.

-

The February flooding took total UK winter losses to £775mn.

-

On its current forecast trajectory, the storm will hit Little Rock, Arkansas, where it could cause flash flooding.

-

AM Best draws a comparison with $6.4bn Hurricane Rita as Laura’s strength approaches Cat 5.

-

The hurricane is expected to track north-northwest and make landfall later tonight.

-

Buyers and sellers are eyeing a 20% RoL, but contracts have yet to trade.

-

Forecasters predict landfall around 100 miles to the east of Houston.

-

The Category 3 storm is set to move further away from the west coast of the country, which has been downgraded to yellow alert.

-

Shipping is currently heading away from the port of Houston for safer waters, according to live vessel location information.

-

The storm is due to impact the west coast on Thursday after hitting southern island Jeju today.

-

Sources estimated combined property and crop claims could reach $4bn up to $10bn.

-

The blaze in northern California has so far burnt more than 350,000 acres and is 22% contained.

-

Marco is forecast to make landfall in Louisiana on Monday, with Laura hitting Texas by Thursday.

-

The storm is predicted to hit the US Gulf of Mexico on Wednesday as a Category 2 storm.

-

The storm is expected to affect the west coast of the country, including Seoul, before making landfall in North Korea.

-

President Trump releases federal aid for the fires, which include the third-largest blaze in California’s history.

-

The weather system dubbed “Nine” is currently off the east coast of Taiwan and appears more likely than not to hit as tropical storm on Saturday.

-

Storms could develop into hurricanes before striking the US, but long-range outlooks are uncertain.

-

The now tropical storm is expected to move further out into the Pacific and become a tropical depression by tomorrow.

-

Almost 350,000 acres burn in the Golden State as firefighters battle two major blazes west of Denver.

-

A fire tornado is formed when rising heat combines with turbulent wind conditions, creating towers of flame and ash.

-

The storm system is not currently forecast to make a US landfall, although could impact Bermuda later next week as a tropical depression.

-

The modelling agency included $400mn to $700mn of losses to the US government’s National Flood Insurance Program as part of its estimate.

-

Tornadoes, hail and strong winds hit the eastern half of the US last week.

-

The updated total of A$958mn ($675mn) includes additional property and motor damages.

-

The developing world specialist insurer is looking for input from ILS funds and reinsurers.

-

The Texas state-backed carrier secured $2.1bn in cover for the 2020-21 hurricane season for $107.5mn above the $93.1mn budget.

-

Insurers need to “be ahead of the game” on rate increases, company officials told Trading Risk.

-

Loss estimates outstrip early expectations.

-

The meteorological service has lifted its hurricane estimate from six to 10 to seven to 11.

-

The business will be known as SiriusPoint and led by ex-AIG CFO Sid Sankaran, who will become chairman and CEO.

-

Sources say initial modelled loss data converges on another sub-$1bn loss with wider variations than over earlier 2020 storms.

-

Reports of flooding in eastern US states as millions were left without power.

-

The storm is producing tornadoes on its way up the US east coast.

-

Parts of South and North Carolina are under hurricane warning but the storm is expected to bypass the city of Charleston.

-

The storm is now expected to make landfall in the Carolinas late Monday.

-

Isaias is currently a Cat 1 hurricane and is nearing Andros, the largest island in the Bahamas.

-

Florida could face heavy rain and flooding as a result of Isaias, the National Hurricane Center (NHC) has warned.

-

NFIP claims are expected to make up about $100mn of the claims tally.

-

Puerto Rico, the US and British Virgin Islands and other territories are under storm warning.

-

The estimate includes privately insured wind and storm surge damage to homes, commercial properties and cars, but not NFIP losses.

-

The storm remained offshore but lashed Kauai with rain.

-

Rainfall in some areas could lead to flooding and landslides.

-

Notices of legal action jumped 65% year on year to an all-time high in H1 2020.

-

Barbados and St Vincent are under hurricane watch from Gonzalo while Tropical Storm Hanna will bring heavy rain to parts of the Texas coast.

-

Ex-Novae deputy CUO to become active underwriter at Syndicate 2358.

