-

Total yield is down from 11.18% in the last week of October 2024.

-

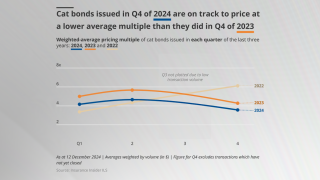

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

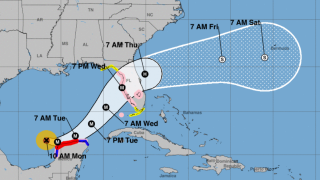

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The funds will combine credit and ILS holdings.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

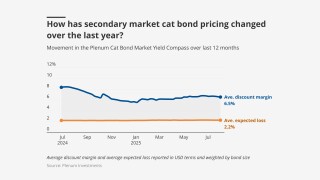

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

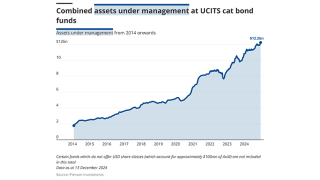

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

The sponsor extended two notes issued in 2022.

-

The investment bank had stopped offering ILS services last September.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Market participants have until 13 October to provide any comments.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The consultation period around UK ISPVs was opened in November last year.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Property cat-focused sidecar capital was up by approximately 10% in H1.

-

The sidecars will provide capacity for reinsurers and large insurance carriers.

-

Initial responses to ESMA’s report welcomed the long timeframes for any changes.

-

Weighted average multiples were down as sponsors capitalised on demand to push spreads lower.

-

The total return for the Swiss Re Global Cat Bond Index stood at 0.61% for the month.

-

The body said cat bonds are closer to an insurance product than a security.

-

The awards celebration took place at the Hilton Bankside on 25 June.

-

Twelve Securis is now a challenger for the top spot on the Insurance Insider ILS leaderboard.

-

The bond is split across a Series 1 and Series 2 structure, with eight notes in total.

-

Everest Re increased the targeted size of Kilimanjaro Re across all four classes of notes.

-

M&A and shifts in distribution arrangements bring risks and opportunities.

-

Pricing on all classes of notes are being offered at the bottom of the guided range.

-

AuM in GAIA Cat Bond Fund had grown to $3.9bn as of 31 May.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The California Earthquake Authority upsized its Ursa Re deal by 60% to $400mn.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

The firm said it was the first time a UCITS cat bond fund passed the $4.0bn mark.

-

Everest Re has structured its deal into two sections targeting aggregate and per occurrence cover.

-

The fund was set up 18 months ago by cat bond investor Florian Steiger.

-

Total yield was 10.93% as of 30 May, including 4.34% of risk-free rate.

-

This followed a $650mn fall in April, after management change of the fund.

-

A total $225mn of fresh limit entered the market across two deals.

-

The bond will provide protection for storms, quakes and fires in seven US states.

-

The bond protects against losses in the US, Canada, Europe and Australia.

-

The company also has $100mn for US hurricane events.

-

The index provider revised up its return for March by 0.39 percentage points to 1.21%.

-

The carrier previously raised a Finca Re cat bond in 2022.

-

The company is a wholly owned subsidiary of AmTrust Financial.

-

The carrier previously redeemed from a Herbie Re cat bond for California wildfire claims.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

The ILS market has won market share at the top of programmes as buying expands.

-

The bond will provide protection for Allstate’s Florida subsidiary, Castle Key.

-

The Italian sponsor has $237mn of limit maturing this July.

-

The cat bond limit total is an uplift of around 60% on the carrier’s 2024 bonds.

-

Some assets in the Medici Fund were transferred to a new UCITS strategy.

-

The bond will provide named storm and quake coverage in the US.

-

The bond is offering a spread range of 850-925bps.

-

One dollar-denominated deal has opted to hold collateral in EBRC notes.

-

The bond will cover named storms in five US states.

-

Price guidance for the bond is 4.00%-4.50%.

-

The platform’s aim is to support the ILS industry in ‘getting the marks right’.

-

Debut sponsor SV SparkassenVersicherung also secured its target size of $100mn.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

Some $200mn of fresh limit entered the ILS market as $3.4bn of deals priced.

-

Sources believe the market will grow gradually over years after its initial cluster of dealmaking.

-

The bond provides coverage on personal-lines property in Florida.

-

The series one notes will provide protection to the benefit of Twia.

-

The total yield, inclusive of the risk-free rate, was down on the same period last year.

-

The bond will provide multi-peril coverage on an industry loss basis.

-

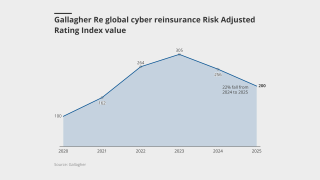

Gallagher Re said rates had softened in 2025 versus the prior two years.

