-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

-

The facility provides solvency support via a fresh equity injection under various scenarios.

-

The Carlyle and Hellman & Friedman vehicle will sell for 1.5x book value.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

CA Fairplan’s Golden Bear Re deal upsized 200% to $750mn.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The industry has continued to build and innovate through a third strong year of performance.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The note is paying a spread of 975bps, 11.3% below the midpoint of the initial guidance range.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

The offering is born out of software Ledger developed to manage its own portfolio since 2021.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The firm will support administration of casualty ILS and other data-rich transactions.

-

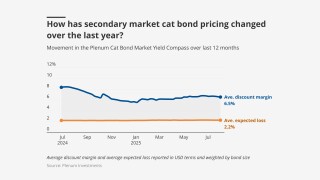

The total yield is down 162bps from 10.31% in the last week of November 2024.

-

Migdal Insurance placed its debut cat bond Turris Re for $100mn of quake limit.

-

Oaktree will fund the syndicate and act as investment manager for its assets.

-

There are various routes for ILS managers wanting to access the diversity of Lloyd’s underwriting.

-

The European ETF launch has benefited from the performance of the Brookmont US cat bond ETF.

-

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

One fund tracked by the index had a negative month.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

North Carolina Farm Bureau raised $500mn with its latest Blue Ridge Re cat bond deal.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

The single note is offering an effective coupon of 23.5% at the midpoint of guidance.

-

The firm anticipates potential growth in cyber cat ILS similar to property cat ILS post-2005.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The venture will launch in early 2026 and include captives, ART, cyber ILS and specialty (re)insurance elements.

-

Assets under management in UCITS cat bond funds stood at $17.8bn as of 7 November, according to data from Plenum Investments.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The outcome of Eaton Fire subrogation is an uncertainty for some vehicles.

-

The two funds feed into the $892.5mn Schroder IF Flexible Cat Bond Fund.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The issuance will be the fourth deal offered by the Lloyd’s carrier.

-

The shift in multiples is indicative of price softening in the cat bond the past two years.

-

Japanese firm MS&AD acquired 80% of ILS manager Leadenhall Capital Partners in 2019 from another affiliate.

-

The deal provides protection in Europe, after Mapfre Re’s debut bond last year covered US perils.

-

Growth included a $240mn increase in partner capital in DaVinci equity plus debt.

-

The average weighted spread on the deals was 651bps, skewed upward by cyber and wildfire deals.

-

Carriers are grappling with a rush of investor interest in longer-tail lines.

-

On a nine month basis, fee income was up nearly 30% to $146mn.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

Mt Logan’s Q3 loss ratio improved by 44.2 points to 11.5% for the quarter.

-

The ratings agency first indicated it would consider a new methodology in March.

-

The single Class A note is offering an initial spread range of 1,050-1,150 to investors.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The sponsor has $140mn of cyber cat bond protection maturing in December.

-

The carrier attributed the results to a significant fall in major-loss expenditure.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

Hole will spearhead the launch of the underwriting and analytics platform.

-

One William Street priced its debut cat bond 13% below the midpoint of guidance.

-

The hedge fund had significant investment aims for the London market.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

As the P&C market shifts, carriers are looking for growth from acquisitions.

-

The ILS start-up was founded in January by Hanni Ali and Peter Dunlop.

-

Pre-tax income at the vehicle was $30mn in the first nine months of 2025.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

The sponsor has $200mn of cat bond protection maturing in December this year.

-

The firm said this was due to planned returns of capital to ongoing investors.

-

Cassis joins from Swiss Re, where she was a senior ILS structurer since February 2022.

-

Brant Loucks is one of four promotions across the Capital Partnerships and reinsurance units.

-

Total yield is down from 11.18% in the last week of October 2024.

-

Widespread underinsurance and low exposures will limit losses.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The French reinsurer improved its P&C combined ratio by 7.4 points to 80.9%.

-

The syndicate is expected to write ~$300mn of business in 2026.

-

Operating revenues were also up on the $29.1mn reported over Q2.

-

O’Donnell believes RenRe is well positioned to produce longer-tail risk to third-party investors.

-

Third-party investors made a net income of $415mn in the quarter.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The sidecar was launched today by the Bermudian reinsurer and investment firm Carlyle.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

The capital will provide retro cover for life-focused reinsurer Fortitude Re.

-

Majority shareholder Fosun will continue to hold the remaining 86.7% of shares.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

EMEA CEO Laurent Rousseau said reinsurance must retain its relevance to investors.

-

The executive is charged with defrauding investors out of nearly $500mn.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

ILS has been a driver of innovation in reinsurance, Convergence 2025 attendees heard Wednesday.

-

Mory Katz joined the broker earlier this year.

-

The carrier will continue to write assumed retro in Bermuda.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

The funds will combine credit and ILS holdings.

