Property

-

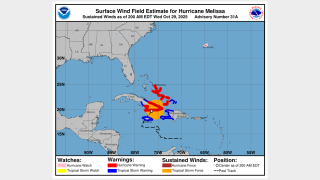

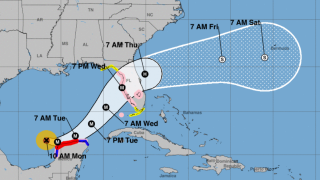

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Widespread underinsurance and low exposures will limit losses.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The funds will combine credit and ILS holdings.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

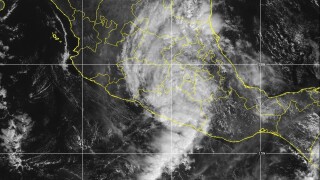

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The data modeling firm said losses previously averaged $132bn annually.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The estimate covers property and vehicle claims.

-

Both organisations still predict an above-average hurricane season.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Scor's CEO said the P&C market had experienced a “competitive” first half.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

US events accounted for more than 90% of global insured losses.

-

In the US, the index fell 6.7% year on year.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The Diversified Alternative Fund’s allocation to cat bonds was up by 31% from $386mn at 31 January.

-

The Australian carrier’s nat cat losses are A$200mn lower than its annual allowance.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The cost comes in at $530.6bn, roughly $20mn lower than budgeted.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

Almost 50,000 people have been forced to evacuate.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

The revision is significantly lower than the $4.5bn October estimate.

-

California homeowners are also expected to move admitted business to E&S.

-

The bond initially sought $425mn across three tranches.

-

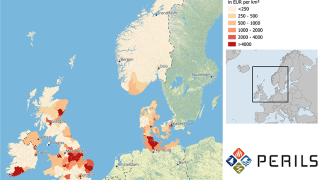

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The Floridian company applied to be traded on the NYSE.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

Torrey Pines Re is split among three tranches of notes.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The reinsurance broker said total reinsurance market capacity was up 5.3% year over year.

-

The cedant’s Namaka Re bond is offering a spread range of 200-250 bps.

-

The bond provides coverage for North American storms and earthquakes, as well as European windstorms.

-

The pricing is at the top end of the initial guidance range of 550-600bps.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The business offers parametric windstorm coverage.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

Both carriers have extensive reinsurance coverage.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

Almost 300,000 people have been left without power from the storm.

-

This loss number covers the property line of business.

-

The London D&F market will shoulder most of the losses.

-

Eric Paire was head of capital advisory at Aon for nearly seven years.

-

The terrorism pool has shifted its programme from facultative to an XoL arrangement.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

DaVinci equity plus debt stood at $3.25bn as of 31 December.

-

The firm ceded $417mn of premiums to the sidecar in 2024.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Several Florida start-ups are poised to begin writing business this year.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

The carrier said 72% of those losses occurred in personal property.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

Insurance Insider ILS revealed last week that the executive was leaving Property Claims Services.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

The Class B segment of the bond has priced below initial guidance.

-

More than 33,000 claims had been filed as of 5 February.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The changes follow a strategic review of the Pool Re scheme in 2022.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

The bond will provide coverage for named storms in North Carolina.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

But cat bonds are experiencing negative secondary market price movement.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

The value of its investment in RenRe stood at $330.4mn as of 30 June 2024.

-

Theokli joined the company in 2021 as a senior underwriter.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The carrier previously raised $125mn via an Ocelot Re cat bond in 2023.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

The carrier has been reducing its exposure to the area where the wildfires occurred by over 50%.

-

-

The figure does not include specie or auto losses.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The company received over 10,100 home and auto claims as of January 27.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

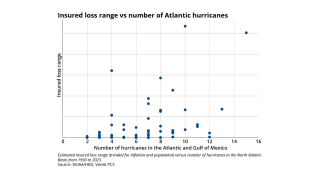

Severe convective storms accounted for 41% of last year’s insured loss load.

-

The former Credit Suisse ILS head Niklaus Hilti said working on life buyout hedges could rejuvenate the life ILS market.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

Kusche and Rosenberg will co-lead the firm’s global ILS business.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Investigators are homing in on the likely causes of the incidents.

-

The number of structures damaged may put the event on par with the fires of 2017 and 2018.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

The vehicle is smaller by 8% as White Mountains’ participation grew.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

More than 4,000 acres are burning as thousands evacuate.