-

The bond will provide storm protection in Florida and South Carolina.

-

Fermat and GAM announced that the former will take sole control of the GAM FCM Cat Bond Fund.

-

The deal will provide named Florida storm protection on an indemnity, per occurrence basis.

-

Florida Citizens upsized its latest Everglades Re deal by 50%.

-

The buzz in the air at ILS Connect told of a market entering its next growth phase.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

The renewal and upsizing of the Trouvaille E&S sidecar highlighted the market’s potential.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

The bond will offer retrocession coverage for Hannover Re.

-

The catastrophe bond comes after the issuance of a Mayflower Re bond last year.

-

Its 2025 programme exhausts at $9.5bn excess $1bn.

-

All 29 funds tracked by the index returned a positive performance.

-

The bond will provide protection against named storm and thunderstorm.

-

Cat bond sponsors continue to secure higher limits and lower rates versus their targets.

-

Investor interest and capital flows point to potential for ILS proliferation.

-

The bond initially sought $425mn across three tranches.

-

The bond will cover China, India and Japan quake and Japan typhoon.

-

The bond will provide protection against German and Japan quake.

-

Secondary market traders are baking in further loss potential after PCS increased its wildfire and Helene loss estimates.

-

Franklin Templeton’s allocations to ILS are managed by fund of funds manager K2 Advisors.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

This is the first time the Texas Fair Plan has entered the cat bond market.

-

The deal of the size was unchanged at $100mn.

-

Portfolio rebalancing was not triggered last week, but investors are now distracted and nervous.

-

US Coastal Property and Utica Mutual Insurance have brought out their first cat bond deals.

-

The bond will provide protection against China, India and Japan quake, and Japan typhoon.

-

The subject business covers a portfolio of residential insurance.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Sutton National and Bamboo Ide8 secured $170mn of sidecar and cat bond protection.

-

The bond will provide coverage against named storm or severe thunderstorm over three years.

-

Torrey Pines Re is split among three tranches of notes.

-

The issuance is split across three tranches with varying degrees of risk.

-

The deal is split across four tranches, with the riskiest note Class D targeting $150mn.

-

The cat bond will initially cover named storms in Florida and South Carolina.

-

Market participants expect pricing will be flat to down through Q2.

-

The bond will provide protection against Louisiana named storm.

-

Fees on the GAM Star cat bond funds will drop in May in a recognition of fee competition in the market.

-

The sponsor secured $240mn of limit as the bond upsized by 20% on its initial target.

-

The insurance discount margin is now at a similar level to where it was in the final week of March 2022.

-

Most of the ILS investments were made via the cat bond heavy High Yield Fund.

-

Palm Re will provide Florida named storm cat bond coverage for Florida Peninsula, Edison and Ovation Home Insurance Exchange.

-

Multiples in March were below historic averages from 2001 through 2024.

-

The ETF will invest solely in natural catastrophe-exposed bonds.

-

Scor is targeting limit of $200mn with its latest Atlas DAC retro cat bond.

-

The notes replace a 2021 issuance that matured in January this year.

-

The deal is 45% larger than 2024’s issuance after attracting a “greater number of investors”.

-

The cedant’s Namaka Re bond is offering a spread range of 200-250 bps.

-

The bond provides coverage for North American storms and earthquakes, as well as European windstorms.

-

The pricing is at the top end of the initial guidance range of 550-600bps.

-

The bond is being issued through Lloyd’s London Bridge 2 platform.

-

The bond upsized by around 20% as pricing settled 2% below initial guidance at 7%.

-

The bond will provide coverage for Japan typhoon and flood on an indemnity, per-occurrence basis.

-

Caution about capital markets volatility is leading sponsors to stagger bond renewals.

-

The ILS segment is not ready to gloss over loss-heavy years in renewal discussions.

-

The mega cat bond season in Q2 last year recorded issuance of $8.2bn.

-

The agency said introduction of a new methodology will depend on the feedback it receives from the ILS market.

-

Guernsey’s TISE listed the world’s first private cat bond issued by Solidum Re in 2011.

-

Founding partners DeCaro and Rettino will continue to provide oversight and investment advice.

-

This will be the third cat bond issuance through Baltic Re PCC.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

Flood Re’s bond Vision 2039 bucked the trend by pricing up 7% as its secured £140mn ($174mn) of limit.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

The reinsurer had taken the opportunity to buy more limit across event and aggregate covers.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

This year’s coverage will involve $2.94bn of new risk transfer.

-

This will be Brit’s first cat bond issuance since its 2020 deal through Sussex Capital.

-

The deal is being issued through Lloyd’s London Bridge 2 PCC.