-

Ryan Saul will work at Ledger’s broker-dealer subsidiary Ledger Capital Markets.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

Newsom has yet to sign a pending bill to create a public cat model.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

A cat-focused vehicle is “the missing piece” of Hannover Re’s ILS offerings, said Silke Sehm.

-

The allocation is around 3% of the fund’s total assets.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

Toh joins from Nephila, where he spent the last decade, bringing expertise in ILS.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Founder and CEO of Nascent Andre Perez will join Sephira’s board of directors.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Improved performance and growing investment returns played a role in the upgrade.

-

The business has been ~70% owned by White Mountains since January 2024.

-

The executive has worked at Aon for almost two decades.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

The facility will initially focus on US, Bermudian and European business.

-

Spectrum joins investors ForgePoint, Hudson and MTech.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

Bellal Rahman joins from Catalina Life Re, where he was head of finance for two years.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The tropical cyclone is expected to be named Imelda.

-

In the new role, Edward Johnson will be rejoining former Aon Securities colleague Chris Parry.

-

The Bermuda firm said HS Sawmill reflected its continued focus on life insurance.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

The ILS services specialist has worked in the ILS market in Bermuda for 10 years.

-

Charles Mixon joined the firm a year ago in a business development role.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The resource was developed by leading ILS managers and investors.

-

The major storm is set to move on to mainland China later in the week.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The economic loss from the event was around EUR7.6bn.

-

The Bermuda reinsurer has been active in ILS since launching in 2007.

-

Samild held multiple roles including head of alternatives at the Future Fund.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The sidecar will support five programs providing specialty frequency coverages.

-

Axa IM’s acquisition by BNP Paribas was confirmed in July this year.

-

Vantage Group Holdings received a BBB- long-term issuer credit rating.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Losses were primarily driven by personal property lines.

-

The tech firm is building a joint stock company with insurers and investors.

-

Nick Fallon is the latest in a string of retro-broker moves in the market.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Arch set up Bermuda investment manager Arch Fund Management in February.

-

The syndicate is targeting capital allocation for 1 January, the company confirmed.

-

Terms are expected to hold, underpinning the stronger recent performance of reinsurers.

-

Scott Cobon's most recent title was MD, insurance management services.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

-

The sponsor extended two notes issued in 2022.

-

It is understood that CyberCube has been considering a sale of the business.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The vehicle will be capitalised by an asset manager with more than $100bn in AuM.

-

The target allocation to Munich Re, Elementum and the run-off AlphaCat funds fell in the year to 30 June 2025.

-

Bohm has held senior roles at BMS, Swiss Re and Aon during his career.

-

The trend for private credit in alternative asset management is “set to continue”.

-

The capital supported sidecar-style syndicates and reinsurance start-ups.

-

Syndicate 1440 was approved to assume business incepting January 2026.

-

The investment bank had stopped offering ILS services last September.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The Japanese carrier faces integration challenges to make a success of the deal.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

The global specialty player is also exploring ILS offerings across specialty and cat bonds.

-

The violations included not using propertly appointed adjusters and failing to pay claims.

-

Market participants have until 13 October to provide any comments.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Aspen Capital Markets earned $169mn in fee income in 2024 alone.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The purchase brings Sompo an established ILS platform as part of the deal.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

The ILS play will make the business more capital efficient under new owner Sixth Street.

-

Hagood will stay on as sole CEO of Nephila Holdings, with Taylor continuing as president.

-

The group claims the White House is undermining disaster preparedness.

-

Benjamin Baltesar spent more than six years at Euler ILS.

-

The reinsurer’s capacity is hugely important to ILS firms, with few alternative providers.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

This is the latest in a string of appointments made by the firm’s ILS unit.

-

The Bermudian firm has an active ILS division, unlike the Japanese conglomerate’s insurance divisions.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

Aaron Garcia will hold a senior role at the operation, sources have confirmed.

-

Reinsurers are confident on cat rates and ready to deploy ILS capital.

-

The vehicle will support Platinum Specialty Underwriters, XPT Group’s MGA underwriting unit.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The P&C division booked a combined ratio of 81.1% for the first half of 2025.

-

Property MGA Arden Insurance Services specialises in multi-family habitations.

-

The company plans to launch in New York and New Jersey next year.

-

American Integrity grew GWP by 30% to $287mn and Slide GWP was up 25% to $435mn in Q2.

-

The estimate covers property and vehicle claims.

-

The ILS manager revised down slightly its forecast for the syndicate’s 2023 YOA.

-

The reinsurer plans to repeat its 2025 purchasing for property and specialty protections.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The Florida carrier said ceded premiums will rise slightly to $106mn in Q3.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

Aspen’s gross premium cession ratio grew 7.1 percentage points to 42.2%.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The forecast has increased since the early July update due to several additional factors.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

Around 95% of the Hiscox Re & ILS portfolio is rated rate “adequate” or better.