-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

The firm is understood to be reviewing contracts to bind coverage for 1 January.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

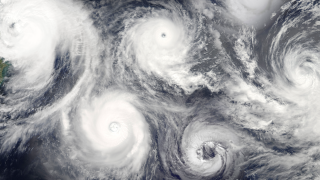

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The ruling indicated it was unlikely all claims would be dismissed, as defendants had requested.

-

The fund will invest in listed and private transactions.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

The ILS manager has hit back at an attempt by the defendants to have the case dismissed.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The bond will provide aggregate coverage against named US storm.