-

Some $4.8bn of reinsurance and cat bond limit will come up for renewal in 2025.

-

Some $625mn of new issuance entered the market in the first week of March.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The scope of QRT’s new ILS strategy will include cat bonds and private ILS.

-

As of 14 February, the company received 405 claims.

-

The fund is open to European and other global investors.

-

The bond will provide fire protection for MGA Bamboo’s California business.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The coverage will be on an indemnity, per-occurrence basis.

-

The bond will cover named storms in the state of Florida.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

Deal sizes increased by 84% on average across the six tranches that saw an increase.

-

The Class A section of the bond has doubled in size, at lower pricing.

-

The firm has rotated capital in sidecar Voussoir toward direct investor relationships.

-

The NCIUA had initially sought $350mn of limit.

-

The state-backed carrier has $2.1bn of Alamo Re cat bond coverage.

-

UCITS fund diversification targets limit their capacity for US wind bonds.

-

Pricing fell by 13.5% on a weighted average basis across deals that updated last week.

-

Several Florida start-ups are poised to begin writing business this year.

-

Modest increases to reinsurance costs were partly offset by the Australia cyclone pool.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

The aim is to capitalise on cat bond market’s robust growth and US peril concentration.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

New limit of $474mn entered the market across two deals.

-

The Class B segment of the bond has priced below initial guidance.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The bond provides coverage for storms, earthquakes and severe weather events.

-

Two ILS funds featured in the top five asset-raisers within the index.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The deal is being issued through Lloyd’s London Bridge 2 PCC.

-

The combined entity ranks third in the Insurance Insider ILS leaderboard.

-

Liquid alternative strategies accounted for around $1.4bn of the total.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

The bond will provide coverage for named storms in North Carolina.

-

American Integrity is seeking expanded limit on more favourable terms.

-

But cat bonds are experiencing negative secondary market price movement.

-

Tower Hill secured $400mn of Winston Re limit in 2024.

-

The sponsor secured $100mn limit last year, paying a multiple of 8.3x.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The deal priced below guidance for the Class A and Class B tranches.

-

The carrier previously raised $125mn via an Ocelot Re cat bond in 2023.

-

The Integrity Re bond is structured into five tranches.

-

The deal has upsized by around 64% compared with the initial target.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

The reinsurer added two new tranches to its 2025 issuance.

-

Peril- and geography-specific deals are being well received by investors.

-

A negative January return will be unprecedented for ILS industry.

-

The index delivered a total return of 1.29% for the month of December.

-

The bond went on watch after Mercury said it would exceed its $150mn retention.

-

Company touts growing investor demand for Asian cat risks.

-

Both the Class A and Class B notes increased in size.

-

The latest issuance will add extra cat bond limit, with a $100mn note still on risk.

-

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

Fermat stayed in the top spot surpassing $10.0bn for the first time.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

The reinsurer has issued updated pricing for the instrument.

-

Theo Norris joins from Gallagher Re, which brokered one of the first 144A cyber cat bonds.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The bond is split into five tranches, with two notes offered on a zero-coupon basis.

-

Price guidance for the bond is 7.00%-7.75%.

-

The vehicle has $2.55bn in capital committed by institutional investors.

-

The bond is likely replacing the 2021-1 Class F bond, which matured in December.

-

The fund returned 15.69% in calendar year 2024.

-

This comes after the firm’s distribution partner GAM has had a challenging few years.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Aetna, Inigo and GeoVera were the three sponsors seeking lower multiples.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Compressed cat bond spreads could drive some rebalancing, as M&A remains a prospect.

-

Plenum said impact is marginal because wildfire contributes only marginally to the risk of bonds.

-

The ILS manager analysed 16 UCITS fund portfolios to compare risk levels.

-

The reinsurer is seeking annual aggregate cover against earthquakes and second-event named storms.

-

The sponsor has expanded its target deal size compared with a year ago.

-

The first cat bond deal from the carrier achieved its target size of C$150mn.

-

The reinsurer is seeking index-based cover for a wide scope of perils and territories.

-

The deal is split into two tranches compared with the single note issued last year.

-

Cat bond investors have earned a cumulative 39.6% over 2023 and 2024.

-

Novelty premiums will likely fade once investors are more comfortable with the risk.

-

Spread guidance anticipates a lower multiple compared to 2024’s Vitality Re issuance.

-

The forecasts anticipate a large volume of maturities and rising sponsor demand.

-

The manager’s Interval Fund returned 28.25% over the financial year.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

The broker anticipates strengthening investor demand for collateralised re.

-

Over-subscriptions have been evident on well-priced US cat treaties.

-

The Bermuda based entity is expected to continue on its “responsible growth trajectory”.

