Stocks

-

The Hanover has agreed to sell London market carrier Chaucer to China Re in a deal which values the insurer at $950mn.

-

Flood risk concerns could mean more drain on the public purse to pay for damages via the NFIP.

-

The French carrier has received final regulatory approval for its $15.3bn acquisition of XL Group.

-

A well-known market figure, Neville Weston will stand down from Bermudian ILS manager Aeolus in the next couple of months, according to sources.

-

This is believed to be the first ever listing of blockchain notes on a regulated exchange.

-

The start-up plans to put the assets to work in the January retro renewals.

-

The cat bond market has been the fastest-growing ILS segment in the past year, Aon said in its latest ILS report.

-

The reinsurer has created a new P&C partners unit encompassing its retro and third-party capital strategies as well as insurtech ventures, underwriting management and product development.

-

Covea put in an all-cash offer of EUR43 ($49.85) per share for the French reinsurer, however the offer was turned down.

-

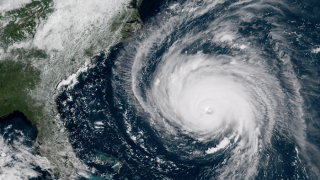

Hurricane Lane, which hit Hawaii earlier this month, is set to be more of a flood event than a wind event for insurers, rating agency AM Best has said.

-

As the challenging operating market leads more and more reinsurers to raise third-party capital, it seems strategic benefits might be easier to come by than financial benefits, commentators have suggested.

-

California has suffered another record-breaking wildfire season but the impact on the ILS market is likely to be marginal, sources have said.