-

The firm predicts 2024 will be a record year for primary issuance.

-

The proportion of total fund assets invested in non-life ILS held steady at 0.6%.

-

Florian Steiger’s strategy is seeking institutional capital for the Q4 primary issuance season.

-

The firms’ partnership preceded Japan's first ‘megaquake’ warning.

-

The peril can no longer be considered secondary, according to Gallagher Re.

-

The July downtime will increase relevance, demand and innovation for the market.

-

The losses were not passed through to the firm’s ILS business.

-

Everest losses ceded to Mt Logan grew by 63% to $26mn.

-

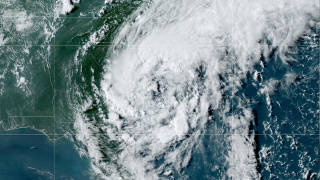

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

-

Subsidiaries Core and Typtap have applied to participate in the November Citizens policies assumption.

-

The deal takes year-to-date cat bond lite issuance to $367.6mn