-

Barbados is on a hurricane watch.

-

Six-month figures beat long-term average of $20bn with North American natural disasters driving the majority of the losses.

-

The storm breaks the record for the earliest seventh named storm of the season.

-

Over 200 nat cat events occurred in H1 2020, topping the 20-year average.

-

Assignment-of-benefit claims spiked in June from the prior month.

-

Claims on 15 cat events impacted the carrier, with most losses related to April.

-

Hailstorms across the Midwestern US will likely add to substantial losses this year.

-

Damage to property and automobiles stretches across five states, the agency said.

-

The Monetary Authority is also exploring initiatives to support pandemic, cyber and climate ILS, an official says.

-

The claims emanate from 14 weather events and amount to $12.8mn on an after-tax basis.

-

Several US states were hit by tornadoes, heavy rainfall and large hail in July.

-

Bushfire losses make up just over 40 percent of the total claims bill.

-

The Calgary hailstorm in mid-June could become the fourth-costliest nat cat event in Canadian history.

-

The research team increased its estimate for named storms in 2020 from 19 to 20.

-

The estimate marks a 19 percent deterioration on a February forecast.

-

The interim CEO said this marks a new era for the utility firm.

-

The deal settled at the low end of the revised spread guidance.

-

Syndicate 2358 may target lines such as cyber or terrorism.

-

Earlier this week, Guatemala received a $3.6mn payout for losses incurred from tropical storms Amanda and Cristobal.

-

Tropical Storms Amanda and Cristobal triggered the country's excess rainfall cover.

-

The utility expects to emerge from Chapter 11 in July after a bankruptcy court approves its settlement.

-

The deal will add to $125mn of ILS cover that the electricity provider has from an earlier transaction.

-

Calgary storm could rank among Canada’s costliest cat events, according to Aon.

-

High Atlantic sea surface temperature is one driver of the forecast.

-

The estimate for the third named storm of the season covers privately insured wind and storm surge damage.

-

US convective storm losses have already topped $13bn for the year.

-

Surge warnings are in place, with the tropical storm forecast to move across Arkansas and Missouri.

-

Cristobal could impact the Gulf Coast as a tropical storm late on Sunday.

-

The university scientists now expect nine hurricanes, up from eight in their earlier forecast.

-

The second named storm of the year is to make landfall at around midday local time.

-

The US government agency said it expects between three and six major hurricanes in the Atlantic Basin this season.

-

Colorado State University released updated predictions that this year’s season would be stronger than average.

-

NOAA said there is a 75 percent chance of near- or below-normal tropical cyclone activity this year.

-

The platform said a narrowing spread between buy and sell offers on ILWs suggests more trades will clear.

-

Some argue that what appears to be a stepping back by Japanese investors may just be a pause as investors switch managers.

-

The carrier expects to restructure quota share and aggregate protections after heavy losses.

-

Tornado outbreaks along with thunderstorms caused significant damage.

-

Losses from 2019 Japanese cat events have risen by nearly 13 percent since mid-March.

-

The data firm’s latest survey shows $108bn in premiums across 236 million policies in Europe and Australasia this year.

-

Windstorms and heavy rain earlier this month were already likely to cause over $1bn in estimated insured losses.

-

There were at least 121 confirmed tornado touchdowns from Texas to Maryland from 10-14 April.

-

The scheduled capital release next month stems largely from 2019 side pockets, the company said.

-

There are also likely to be substantial property insurance claims.

-

The asset manager said it would also be impacted by a slowdown in auto insurance premiums.

-

The forecaster expects activity to be 5-10 percent higher than the past 10-year average.

-

The firm revised its 2019 estimate for insured disaster losses up by $4bn but kept Typhoon Hagibis under $10bn.

-

The region will see a fifth consecutive year of tropical storms that are stronger than average, the firm predicts.

-

Property damage in eastern Australia totals $488mn, according to an initial loss estimate by Perils.

-

The majority of losses hit the UK, Germany and Belgium, estimates show.

-

The ICA has increased its estimate for the January hailstorm total losses to A$1.2bn.

-

The total has increased 30 percent since December, the General Insurance Association of Japan said.

