-

The Eurekahedge ILS Advisers Index was up by 0.45 percent in August but this figure was below the 13-year average of 0.68 percent.

-

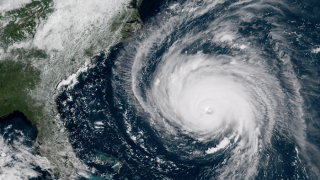

Modelling firms have put an average $3.8bn loss estimate on private market claims from Hurricane Florence.

-

The US flood market has traditionally been the domain of the publicly backed National Flood Insurance Program (NFIP).

-

The Category 4 hurricane has a central pressure of 940mb, above the 935mb threshold needed to trigger the Pacific hurricane layer of the 2017 Multicat Mexico cat bond.

-

The Category 2 typhoon is due to strike the Okinawa Islands early on Saturday.

-

North Carolina insurance regulators said that 11,457 claims have been filed with the National Flood Insurance Program (NFIP).

-

Utilities company Sempra Energy has become the second sponsor to bring a wildfire cat bond to the ILS market, with the launch of the $125mn SD Re.

-

Hurricane Florence may cost (re)insurers between $4.5bn-$4.8bn, according to an estimate from Credit Suisse Insurance Linked Strategies.

-

Munich Re and Swiss Re as well as Lloyd’s insurers are among the top reinsurers of the leading insurers in North Carolina and South Carolina.

-

Most of the losses resulting from floods caused by Hurricane Florence will be uninsured, JLT said.

-

The city of Osaka sustained most of the losses.

-

The National Hurricane Center predicted catastrophic freshwater flooding as the eye of the hurricane touched down at Wrightsville Beach.