-

First-time sponsor QBE secured $250mn of quake and storm coverage.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Some $1.2bn of limit was placed in the cat bond market this week.

-

The $600mn fund could allocate up to 10% of assets to cat bonds from 2025.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

The firm will also act as sub-adviser to the Brookmont ETF cat bond fund.

-

Recoletos Re DAC SPI takes its name from the Paseo de Recoletos boulevard in Madrid.

-

The carrier has raised $75mn of higher-risk Class C coverage.

-

The bond offers a higher multiple than a similar Fuchsia Re deal placed last year.

-

The bodies said that tapping into the cat bond markets was a possibility.

-

The Class A and C notes increased in size, while the Class B note remained unchanged.

-

MMIFS Re is the debut cat bond offering from the Canadian carrier.

-

Mapfre Re CEO Miguel Rosa was “very satisfied” with the debut cat bond deal.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

Full year 2023 set the record to beat of $15.8bn in new issuance volume.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

The former co-head of ILS at Schroders left the bank last month.

-

The pricing multiple on the deal is 12.1x the sensitivity case expected loss.

-

The single Class A note is paying a multiple of 2.1x.

-

The Class A and Class B notes are paying lower multiples than initially guided.

-

Beazley returned with its second Fuchsia cat bond issuance.

-

The bond will provide coverage for named storm across five US states.

-

Former ILS investors who left the space have looked again and re-allocated.

-

The ILS manager’s existing Medici cat bond strategy stood at $1.68bn in assets under management (AuM) as of 30 September.

-

Pricing on the Class A and Class B notes settled below guidance.

-

The bond will provide named storm and quake coverage.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The $100mn note was unchanged in size.

-

Fidelis is seeking more cat bond cover than it did almost a year ago.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The fund will invest in listed and private transactions.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

The bond will provide aggregate coverage against named US storm.

-

The bond is split into three tranches of notes.

-

This is the second time Fidelis has entered the cat bond market this year.

-

The latest clutch of offerings indicates pricing discipline in the bond market.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

Athena Re provides coverage against terrorism in France and its overseas territories.

-

The deal is offering a multiple of 13.6x on the sensitivity case expected loss.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The UCITS fund was launched in 2021 and invests in cat bonds and the money markets.

-

The headline figure of $7.72bn includes $3.11bn of DaVinci equity plus debt.

-

The bond is targeting $225mn of limit across the Class A and Class B notes.

-

Spreads at levels favourable to sponsors could power Q1 2025 pipeline.

-

The consultation period closes on 14 February 2025.

-

The notes provide coverage in the US and District of Columbia but exclude Florida.

-

The latest issuance is the second cat bond RenaissanceRe has issued this year.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

Cheaper traditional reinsurance as of mid-year may have dampened deal pipeline.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The latest issuance signals the second time the sponsor has entered the cat bond market.

-

The bond offers a midpoint multiple of 4.1x with an expected loss of 0.92%.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Michael Rich left the portfolio management role in May.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The bond provides protection in France and its overseas territories.

-

September was the strongest performing month since the index began in 2006.

-

Some $409mn of volume entered the market in the week to 4 November.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The four-year deal is split across three tranches of notes.

-

The latest issuance offers a spread range of 650-700bps.

-

The final price fell 14% from the initial midpoint price offered by the sponsor.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The deal would represent a diversifying auto risk deal.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The sovereign wealth fund’s ILS investments grew to $828mn.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

The multiple offered on the deal is around 2.5x the expected loss.

-

The bond triggers on a parametric, per occurrence basis, across Class A and Class B tranches.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The government-backed scheme has greater take-up in areas in Milton’s path.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The class of 2023-24 cat bond funds will grow existing investors and add new ones.

-

Richard Pennay will become CEO of Aon Securities.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The strategy invests in subordinated bonds issued by European insurers.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

Only three storms have impacted a larger area than Helene since 1998.

-

The cat bond application process will be streamlined to 10 working days.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

Maya Henry will be tasked with raising capital and managing clients in North America.

-

The ETF format provides for publication of a daily NAV.

-

The deal is offering a multiple of 11.3x on the expected loss.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

The bond offers a multiple of 11.3x based on a modelled expected loss of 0.93%.

-

Brokers expect strong competition at remote risk layers at the 1 January renewal.

-

A strong forward pipeline will require fast work by ILS investment houses.

-

The sponsor has kept $25mn of principal in extension for any further loss development.

-

The ILS industry offered 11 points of merit that justify cat bonds being eligible for UCITS funds.

-

Kin’s reinsurance structuring means the bond’s losses will be kept to a minimum.

-

Most of the ILS capital was attracted to the cat bond market.

-

Demand for peak peril retro increased significantly in Q2 2024.