-

Brant Loucks is one of four promotions across the Capital Partnerships and reinsurance units.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Improved performance and growing investment returns played a role in the upgrade.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

The group claims the White House is undermining disaster preparedness.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

Both organisations still predict an above-average hurricane season.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

In Q2 last year, Everest ceded $26mn in losses to Mt Logan.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The consultation period around UK ISPVs was opened in November last year.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The proposed reforms are designed to put the UK’s regulatory framework on par with Bermuda and the US.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

There’s not much supply in that marketplace, Papadopoulo said.

-

The carrier is offering shares priced at $29-$31.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The bond is being issued through Lloyd’s London Bridge 2 platform.

-

This will be Brit’s first cat bond issuance since its 2020 deal through Sussex Capital.

-

The carrier increased premium by 7% at the January renewals.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

More than 33,000 claims had been filed as of 5 February.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

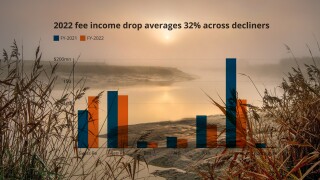

Programs did not offer adequate risk-adjusted return.

-

Standards and guidelines address institutional investors’ concerns over valuation risks.

-

Menzinger succeeds Rowan Douglas, CEO of climate risk & resilience at Howden.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

Price guidance for the bond is 7.00%-7.75%.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Prominent Name Dhruv Patel is the firm’s founder.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

Investigators are homing in on the likely causes of the incidents.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Moody’s also expects losses in the billions of dollars.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

The storms struck Victoria, New South Wales and Queensland.

-

Recoletos Re DAC SPI takes its name from the Paseo de Recoletos boulevard in Madrid.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The Class A and Class B notes are paying lower multiples than initially guided.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The bond will provide coverage for named storm across five US states.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

CEO Jonathan Zaffino said he saw opportunities for expansion in casualty.

-

This is the second time Fidelis has entered the cat bond market this year.

-

Other capacity supporting the syndicate is mostly individual Names, sources have said.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The bond is targeting $225mn of limit across the Class A and Class B notes.

-

The notes provide coverage in the US and District of Columbia but exclude Florida.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Nat cat pricing is expected to be more or less flat, with rises on loss-affected programmes.

-

The latest issuance signals the second time the sponsor has entered the cat bond market.

-

In its first deal, Enstar received $350mn in premium for certain 2019 and 2020 business in AlphaCat’s portfolio.

-

The firm will provide an update on 22 November to avoid holiday season.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The pension scheme has been winding down its ILS portfolio in recent years.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

The multiple offered on the deal is around 2.5x the expected loss.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

A strong forward pipeline will require fast work by ILS investment houses.

-

The headline figure of $7.15bn includes $2.91bn of DaVinci equity plus debt.

-

Some Canadian cedants have approached the market for top-up cover.

-

The ratings agency said comparing companies was complicated by the adoption of IFRS 17 accounting.

-

Reinsurers continued to diversify into primary and specialty business.

-

The CEA has $326.4mn towards risk transfer, 44% below budget.

-

Everest losses ceded to Mt Logan grew by 63% to $26mn.

-

The CEO cited ‘no change’ in appetite from a shift in the capital mix.

-

Allocators are waiting for 2024 to pan out, according to Hiscox CEO Aki Hussain.

-

Fee income at the Re & ILS division grew by 58% to $44.3mn in H1.

-

The insurer said once firms give up lower attachments or aggregates they “simply do not get them back”.

-

-

In 2023, Berkshire provided around $1bn in capacity to the Floridian insurer.

-

The carrier purchased an additional $150mn of cover.

-

The firm said the move would let it build a multi-vehicle capital management platform.

-

The backing represents a rare move from a collateralized reinsurer to take on risk in the legacy space.

-

-

The broker said high ILS maturities would boost cat bond issuance though the hurricane season would impact capital availability.

-

Berkshire Hathaway and Canada Life Re will provide as much as A$680mn of protection annually.

-

The model uses machine learning and daily data to forecast hurricane seasons.

-

Reinsurers are much better placed to absorb cat losses; insurers are carrying more risk.

-

The Italian hailstorm event in the summer 2023 saw estimated losses nearly triple.

-

The company increased its full year 2024 adjusted net income guidance.

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

The proposals include increasing either statutory or CRTF funds.

-

The program includes all perils coverage and third-event protection.

