-

The broker anticipates strengthening investor demand for collateralised re.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

Increased reinsurance capacity was more than sufficient to meet continued growth in global demand.

-

The firm has commenced writing collateralised retro and reinsurance but its rated launch is still pending.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

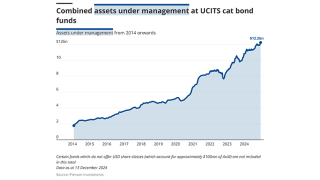

The broker estimated ILS capital has reached $107bn.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Some $1.2bn of limit was placed in the cat bond market this week.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The $600mn fund could allocate up to 10% of assets to cat bonds from 2025.

-

Initial spread guidance for the three-year bond is set at 425-500bps.