-

Pricing for quake exposures is understood to be broadly flat.

-

Pricing has moved to the top of the guidance range, sources said.

-

The ratings agency also said ILS capacity would ‘hold the line’ on returns following catastrophes.

-

The firm's K sidecar avoided major Dorian claims, as the firm also grew its whole-account covers.

-

The European storm was the most expensive cat event of February, followed by US winter storms that cost nearly $700mn.

-

The APRA’s chairman says carriers are well placed to pay out claims and respond to new events.

-

The loss aggregator lifts the tally by EUR10mn from its previous prediction.

-

Insurers are facing estimated losses of £363mn ($473.7mn) from storms Dennis and Ciara, which caused widespread damage in the UK during February.

-

GWP was up 53 percent in the last quarter, reflecting the growth of the InsurTech subsidiary.

-

The losses include those of the parent company as well as Monarch National Insurance Company.

-

The losses were initially pegged by the Insurance Council of Australia at A$320mn ($211.5mn).

-

First-event cover and the level of per-event deductibles in aggregate typhoon deals are being re-examined.

-

The fund helps compensate victims for losses from fires started by the utilities’ equipment.

-

Scor posted a fourth-quarter operating loss of EUR29mn ($31.7mn) for its P&C unit, which was almost two thirds down on the prior-year quarter’s loss.

-

The Cambridge Centre for Risk Studies released an index analysing extreme weather risk.

-

The carrier said it has already secured two-thirds of the private reinsurance limit it will place this year.

-

Projected Ciara/Dennis losses for major local insurers are expected to be below reinsurance retentions.

-

The GDV says natural events caused EUR3.2bn of insured losses in Germany in 2019.

-

The deal will take total cat bond cover available to the National Flood Insurance Program over the $1bn mark.

-

Ciara and Dennis could be the most significant European windstorm losses since 2018.

-

The insurer lifted the attachment on an aggregate portion of its group reinsurance treaty, which was otherwise unchanged after its restructure for 2019.

-

The firm will consider writing more retro after raising $300mn new equity.

-

The storm struck parts of Ireland and the UK on 9 February, before moving to mainland Europe.

-

The cyclone will hit Western Australia this weekend.

-

There is room to scale up existing risk transfer pilots, said Dfid’s Nick Dyer at Aon's Collaborating to Close the Protection Gap conference.

-

The pricing targets imply a minor uplift in the premium multiples on offer.

-

The cat loss figure is 2.4 percent of Everest Re’s total shareholders’ equity of $9bn.

-

The ILS manager has no current plans to deploy investor capital in cyber underwriting risks.

-

The political boards will consider future funding structures for the insurer of last resort as well as a possible merger with the Texas Fair Plan.

-

The pricing benchmark on the low-risk quake bond has risen 10 percent above a similar 2018 transaction.

-

CEO Mike Sapnar said losses in the last two years have wiped out premiums.

-

The topsy-turvy nature of the past few years for the ILS market is apparent when you look at our half-yearly surveys of assets under management.

-

The carrier issued a profit warning as it revised up projected annual cat losses and forecast lower reserve releases.

-

This is the first time the Bermuda-based ILS manager is known to have been linked to cyber risk deals.

-

Hagibis, Faxai and flooding in the Mississippi River basin were the costliest events.

-

The Insurance Council of Australia lifted its claims tally by 27 percent from its initial figure, with aggregate deductibles the main reinsurance exposure to the loss.

-

The (re)insurer faced increased losses from Hurricane Irma alongside Typhoon Hagibis and wildfire claims.

-

The storms will compound wildfire losses and put reinsurers on Suncorp's aggregate covers on watch.

-

Quota share and aggregate-property cat contracts are under watch as a result of the recent Australian bushfires but occurrence covers will probably remain mostly unscathed, sources expect.

-

Cat bond fund returns rebounded in 2019, with widely divergent experience among ILS funds investing in private instruments.

-

The exposure to this transaction across private ILS strategies varies from 1.7 percent to 1.9 percent of November's portfolio, the manager said.

-

The company’s Francis Bouchard said climate change was “one of the most dangerous and most complex risks we face”.