-

Traditional reinsurers such as Berkshire Hathaway and Arch pushed for more share, our annual study of Florida cessions shows.

-

The carrier reported 1 April price increases of 3.2%.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

CFO Christoph Jurecka declined to give a loss estimate for the Baltimore Bridge loss.

-

Sanders Re cat bond coverage attaches higher than last year at $5.46bn.

-

The firm said it expects Capital Partners to continue to grow.

-

Aspen said reduced reinsurance appetite made it a good time to seek alternative capacity.

-

The carrier of last resort is proposing total risk transfer of $5.5bn.

-

The firm said it was poised to build on ‘significant growth’ in 2023.

-

Reinsurers have a "strong desire" for growth, but not at the expense of underwriting.

-

The broker said 1 April Japanese renewals reinforced positive trends in the US at 1 January.

-

Chris Parry said the denominator effect remains a suppressant on ILS inflows after a strong phase of returns.

-

The firm is focusing on developing specialty offerings.

-

This year, the association’s funding will come to $4.05bn with a $2.45bn retention.

-

Risk partnerships will now report direct to the board through the CFO.

-

Pockets of new capital will not shift pricing at mid-year.

-

The state carrier is moving to redeem its 2022 Everglades issuance a year early.

-

The carrier is seeking named storm coverage in the state of Texas.

-

Sources are expecting multi-billion new limit to be placed.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

The cat bond will cover earthquake and named storm events.

-

Insured losses from the Christmas storms reached $968mn.

-

The vehicle is 52% larger than it was at launch 3 years ago

-

Twia’s actuarial and underwriting committee made the recommendation last week.

-

The Australian insurer will have $1.7bn of core XOL cover this year.

-

The increase in limit reflects the carrier’s growing exposure.

-

The Bermudian said its third-party vehicles were “sufficiently capitalised”.

-

The Medici cat bond fund experienced the largest growth in AuM.

-

The review followed a methodology change.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

Improving the speed and efficiency of settlements is required to help the market grow.

-

The executive joins the company as it looks to bolster its reinsurance capabilities.

-

Participating insurers would be required to provide all-perils property insurance for residential and commercial policyholders.

-

In total, insurers paid indemnity of $11bn and loss adjustment expenses of $1.5bn for claims closed in 2022.

-

GC Securities is the sole structuring agent and sole bookrunner on the deal.

-

Reinsurers are making some adjustments to secure target signings but appetite to grow is finely balanced.

-

The deal closed at the top end of the Farm Bureau’s revised target size, having grown from an initial $200mn offering.

-

Projected 2024 ILS returns remain historically high, but signs of increased appetite for top-layer cat risk and top-end retro raise questions over how long this will last.

-

Global cat-bond capacity has grown by about 4% annually over the last six years, according to a report by the Swiss Re Institute.

-

Anticipations of a tug-of-war around a ‘flat to slightly up’ pricing renewal have indeed come to fruition.

-

Slade was previously president at Markel’s ILS fund manager Lodgepine Capital.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

The amount offered in Class A and B notes has also expanded slightly.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

AuM stood at $1.5bn as of 30 September, up from $1.2bn as of January 2023.

-

Axis set up a new casualty sidecar in the quarter.

-

E+S Rück said that natural disasters and persistently high inflation have again "taken a toll" on the German insurance industry.

-

However, most P&C insurers will still miss their cost of capital targets and as a result, rate hardening and capacity constraints are expected to continue into 2024, according to Swiss Re.

-

The pressure on catastrophe terms and conditions seen at the January 2023 renewals will likely not be repeated as renewals get more orderly in 2024.

-

Court filings indicate use of “phony phone numbers” and creation of a “wholly fictitious person” in the letters of credit fraud that has engulfed Vesttoo.

-

The ratings agency said the reinsurance market was ‘the hardest in decades’ amid tightened terms and conditions as well as increased rates.

-

Super Typhoon Saola has the potential to be one of the five largest typhoons to land in Guangdong in over 70 years, according to reports.

-

Mark to market investment losses and decreased capital allocation in high volatility lines are contributing to an ongoing hard market for reinsurance.

-

More than half of the top 20 global reinsurers maintained or reduced their natural catastrophe exposures during the January 2023 renewals.

-

The broker said that capital levels should stabilise at previous levels, given a normal second half.

-

Homeowners’ and commercial insurance policies typically exclude floods, mudslides, debris flow and other similar disasters unless directly or indirectly caused by a recent wildfire.

-

The carrier was originally in the market for extra capacity at January 1 before pulling plans.

