-

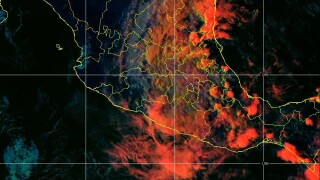

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.

-

Carriers have been dealing with elevated storm activity this year, whilst additional purchases to match inflating values had largely been parked in 2023.

-

PoleStar Re will provide worldwide coverage for any cyber event or series of cyber events.

-

This will be the third time this year the California Earthquake Authority has issued its Ursa Re cat bond.

-

The $75mn cat bond will cover systemic cyber events on a per-occurrence basis.

-

The Bermuda-based transformer vehicle has issued $109.9mn in 2023 so far..

-

The global carrier has expanded its target limit to $250mn-$275mn.

-

The $75mn cat bond is expected to close in late November.

-

The insurer previously sought $250mn of coverage for any named storm event in North Carolina.

-

The bond will provide cover for windstorm, hailstorm, flood and quake.

-

With more ILS managers chasing the popular bond space, how will new operators differentiate themselves?

-

The first-time cat bond sponsor is seeking multi-year coverage across two tranches of notes.