-

The renewal marks the seventh issue of the retro vehicle.

-

The deal comes around three years after Markel sold a controlling interest in Velocity for $181.3mn.

-

The carrier said reinsurance was a key component of its “low-volatility strategy”.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

In the US, pricing fell by 6.2% at the major renewal.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The broker anticipates strengthening investor demand for collateralised re.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

The broker estimated ILS capital has reached $107bn.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

The storms struck Victoria, New South Wales and Queensland.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

Everest is in the process of transforming its ILS offering.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

Losses are concentrated in the states of Baden-Wuerttemberg and Bavaria.

-

The carrier attributed the intensification of storms this season to climate change.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

The loss figure has increased 200% from the initial number provided in October.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

The deal is offering a multiple of 13.6x on the sensitivity case expected loss.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

The new funds will target the US wealth market through financial professionals.

-

A total of $2.1bn in Fema money has been approved for the state.

-

Tyler left Gallagher Re earlier this year.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Stokes has been with Pillar for nearly four years.

-

Only around EUR70mn-EUR140mn will fall to private insurers.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

Ceded losses grew by 69.2% in Q3 from the prior year quarter to $44mn.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

In its first deal, Enstar received $350mn in premium for certain 2019 and 2020 business in AlphaCat’s portfolio.

-

Most of the losses derive from France.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The firm is also integrating changes to its process to allow it to cover wider ground.

-

Nephila revenues would likely have been higher, but for an ‘elevated climate signal’ this year.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The final price fell 14% from the initial midpoint price offered by the sponsor.

-

The scheme is researching options for allocating to Lloyd’s.

-

The partnership is aiming to bring training and development to the DIFC Authority.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The cyclone pool received $479mn in GWP in the year to 30 June 2024.

-

The deal would represent a diversifying auto risk deal.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The policies assumed represent $200mn of in-force premium.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

The company said $13bn-$22bn will come from wind damage.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

The Dutch scheme is the largest ILS allocator with a long list of mandates within the sector.

-

The multiple offered on the deal is around 2.5x the expected loss.

-

The bond triggers on a parametric, per occurrence basis, across Class A and Class B tranches.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

The company incurred $563mn of total cat losses related to the storm.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

Roman Romeo was named CEO of Reinsurance Solutions in Bermuda in April this year.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Restrengthening to Category 5 is still possible, Siffert warns.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

A hurricane warning has been issued for the east coast of Florida.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

Paul Bantick will continue to oversee the cyber risks division during the search for his successor.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Moody’s described Hurricane Helene as “like Idalia but worse”.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

The ratings agency expects insured losses of around $5bn for Helene.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

The effort will draw from California’s research and higher education communities.

-

The estimate is like others in the market, suggesting a relatively small loss from the event.

-

Brokers expect strong competition at remote risk layers at the 1 January renewal.

-

The ratings agency said companies focused on growing business in Gulf Coast states, however, would face a “key test” as claims materialised.

-

Nick Pritchard has been appointed underwriting portfolio and alternative capital manager.

-

A strong forward pipeline will require fast work by ILS investment houses.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

‘Life-threatening’ storm surge and hurricane-force winds expected for the state, according to the NHC.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

The carrier said European cat business needs further price improvement.

-

Some Canadian cedants have approached the market for top-up cover.

-

Guy Van Hecke has spent the last 26 years working at Axa, starting at Axa Corporate Solutions.

-

The expanded team aims to increase capability across global specialty lines and property specialty retrocession.

-

The loss has increased by 1.4% since the company’s first assessment.

-

The number of sponsors has risen from 46 about a year ago to 66 over the last 12 months.

-

Eight Floridians will take on personal residential multi-peril and wind-only policies.

-

The US carrier abandoned the project due to high price expectations.

-

Urban expansion, climate change and inflation are key drivers of losses.

-

The subject business of the deal is Ascot’s ~$1bn property portfolio.

-

The rate change will be implemented in November.

-

The executive has worked for Scor, RMS, Aon and SiriusPoint, among others.

-

The unit will support Ascot’s third-party capital business.

-

Positive cat experience impact of $600mn was offset by $500mn in property and specialty reserves.

-

Rising premium income is not keeping pace with the increased cost of claims.

-

Sources said Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

The ILS business increased H1 fee income by 13% to $68mn.

-

Sidecar vehicles are being tailored to match investors’ objectives.