-

Loss estimates from Aon, Gallagher Re, Swiss Re and Munich Re all point to a significant component of severe convective storm losses.

-

Most forecasters now predict above-average storm activity for the Atlantic as a result of record-high sea-surface temperatures.

-

Primary market, reinsurance and ILS will all need to prove themselves before capital flows back in, said LCM CEO Paul Gregory.

-

The executive also lambasted the growing tide of corporate regulation in Germany and the EU.

-

The carrier had renewed its catastrophe XoL private market reinsurance for its property business, effective June 1.

-

The reinsurer’s ILS vehicles delivered returns of $174.9mn to investors during the quarter, with improved returns from PGGM joint venture Vermeer and the Medici cat bond fund.

-

The reinsurer recorded net income of $1.9mn, helped by a reduction in losses and loss adjustment expenses.

-

Insurance Insider has gathered data on geographical areas prone to cat events, which are outside of southeastern US states, that keep weather experts awake at night.

-

The underwriter has worked at the carrier for almost 20 years and has a background in specialty reinsurance.

-

Citizens has disclosed that Nephila Capital increased its exposure to the carrier’s reinsurance program by 68% to a total $756mn line.

-

The carrier said it had mitigated the impact of a challenging reinsurance market.

-

The reinsurer is seeking coverage for any named storm, earthquake, severe weather or fire event in several states in the northeast of the US.

-

The comment comes after major US carriers pulled back from new business in wildfire-prone California.

-

The reinsurer launched the cat bond as its first entry to the cat bond market seeking an alternative to retro.

-

The structure envisages bringing in philanthropic capital to provide project funding to mitigate disaster risk as part of ILS deals.

-

The bond will provide indemnity, per-occurrence coverage for named storm across 13 states in the US northeast.

-

Tower Hill Insurance Exchange has completed its 2023 Florida reinsurance program, which offers nearly $2bn for catastrophe cover, including all perils.

-

This compares to the subsidiaries’ 2022-2023 reinsurance tower, in which they secured coverage for losses up to $3.16bn.

-

This year’s program – sealed with a panel of 78 reinsurers – includes $875mn of multi-year ILS capacity providing diversifying collateralized reinsurance capital.

-

The deal will be the carrier's first cat bond issuance, as it enters the market seeking an alternative to retro.

-

First event reinsurance tower exhaustion points are $1.3bn for the Northeast, $1.1bn in the Southeast and $870mn in Hawaii.

-

Five counterparties account for almost half of all premiums ceded by a sample of major Floridian carriers, analysis shows.

-

Citizens’ board is slated to meet on May 16 at 13:30 ET to discuss the reinsurance and risk transfer program.

-

-

The New York-based executive had been one of the firm’s co-heads of ILS, leading on investor relations and sales.

-

He joins the division during a period of growth, with GWP surpassing $1bn for the first time in 2022.

-

The multi-peril bond will cover all 50 US states and the District of Columbia.

-

The reinsurance recoverables from Lorenz investors were up by 56% to $921mn in the 2022 year.

-

The ILS expert had joined as a portfolio manager in 2018 from Ontario Teachers’ Pension Plan.

-

Reinsurer-owned ILS platforms were challenged to grow fee income in a tough year for nat cat losses and as cat market economics shifted.

-

The reinsurer reported risk-adjusted prices up 2.3% based on conservative inflation and other assumptions.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

Should reinsurers retain the option of playing in ILS, or take a ‘go hard or go home’ approach?

-

The capital commitments to the vehicle have expired.

-

A difficult fundraising environment had not eased during 2022.

-

The Italian group previously halted writing catastrophe excess-of-loss business.

-

Reports said at least 641 people have died and thousands are injured, with damage to 1,500 buildings.

-

The (re)insurer has been reorienting itself away from writing property cat.

-

The company's portion of net written premiums from Fidelis is expected to be around $550mn to $600mn for the full year.

-

The broker said cedants will return for extra property cover after a tough 1.1.

-

The transaction is the first proportional deal for cyber risk in the capital markets.

-

The firm missed its earning per share target for the quarter.

-

The new firm has registered Jireh Re (SAC), an unrestricted special purpose insurer, with the Bermuda Monetary Authority.

-

The carrier has renewed two of its quota shares with continental reinsurers with final negotiations underway.

-

Key themes of the renewal that resonated across the ILS investor base include the elevation of attachment points, though lack of take-up of named perils coverage may disappoint some.

