Stone Ridge Asset Management

-

The fund was set up in 2015 to capitalise on higher post-event yields.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

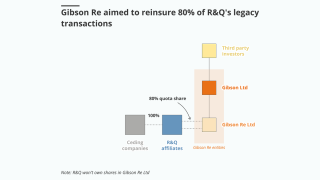

ILS investors’ stress over Gibson Re is unlikely to inhibit legacy ILS’s future.

-

The deal economics take into account the investment return that Longtail Re can leverage.

-

The manager’s ILS allocation has grown by 16% since 31 October 2023.

-

-

The asset manager’s flagship ILS funds posted stellar returns for its 2023 fiscal year.

-

The firm’s flagship reinsurance strategy delivered its best performance in its 10-year history.

-

The cat bond fund posted returns of around 10.75% for the first six months of Stone Ridge’s financial year.

-

The former chairman and CEO of New York Life will support the asset manager in developing strategies that harness longevity pooling.

-

The transaction is the first proportional deal for cyber risk in the capital markets.

-

The asset manager’s reinsurance funds shrank 17% in its fiscal year to end October to reach $2.6bn.