Property

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

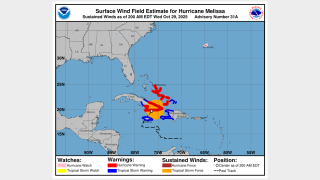

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The funds will combine credit and ILS holdings.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The data modeling firm said losses previously averaged $132bn annually.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The estimate covers property and vehicle claims.

-

Both organisations still predict an above-average hurricane season.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

US events accounted for more than 90% of global insured losses.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

Almost 50,000 people have been forced to evacuate.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

The revision is significantly lower than the $4.5bn October estimate.

-

California homeowners are also expected to move admitted business to E&S.

-

The bond initially sought $425mn across three tranches.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The Floridian company applied to be traded on the NYSE.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Torrey Pines Re is split among three tranches of notes.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The cedant’s Namaka Re bond is offering a spread range of 200-250 bps.

-

The bond provides coverage for North American storms and earthquakes, as well as European windstorms.

-

The pricing is at the top end of the initial guidance range of 550-600bps.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The business offers parametric windstorm coverage.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

Both carriers have extensive reinsurance coverage.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

Almost 300,000 people have been left without power from the storm.

-

This loss number covers the property line of business.

-

The London D&F market will shoulder most of the losses.

-

Eric Paire was head of capital advisory at Aon for nearly seven years.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The firm ceded $417mn of premiums to the sidecar in 2024.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Several Florida start-ups are poised to begin writing business this year.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

The carrier said 72% of those losses occurred in personal property.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

Insurance Insider ILS revealed last week that the executive was leaving Property Claims Services.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

The Class B segment of the bond has priced below initial guidance.

-

More than 33,000 claims had been filed as of 5 February.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The changes follow a strategic review of the Pool Re scheme in 2022.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

The bond will provide coverage for named storms in North Carolina.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

But cat bonds are experiencing negative secondary market price movement.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

Theokli joined the company in 2021 as a senior underwriter.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The carrier previously raised $125mn via an Ocelot Re cat bond in 2023.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

-

The figure does not include specie or auto losses.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The company received over 10,100 home and auto claims as of January 27.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Investigators are homing in on the likely causes of the incidents.