-

The full size of the sidecar for 2023 will be known when Class B notes are issued in January.

-

The outcome over the debate on narrowing cat reinsurance coverage will not be an all-or-nothing bet, with all perils deals with exclusions not a polar opposite of named perils coverage.

-

The ratings agency said PartnerRe would act as a ‘natural diversifier’ to Covéa’s operations.

-

FGF is a reinsurance and asset management holding company focused on collateralised and loss capped reinsurance and merchant banking.

-

Tristan Abend has been with the Axa XL Reinsurance team for 10 years.

-

The move comes amid a general cutback from reinsurers’ in their cat risk appetite.

-

The deal protects the carrier’s capital in the event of large nat-cat or mortality losses.

-

Tension is emerging at the reinsurance level over the retrenchment from all-perils coverage, which previously offered ‘sleep-easy protection’.

-

A FLOIR arrangement will help Floridians secure homeowners cover during hurricane season.

-

The broker said clients can move fast in a harder market but need time to review quotes.

-

The reinsurer is ready to “walk away from business” where it feels pricing and terms and conditions are not good enough.

-

Some firms have fared better than others in the competition to raise funds during the year.

-

Outrigger Re will write a quota share of Ark’s Bermuda property treaty book.

-

Conduit Re CEO Trevor Carvey said that a lack of legacy left the carrier well placed for the upcoming renewal.

-

Early reporters emphasised an ongoing demand for structural change.

-

Reinsurers and brokers alike have warned of a rocky 1 January renewal process ahead as the industry grapples with multiple issues including inflation, climate change and geopolitical uncertainty.

-

Florida specialists have continued to cede more premium to reinsurers, topping $7bn in 2021.

-

Inver Re said the launch was part of its growing inter-disciplinary approach to reinsurance broking.

-

How much capacity is available to meet rising cat reinsurance demands was a key theme throughout this year’s Rendez-Vous.

-

The CEO said the (re)insurance industry is not doing enough to meet the climate challenge ahead.

-

The expansive broker has also hired Mario Binetti from Everest Re as head of casualty treaty and actuarial.

-

Third-party capital is showing “skepticism” over the market while traditional capital will decline this year.

-

Aon’s reinsurance solutions CEO, Andy Marcell, said the loss ratios of treaties managed by the brokerage firm performed “pretty well” in the past 10 years.

-

einsurance has contributed increasingly to the results of the Belgian carrier, which is looking to further diversify.

-

Rhoads joined Markel in 2013 as part of its acquisition of Alterra Capital Holdings Limited.

-

The broker said some reinsurers were planning for significant growth in property catastrophe as demand is expected to pick up pace.

-

Loss creep from Hurricane Ida has led to the loss and an increase in loss reserves.

-

A report warns that recent rate increases may not be enough to protect against headwinds.

-

A Moody’s survey of reinsurance cedants found most are expecting cat rate increases to remain in a high-single-to-low-double-digit bandwidth.

-

Ratings agencies suggest that carriers must do better on controlling volatility – but diverging risk appetites give the lie to the idea that the industry is walking away from risk.

-

Insured losses in 2021 alone hit $20bn.

-

The Lloyds-centric reinsurer has become a signatory member of the Standards Board for Alternative Investments.

-

Nat cat losses added 11.8 points to the combined ratio at 101.5% over five years on average, S&P has found.

-

The reinsurer’s CFO and COO Michael Dennis has been named CEO, subject to immigration approval.

-

The Sompo International company was placed into run-off in June 2019.

-

Vesttoo's aim for the partnership is to bridge the gap between the insurance and capital markets, scaling insurance-linked investments as a source for reinsurance capacity.

-

Contasta joins the Connecticut-based reinsurer after over 14 years at Alleghany-owned carrier TransRe.

-

Neyme was previously vice president, US casualty treaty.

-

Twia noted that the cancellations had come as Texas enters peak hurricane season.

-

-

The Bermuda sidecar took losses of $21.1mn from the reinsurer during the quarter.

-

It is unclear if policies transferred by UPC to other entities through quota shares and renewal rights deals are covered by federal mortgage institutions.

-

It is launching the new capability through a new SEC-registered investment advisory firm.

-

Jacquet previously served for five years at Credit Suisse ILS.

-

The insurance agents’ trade body also raised concerns over brokers’ E&O cover.

-

Market orthodoxy suggests cross-class reinsurers secure more leverage – but are there too many implicit offsets in this game?