-

Allocators are waiting for 2024 to pan out, according to Hiscox CEO Aki Hussain.

-

Severe thunderstorms, mainly in the US, accounted for 70% of insured losses globally.

-

It consisted of three major earthquakes within a nine-hour period on 6 February 2023.

-

Geico more than tripled underwriting profits.

-

Total pre-tax cat losses for the quarter grew sixfold YoY to $135mn.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

The rise is equal to 5%-10% of catastrophe capacity purchased, including cat bonds, depending on region.

-

-

The property market remains “one of the most favorable ... I've seen in my career,” the executive said.

-

The reinsurer raised $84.5mn of third-party capital in the quarter.

-

Changes made will make it easier to compare the funds, said Albourne’s Michael Hamer.

-

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

The carrier purchased an additional $150mn of cover.

-

The modeller said 3 million homes were without power at its peak.

-

Two-thirds of Guy Carpenter’s clients bought more coverage in H1.

-

Hennon spent 17 years as professor at the University of North Carolina.

-

Most of the losses occurred in Bavaria and Baden-Wuerttemberg.

-

The insurance sector’s RoE is expected to exceed 10% next year.

-

Uncertainty around the quantum remains due to policy deductible variation.

-

The insured loss from Beryl in the US was pegged at $2.7bn.

-

The flattish outcome comes after a larger year-on-year hike in January.

-

The estimate is up from A$1.5bn, published by Perils in April.

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

The broker said the mid-year reinsurance renewals benefitted from “more than ample” capacity.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

Evercore is leading the capital raise process and Aon is assisting with the Lloyd’s application process.

-

The bond is seeking coverage for named storm, severe thunderstorm and winter storm.

-

There was a 12% increase in flood sums insured to C$7.3tn.

-

Loss estimates are coming in for the weather event in Bavaria and Baden-Württemberg.

-

The deal is offering a multiplier of 6.6x on the expected loss.

-

Torrential rain caused flash floods in the Gulf States in the middle of April.

-

The firm’s P&C and life and health retro buying is being centralised.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

The loss follows the pattern of 2002 and 2013 European flooding.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

Reinsurers “weren’t getting paid” before 2023’s hardening, the Lloyd’s executive argued.

-

Reinsurers scaled back their coverage to non-peak events in 2023.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

The cat bond market was very active in April as spreads began to widen.

-

The Abu Dhabi investor is exploring options for fresh investments in (re)insurance and ILS.

-

This compares to the 2023-2024 tower which covered losses up to $2.83bn.

-

Additional capacity for upper-layer coverage is driving rate reductions, the broker says.

-

The syndicate has appointed former Munich Re active underwriter Stuart Newcombe.

-

The total economic cost from the catastrophe is estimated to be EUR9bn.

-

CEO Wagstaff said the LMG must "compete with other markets".

-

Traditional reinsurers such as Berkshire Hathaway and Arch pushed for more share, our annual study of Florida cessions shows.

-

The carrier reported 1 April price increases of 3.2%.

-

The capital will be deployed by Bermuda-based special purpose insurer Arachne.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

The pension fund’s ILS allocation as of the end of 2023 was CHF300.3mn ($356.8mn).

-

The firm said it expects Capital Partners to continue to grow.

-

Performance fees soared by 605% to $27.5mn from $3.9mn in Q1 2023.

-

Vincent Pomo spent more than 11 years at Everest Re in a variety of roles.

-

The firm expects pricing and terms and conditions to hold.

-

The awards event will be held on 27 June at The HAC, London.

-

The consortium will offer up to $50mn of per-program capacity.

-

The carrier has previously tapped capital markets with Cape Lookout Re transactions.

-

The carrier’s Armor Re deal upsized by 33%.

-

The most extensive damage was caused by rainfall in Texas, Louisiana, Mississippi and Florida.

-

Sums insured for European windstorm increased by 10.1% due to inflation.

-

The value of White Mountains’ stake in the ILS manager grew last year despite the firm shrinking its holding.

-

The firm, one of three major reinsurance fronts, said it would manage run-off in an orderly way.

-

Eleven hurricanes are predicted, with five expected to reach Category 3 or higher.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

The estimate is up from A$1.4bn, published by Perils in February.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

The announcement confirms earlier reports from this publication.

-

Fee income was up by 30% year-over-year to $136mn in 2023.