-

The most likely global risks relate to climate change and environmental issues for the first time, according to the WEF’s 2020 Global Risks Report.

-

The US experienced twice the number of billion-dollar events in the 2010s than in the prior decade.

-

As more claims emerge from the December-January fires, aggregate reinsurance contracts will be exposed to rising losses.

-

Hiscox sold the parametric cyber cover to an as-yet-undisclosed buyer.

-

The firms said their relationship would see RenRe sourcing capital to provide Beazley with cyber catastrophe reinsurance cover.

-

The reinsurer pegged 2019 cat losses at $52bn, in line with long-term averages but 40 percent lower than 2018.

-

The bushfires have drawn attention to extended hours clauses that allow insurers to group together claims as a single event.

-

The Australian insurance organisation put cumulative insured losses at A$431mn ($299.1mn) for the bushfire season.

-

It also put an A$166mn tally on a November Queensland hailstorm.

-

The 2018 event cost insurers A$798mn, but storms and bushfires over the past month are not yet costly enough to be tracked by the agency.

-

The loss tally includes a $7bn loss estimate for Typhoon Faxai and $8bn for Typhoon Hagibis.

-

A bankruptcy court judge approved the utility's planned settlements with insurers and victims yesterday.

-

The biggest risks still stem from natural catastrophes, finance and geopolitical issues.

-

California Governor Gavin Newsom told PG&E on Friday that the current deal fails to comply with state law.

-

The Colorado State University experts had previously questioned whether an active period which began in 1995 had ended.

-

Approval of the settlement agreement puts PG&E on a path to emerge from Chapter 11 by 30 June, which is the deadline to participate in California’s wildfire fund.

-

-

An estimated 683 homes have now been burned as a result of the blazes.

-

Varying levels of Japanese exposure led to a wide range in individual fund returns.

-

The typhoon is expected to reach Category 3 status by Tuesday local time, but the ILS cover is geared towards payouts for even stronger events.

-

It used to be called “diworsification” – a phrase coined by Dowling analysts that took hold and became the industry's standard jargon for low-priced international catastrophe risk back around 2011.

-

Late November flooding in parts of southeastern France and northwestern Italy follows an active year for weather losses in Italy.

-

Nippon Steel is expecting to cede an 8bn yen property loss to the commercial (re)insurance market.

-

Axis said the range was consistent with expectations that it would take on less than 1 percent of industry-wide claims from the catastrophe.

-

The cover will be provided by a consortium of 56 insurers, according to reports.

-

Losses could have eroded as much as 44 percent of the carrier's aggregate deductible.

-

The General Insurance Association of Japan also announced 235,225 claims have been paid out for Typhoon Hagibis.

-

Hudson Structured founder Michael Millette joins the board of directors after his company led the InsurTech’s latest funding round.

-

A long-running inquiry is looking at proposals to set up a public cyclone reinsurance scheme to mitigate affordability concerns.

-

Incurred losses from Hurricane Michael have risen another 4 percent to reach $7.4bn, according to the Florida Office of Insurance Regulation.

-

The Insurance Council of Australia has tracked A$110mn ($75mn) of bushfire losses as it declared the Sunshine Coast hailstorm a catastrophe.

-

Hurricane Dorian and Typhoon Faxai losses have hit (re)insurers following a relatively benign first half of the year for catastrophe activity.

-

The deal covered damage from the 2017 Thomas and Koenigstein fires and the 2018 Woolsey Fire.

-

The New South Wales Rural Fire Service has forecast catastrophic fire conditions – the gravest possible forecast.

-

The capital will help those affected by drought during the 2019 agricultural season.

-

News of adverse development from the two Floridians may point to a market-wide issue.

-

Latest loss estimate comes after the company had estimated Faxai losses of $5bn to $9bn.

-

CoreLogic exposure data suggested homes worth hundreds of millions were at risk.

-

Wildfire recoveries benefitted DaVinci investors and RenRe's retro partners in Q3.

-

At this stage, destroyed property numbers remain well below the thousands impacted in the major 2017-2018 fires.

-

This came as the deal priced at the bottom of the initial range at 515 basis points (bps), according to sources.