-

The release followed an appeal judgment from the High Court of Australia.

-

Inflationary pressure, increased demand and negotiations over attachment points are among the factors that reinsurers believe are ramping up pressure in the catastrophe space.

-

The coverage secured represents higher average insured values compared to last year.

-

Succeeding years of nat-cat losses have left aggregate and lower-layer capacity tighter.

-

The insurer reclassified some Hurricane Ida claims as storm Nicholas losses, producing an overweight loss for the second event.

-

The US P&C carrier is putting more premium through its captive.

-

CEO Kathleen Reardon said recent legislative changes are a ‘band aid’ but will help to calm the stressed Florida market.

-

It is the reinsurance company’s first entry to the cat bond market.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

The intermediary’s reinsurance solutions business has appointed Joanna Parsons as it looks to expand its capital advisory unit.

-

The pooled parametric insurance arrangement was trigged by localised drought.

-

The Bermuda-based InsurTech will deploy a combination of its own and rated paper capital.

-

Reinsurers secured concessions on terms and hiked rates as most insurers managed to patch together cover to enter hurricane season.

-

The state-backed carrier hopes to fill out more of the gaps in the coming days.

-

The ratings agency says a quarter of the Floridians it rates have still not secured multi-event cover, although first-event towers have come together.

-

DE Shaw has been offering a form of “capacity wrap” to insurers in which its limit could be used to plug gaps throughout programmes, sources said.

-

The Floridian said it had not needed to use the new Reinsurance to Assist Policyholders scheme that was created via new legislation.

-

The reinsurer has put the first layer through its captive, a move that reflects the lack of reinsurance capacity for this high-risk business.

-

he broker’s analysis found rate increases and lower cat experience contributed to strong underwriting results.

-

He moves from Axis Capital and will succeed Jon Levenson.

-

Major ILS providers active in Florida including Nephila and Aeolus lifted assumed premiums.

-

The proposal is at the upper end of previous proposals put to the insurer’s board.

-

The move partly reflected de-risking and re-underwriting activity following 2021 losses.

-

Several firm-orders have been released, but there are widespread expectations of a much-delayed renewal as low-layer capacity remains elusive.

-

The Florida carrier has yet to finalise its programs as it awaits potential reforms.

-

A restructure will see a global product leader appointed for all QBE Re’s business lines.

-

The 2022 reinsurance program will support cat losses exceeding $2.5bn, compared to $2bn in the corresponding period last year.

-

The carrier has already secured 85% of all-states, first-event cover for the June renewal.

-

Commutation negotiations continue on the book of underlying contracts written by the retro fund.

-

The Tampa-based carrier said cat losses nearly tripled, while other weather losses also rose from last year.

-

Jefferies has been awarded the mandate to seek a buyer for the segment.

-

The ratings agency cited slowing rate rises and challenges for carriers to achieve above-inflation premium increases.

-

The issuance is Vantage Risk’s second in the cat bond market.

-

The first-of-its-kind deal blends bank financing with ILS funding.

-

The Florida-based insurer’s 2019 issuance is expected to lose up to $37mn of its $40mn principal after Hurricane Ida.

-

The issuance marks the carrier’s return to the cat bond market after a five-year gap

-

Swiss Re’s recent underwriting actions, model updates and risk repricing have prepared it to take on more secondary perils, according to its top team.

-

The new platform has BMA authorisation to hold crypto currency as collateral.

-

The transaction includes a notably high-risk target layer amongst five tranches.

-

The Gallagher Re managing director of EMEA North and East said buyers need to be able to explain their stance on handling inflation, going beyond price to include action on their own underlying limits and deductibles, to get reinsurers on board.

-

There is a tension between securing payback and negotiating higher retentions.

-

Pricing rose to 950 bps, the higher end of guidance.

-

The new law, set to be implemented on 1 July, seeks to lower insurance premiums for cyclone-affected areas of Australia.

-

Continuing a trend of several years, secondary perils caused most insured losses at $81bn, or 73% of the total.

-

The Lloyd’s business is drawing on TMHCC to advise on the future of its reinsurance book.

-

Executive pay at RenaissanceRe fell for the second year in a row in 2021 after a “disappointing” return for shareholders in a year of elevated natural catastrophes.

-

TigerRisk Partners has added two new brokers to its delegated authority business, including entering the Australian market as it appointed Simon Chandler as head of reinsurance broking programmes and binders.