-

This came as the broker earmarked “material softening” of minimum traditional rates on line.

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

Sources said the deal was roughly three times over-subscribed as cat becomes hot.

-

Follow-only specialty Syndicate 2358 has reported a profit in both years since its launch.

-

The partnership will add more capacity on the platform from April.

-

The bond is Allied Trust’s debut issuance.

-

The carrier closed its Sussex Diversified Fund in October last year.

-

The carrier has priced the Class A tranche at 525 bps.

-

Severe convective storms were the biggest driver of last year’s losses.

-

-

The carrier has priced the Class A tranche at 500 bps.

-

Pricing on the Class A notes is at the lower edge of guidance.

-

The pricing guidance is now 550-575 basis points.

-

The firm is focusing on developing specialty offerings.

-

The carrier has added $5mn to the target limit bringing it to $105mn.

-

The underwriter will report to Kristina Maffit.

-

Pricing on the Class A notes moved toward the lower edge of guidance.

-

The coverage is for any named-storm loss event in Florida.

-

The state pool is seeking indemnity, annual aggregate cover.

-

Sources are expecting multi-billion new limit to be placed.

-

The cat bond will cover earthquake and named storm events.

-

Pricing guidance has also been updated to between 8%-8.25%.

-

The agency stressed the physical impact of climate risk on companies.

-

The Truist-owned cat MGA had reduced its line size to $50mn last year.

-

The challenger broker is continuing to build out its presence on the island.

-

The bond will provide named storm coverage in southern US states.

-

The firm’s assets under management dropped to $1.6bn, as a capital return more than offset new inflows.

-

He was executive managing director in Aon’s wholesale treaty team.

-

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

The bond will insure against named storms in eight US states.

-

The vehicle is 52% larger than it was at launch 3 years ago

-

The vulnerability updates are the biggest driver of loss changes.

-

The state pool is seeking indemnity, annual aggregate cover.

-

The parent also expects the ILS platform’s AuM to grow.

-

The executive previously served at McGill and Partners and Willis Re.

-

The carrier is designing an investable portfolio of long-tail risk.

-

The event occurred a fortnight after major North Island flooding in New Zealand.

-

Its property cat aggregate cover renewed with improved coverage.

-

There were 10 fatalities, mostly due to drowning or tree fall accidents.

-

The suggested update to the PML is $2bn higher than last year.

-

The carrier booked a reserve charge of $392mn for casualty insurance.

-

-

The figure represents a 26% increase on the previous estimate.

-

Most of the losses occurred in France, followed by the UK and Belgium.

-

The final estimate is a 12% increase on an August tally of NZ$1.99bn.

-

The fund manager operations booked management fees of $31mn.

-

The Medici cat bond fund experienced the largest growth in AuM.

-

Investment firm Phoenix launched a private credit and lending platform for the mid-market.

-

CEO Trevor Carvey said 1 January 2024 renewals were more “orderly” than in 2023.

-

Phoenix Re renewal ‘shows commitment to doing Asia ILS, for Asia in Asia’, according to MS Amlin Asia Pacific CEO Will Ho.

-

The carrier said it expects to maintain combined ratio expectations as it takes a selective approach to casualty lines.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

As a result of mostly flooding, £467mn of losses occurred in the UK.

-

The sixth edition of the sidecar reflected alignment of interest with long-term partners, the reinsurer said.

-

Participating insurers would be required to provide all-perils property insurance for residential and commercial policyholders.

-

Wind and tornado in the US may already have led to losses in the hundreds of millions, according to Aon’s report.

-

The loss estimate includes property damage, contents and BI insurance across residential, commercial and industrial lines.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

The scale of the claim is expected to be just within the expected total weather losses for insurers.

-

The agreement provides coverage for in-force, new and renewal business, with up to $100mn of limit excess of $10mn per occurrence.

-

Storms Pia and Henk, followed by a cold snap, follow three years of 100+ combined ratios for UK insurers.

-

The figure does not include losses from the likes of infrastructure, automobiles and business interruption.

-

European rates on line increased by 7.60%, while in the US prices were up 5.25%.

-

The broker’s report also hailed the best risk-adjusted margins for ILS investors in a decade.

-

The broker said global cat rates rose 3% in the 1 January reinsurance renewals.

-

The firm’s reinsurance leader said over-subscriptions on cat reinsurance programmes have been driven by a psychological shift.