-

The sale is expected to be completed by the end of the year.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

Hannover Re's cyber bond pays on a parametric basis for each hour after an agreed waiting period.

-

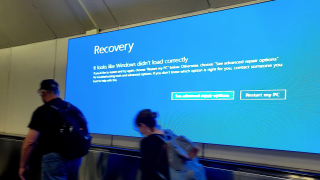

The analyst estimated Beazley’s loss from the global outage at $80mn-$120mn.

-

The current guidance is that Beazley will publish an undiscounted CoR in the low-80s at full year.

-

Aeolus increased its participation on the program more than fourfold.

-

In 2023, Berkshire provided around $1bn in capacity to the Floridian insurer.

-

-

Reinsurer-managers are building out asset management infrastructure as they expand.

-

The carrier purchased an additional $150mn of cover.

-

The event could unpack issues around accumulation risk and cloud services.

-

The deal economics take into account the investment return that Longtail Re can leverage.