-

The firm's reinsurance CEO John Doucette said the firm saw “select opportunities” to grow its retro book.

-

According to the Insurance Council of Texas, the outbreak on 20 October is the costliest tornado loss in the state’s history.

-

Scor Global P&C CEO Jean-Paul Conoscente said the reinsurer’s main retro programme is expected to be placed within a fortnight.

-

Over 70 percent of the losses come from Hurricane Dorian.

-

The finance from the Global Risk Financing Facility (GRiF) will support Jamaica in expanding its financial protection.

-

The firm is the first risk modeller to issue an official estimate after the typhoon made landfall in Japan on 12 October.

-

A stronger storm, Typhoon Bualoi, is forecast to pass to the east of the country.

-

Tropical Storm Nestor made landfall at the St Vincent nature reserve off Florida's northern Gulf Coast on Saturday afternoon.

-

Tropical storm and storm surge warnings are in effect for the region.

-

The investment manager, which is currently in run-off, is also monitoring the impact of Typhoon Hagibis.

-

AIG had $550mn of cover for Japanese losses, analysts at Credit Suisse noted.

-

The Bermudian reinsurer expects to pay out about $100mn in losses from Faxai and about $55mn for Dorian claims.

-

The Saddleridge fire has destroyed 17 structures and damaged a further 77 properties.

-

Gross cat losses for Japanese insurers this year could top 2018’s 1.6tn yen ($15bn) following Typhoon Hagibis, according to equity analysts Jefferies.

-

Saddleridge is one of several wildfires to have hit California in recent days, with nearly 160,000 acres and 134 structures destroyed.

-

The wildfire is threatening 13,000 homes and more than 100,000 people have evacuated.

-

The storm is now at Category 4 strength, and tracking to make landfall in Japan at Cat 3.

-

The provider said the losses were driven by the impact of Hurricane Dorian and Japanese typhoons.

-

Meanwhile, insured losses from Typhoon Faxai will approach $5bn, according to the September Global Catastrophe Recap.

-

Two Rugby World Cup matches scheduled to be played in Japan on Saturday have been cancelled.

-

The capital and a number of Japanese provinces are on alert as the likelihood of an impact from Typhoon Hagibis this weekend increases.

-

The storm could bring Category 1 force winds to Tokyo over the weekend.

-

The storm has strengthened to Category 5 but is expected to weaken to Category 1 as it approaches the mainland.

-

The carrier is among the first P&C insurers to release anticipated loss numbers ahead of the third-quarter earnings season.

-

Severe, unpredictable weather is becoming more frequent, said the Insurance Bureau of Canada’s Amanda Dean.

-

The typhoon is forecast to become a super typhoon with minimum 150 mph winds in the next 24 hours.

-

Cedants are turning to the ILS market for solutions, says the broker’s Catherine Mulligan.

-

The Munich Re Innovation Syndicate will underwrite a wide range of business starting in 2020.

-

The detailed document lays out plans for reform to capital provision, claims and services administration and distributing risk.

-

The EUR45mn ($49.50mn) Atmos Re I cat bond from Unipol is likely to lose nearly 50 percent due to severe weather events in Italy, according to sources.

-

The number of assignment of benefits claims in Florida increased by 40.9 percent year on year in June before the implementation of the state’s new laws designed to stamp out abuses of the system.

-

Pacific Gas & Electric Company has inked its $11bn wildfire insurance subrogation claims deal and criticised an alternative plan put forward.

-

Typhoon Faxai losses are unlikely to have a significant impact on the ILS markets, based on current industry estimates.

-

ILS investors are unlikely to foot much of the bill from Hurricane Dorian due to the market’s low exposure to Caribbean business, according to sources.

-

The risk modelling firm has released the highest estimate for industry losses so far and the top end of its prediction could hit some ILWs.

-

ILS based on parametric triggers are vital in reducing insurance protection gaps and increasing resilience, the Bank of England governor said.

-

The utility firm also criticised an alternative Chapter 11 proposal led by Elliott Management.

-

A tropical storm warning remains in place with wind and rain forecast to affect the island in the middle of the week.