-

The pricing on Inigo Insurance’s Montoya Re catastrophe bond has settled at 675 basis points (bps), or the top end of guidance, Trading Risk understands.

-

Mitsui Sumitomo Insurance Co and Aioi Nissay Dowa Insurance Co have downsized the Tomoni Re catastrophe bond to $190mn-$245mn over two notes, compared with the initial offering of $240mn over four notes of $60mn each, Trading Risk understands.

-

The corporation’s major losses tallied £3bn, half the level of 2020, with Hurricane Ida driving half these claims.

-

The limit has increased by 5.5% on cover of $1,930mn placed last year.

-

Tuttle has more than 35 years’ experience in P&C broking and cat modelling.

-

The purchaser is known for having a very low cession ratio, although it said it would leave Alleghany to operate independently.

-

The company will withdraw all of its outstanding ratings on Russian firms before 15 April, having already announced the suspension of its Russian operations.

-

Carr was previously SVP, global head of property catastrophe at the reinsurer.

-

The transaction will create a reinsurance entity roughly on a par with Scor in terms of net reinsurance premium.

-

The pricing has settled at the mid-to-top end of guidance across the three tranches.

-

The carrier is facing more growth than anticipated after recent insurer failures.

-

The company’s adjusted return on equity will have a floor of 14%.

-

President Putin has signed off on a new law that has banned Russian carriers from ceding risks to reinsurers in "unfriendly states".

-

Pricing settled at 500 basis points, the higher end of guidance.

-

-

Acrisure Re brokered the deal.

-

Catastrophe reinsurers are already off to a messy start for the year and may have eroded a significant part of their year-to-date Q1 cat budgets as floods are still unfolding in Australia following recent European/UK windstorms.

-

The cat bond provides a mix of per occurrence and annual aggregate cover.

-

The company’s reinsurance assets rose 7.3% from December 2020 to December 2021.

-

The ceded premiums were up more than sixfold after it set up a new sidecar.

-

The ILS platform of Everest Re is looking to optimize value for the group and investors.

-

The deal would bring the North Carolina residual insurer’s total ILS coverage to $650mn.

-

Suncorp and RACQ set to recover losses through reinsurance.

-

The bond will replace the 2020 Class B bond which matured in January.

-

This is Allstate’s first entry to the cat bond market in 2022.

-

The firm’s 2020 edition cat bond has also lost $3.2mn.

-

This estimate would rank Eunice as the most damaging European windstorm event since Kyrill in 2007.

-

CEO Mumenthaler emphasised cat as a “core competence” for the carrier.

-

The start-up Bermudian reinsurer has focused initially more on quota share.

-

Reinsurance recoveries will depend on whether losses are aggregated, the ratings agency said.

-

The carrier took a net EUR838mn of cat losses in the full year.

-

Cyber reinsurance premiums may exceed those of property cat by 2040.

-

Combined with a challenging fundraising landscape that is likely to have led to investors cutting more deals, 2022 will be a year of fiscal pressure.

-

The bond provides annual aggregate industry loss cover for named storm and earthquake.

-

Scor’s renewals update denotes a continued push to control volatility while Hannover Re is focused on growth.

-

This is the fifth issuance from FEMA and carries a slightly higher multiple than the 2021 deal.

-

The Cayman Islands reinsurer will source underwriting risk for a new feeder fund investing in non-cat securities.

-

RenaissanceRe had raised $470mn for the high-risk fund platform a year earlier.

-

Absent more significant reform, any changes this year look set to simply shift the timing of burdens falling on the public purse.

-

The reinsurer is expanding its Bermuda presence under the leadership of Tracey Gibbons.

-

The rise accounts for growth in the firm’s specialty auto book.

-

Axis did not share any insurance premium with capital partners in Q4, while reinsurance cessions continued.

-

The issuance is a similar size to that of 2021 and significantly larger than that of 2020.

-

Total issuance during 2021 beat the previous annual peak of £11bn in 2020, according to an Aon note marking the cat bond sector’s 25th anniversary.

-

Axa XL’s UK and Lloyd’s CEO said speed of decision-making was key to UK market growth.

-

The insurer increased its occurrence treaty coverage by $300mn as the aggregate deal shrank, following a full loss to reinsurers in 2021.

-

The firm said its preference for single class exposures had constrained growth in specialty lines as brokers sought to push different classes together in combined programmes.

-

The industry is expected to improve its return on capital slightly in 2022.

-

Richard Pike joins Howden Re from Berkley Re, where he was responsible for regional ceded reinsurance.