-

The fund will offer additional spread versus other similarly rated corporate debt.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

North Carolina Farm Bureau raised $500mn with its latest Blue Ridge Re cat bond deal.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The charity said that improved ecosystems could help protect from disasters.

-

Brant Loucks is one of four promotions across the Capital Partnerships and reinsurance units.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Improved performance and growing investment returns played a role in the upgrade.

-

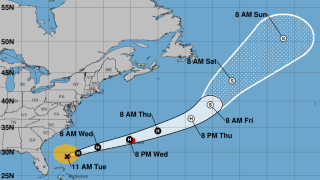

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

The group claims the White House is undermining disaster preparedness.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

Both organisations still predict an above-average hurricane season.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

In Q2 last year, Everest ceded $26mn in losses to Mt Logan.

-

The new team will be headed by Brown & Brown’s Ed Byrns.

-

The reinsurance CoR fell 2.3 points to 79.5% while the primary CoR rose 4.7 points to 98.7%.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

This brings the carrier’s total limit on the program to $1.8bn.

-

The consultation period around UK ISPVs was opened in November last year.

-

The reinsurer returned $216.7mn to investors in Q2.

-

The proposed reforms are designed to put the UK’s regulatory framework on par with Bermuda and the US.

-

The carrier reported preliminary profits of EUR2.1bn, driven by “very low” major-loss expenditure in P&C re.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

Rachel Bardon will also join the board of Compre's Bermuda-based reinsurer Pallas Re.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

Berkshire Hathaway lost market share but remained the largest traditional reinsurer, our study shows.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

The carrier’s estimated first event limit could increase 16%, to $1.35bn.

-

The (re)insurer used alternative capital in the reinsurance coverage.

-

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

There’s not much supply in that marketplace, Papadopoulo said.

-

The carrier is offering shares priced at $29-$31.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

The reinsurer said the probe concerns the alleged involvement of its former chairman.

-

The bond is being issued through Lloyd’s London Bridge 2 platform.

-

This will be Brit’s first cat bond issuance since its 2020 deal through Sussex Capital.

-

The carrier increased premium by 7% at the January renewals.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

More than 33,000 claims had been filed as of 5 February.