-

The hurricane is forecast to have weakened to a Category 1 storm by the time it could approach the island at the start of next week.

-

Non-life insurers in Japan are anticipating a 300bn yen ($2.8bn) loss from Typhoon Faxai, the chairman of the General Insurance Association of Japan has said.

-

Private insurance predicted to cover “lower than normal” share of claims due to bulk of damage coming from water impact.

-

MS&AD noted that losses could yet increase and highlighted its access to reinsurance coverage.

-

According to reports, the island was spared the worst of the storm but has suffered power cuts.

-

The storm is expected to track approximately 100 miles north of the island with hurricane conditions expected in Bermuda on Wednesday night and Thursday morning, the NHC said.

-

The NHC estimates that Imelda will produce between six and 12 inches of rainfall.

-

The NHC has reported that the hurricane may approach the island as a Category 2 storm.

-

The (re)insurance industry should expect a Japanese loss of over $15bn at least once every 20 years, the risk modeller said.

-

The firm’s estimate points to a higher top-of-the-range loss than early market forecasts of between $1.5bn and $5bn.

-

The Catco Reinsurance Opportunities Fund grew again in August, continuing the trend of growth every month in 2019.

-

Earlier this week the agency forecast Dorian losses to cost between $3.5bn and $6.5bn in the Caribbean.

-

The system could bring tropical storm-force winds to east Florida over the weekend.

-

Modelled average annual loss is less than a quarter of the economic estimate, meaning more needs to be done to close the protection gap, the modeller said.

-

The country, which joined ARC this year, will receive a payment of $738,835.

-

The programme has been designed to provide $2bn of excess cover for Sempra and CalEdison.

-

Estimates of insured losses from Faxai are at around $3bn but sources were cautious given Jebi was initially put at the same level but became a $15bn-plus loss.

-

Most losses will come from the Bahamas which are likely to account for just over $3.6bn of losses, the modeller said.

-

The storm killed one person and damaged property.

-

The loss tracking agency's data has been used on $17bn of reinsurance limit in its 10 year history.

-

Global cyber (re)insurance is expected to grow 25-30 percent a year, chairman of Munich Re’s reinsurance committee Torsten Jeworrek said in Monte Carlo.

-

The reinsurer announced it is looking at setting up a separate balance sheet to write risk on behalf of third-party investors.

-

The typhoon is forecast to make landfall over the eastern outskirts of the Chiba prefecture, southeast of Tokyo, with windspeeds equivalent to a Cat 3 hurricane.

-

The Category 1 storm is currently passing by Cape Lookout in North Carolina recording maximum sustained winds of 90mph.

-

Karen Clark & Company said Bahamian losses from Hurricane Dorian will reach $7bn including both insured and uninsured damages.

-

Widespread data theft from an email provider ranked as the most likely significant loss scenario in a report by the broker and analytics platform.

-

The hurricane is forecast to become a post-tropical cyclone with hurricane-force winds as it approaches Nova Scotia late on Saturday.

-

Flooding from storm surge remains a risk for the Carolinas.

-

The storm’s track was not a worse-case scenario for the islands as it avoided New Providence.

-

Hurricane data provider Tropical Storm Risk predicts there is an 85 percent chance of the US mainland being hit by Category 1 hurricane conditions in the next 21 hours.

-

Both North and South Carolina remain within the cone of probability for Dorian’s track but landfall is not projected.

-

Hurricane-force winds now extend outward up to 60 miles from the centre, up from 45 miles yesterday.

-

The storm had been sitting over Grand Bahama but is now expected to skirt Florida’s east coast later today.

-

Devastating winds and storm surge will continue to affect the northern Bahamas for several more hours, the National Hurricane Center said.

-

Previous Category 3-4 storms passing near Grand Bahama and Abaco caused up to $1.3bn of damage in today’s prices, according to the modelling agency.

-

The NHC has warned that the hurricane will move “dangerously close” to the coasts of Florida, Georgia and South Carolina in the coming days.

-

The cat bond pricing index only dropped by 0.78 percent last Friday when Hurricane Dorian was forecast to be a Florida hit.