-

Reinsurers could use retained earnings to target growth and buy more retro.

-

Cat bond market growth has exceeded broker-dealers' 2025 forecasts by some distance.

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

The Italian asset manager also plans to relaunch its multi-strategy ILS fund.

-

The finance committee discussed shifting market dynamics as tort reform takes effect.

-

CA Fairplan’s Golden Bear Re deal upsized 200% to $750mn.

-

PoleStar Re Ltd 2026-1 includes three sub-layers, which run for a three-year term.

-

The note is paying a spread of 975bps, 11.3% below the midpoint of the initial guidance range.

-

Man AHL Cat Bond Strategy has $1bn in assets, around 2% of Man AHL Partners’ total of $54bn.

-

The TPA approach to investing was adopted by US pension fund Calpers last month.

-

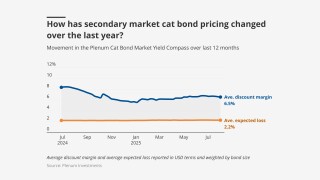

The total yield is down 162bps from 10.31% in the last week of November 2024.

-

Migdal Insurance placed its debut cat bond Turris Re for $100mn of quake limit.

-

The European ETF launch has benefited from the performance of the Brookmont US cat bond ETF.

-

The sponsor is offering two notes but will only place one depending on market interest.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

One fund tracked by the index had a negative month.

-

The fund held $10mn in AuM, with $3mn the minimum investment required.

-

North Carolina Farm Bureau raised $500mn with its latest Blue Ridge Re cat bond deal.

-

Demand for top layer coverage may also need to be supported by underlying market growth.

-

The single note is offering an effective coupon of 23.5% at the midpoint of guidance.

-

Assets under management in UCITS cat bond funds stood at $17.8bn as of 7 November, according to data from Plenum Investments.

-

The cat bond market is on course for $56bn of notional outstanding by the end of this year.

-

The two funds feed into the $892.5mn Schroder IF Flexible Cat Bond Fund.

-

The issuance will be the fourth deal offered by the Lloyd’s carrier.

-

The shift in multiples is indicative of price softening in the cat bond the past two years.

-

The deal provides protection in Europe, after Mapfre Re’s debut bond last year covered US perils.

-

The average weighted spread on the deals was 651bps, skewed upward by cyber and wildfire deals.

-

The reinsurer is the second sponsor opting not to renew cyber coverage in the bond market this year.

-

The ratings agency first indicated it would consider a new methodology in March.

-

The single Class A note is offering an initial spread range of 1,050-1,150 to investors.

-

The sponsor has $140mn of cyber cat bond protection maturing in December.

-

One William Street priced its debut cat bond 13% below the midpoint of guidance.

-

The reinsurer-linked manager now offers three ILS funds encompassing private ILS and cat bonds.

-

The sponsor has $200mn of cat bond protection maturing in December this year.

-

Total yield is down from 11.18% in the last week of October 2024.

-

Covea’s Hexagon IV Re deal priced 13% below the initial target on a weighted average basis.

-

Total gains for the year reached 7.71%.

-

Some experienced investors are pivoting out of cat bonds and into the top layers of private ILS deals.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

So far this year, there have been 11 first-time sponsors to place a deal.

-

Competition on price from traditional markets is weighing on bond market momentum.

-

The insurer of last resort’s exposure was $696bn as of last September.

-

The bond will provide protection against US wind with a PCS trigger.

-

The cedant’s current deal is due to mature at the end of January 2026.

-

Spreads on USAA’s latest deal priced below comparative issuances in 2023-2024.

-

Investor interest is warming up following a colder spell over the past several years.

-

The funds will combine credit and ILS holdings.

-

The hire is the hedge fund manager’s third ILS appointment in the past year.

-

Key topics include private ILS growth prospects and the longevity of longtail interest.

-

Returns from cat risk investments stood at 20.1% for the year to 30 June 2025.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The alternative asset manager was founded in 2021 with offices in London, New York and Abu Dhabi.

-

Sources have said $1bn+ of fresh capital from the region is expected to be deployed in 2026.

-

The figure comprises 5.48% of insurance discount margin and 3.96% of risk-free rate.

-

Pricing has hit historically soft market lows, based on secondary market pricing.

-

The manager’s largest ILS holding is in the cat-bond-heavy High Yield fund.

-

Cat bonds have outpaced the returns on private strategies in the year to date.

-

The new Verisk SCS model is increasing expected losses on aggregate bonds.

-

Deals would need to be sized at $50mn plus for transfer to capital markets.

-

The CEA had $19.3bn of claim-paying capacity as of 31 July.

-

The ILS manager has $6.8bn in assets and will be led by MariaGiovanna Guatteri.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

ILS executives talked pricing, capacity and opportunities in casualty at an ILS roundtable in Monte Carlo.

-

The market has learned lessons from earlier soft market phases that it will apply now.

-

Victory Pioneer Cat Bond Fund also added assets in the past month.

-

The figure comprises 6.07% of insurance discount margin and 4.15% of risk-free rate.

-

He added that Munich Re does not rely on retro or third-party.

-

The sponsor extended two notes issued in 2022.

-

The investment bank had stopped offering ILS services last September.

-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Competition from cat bonds in the top layers of programmes applied downward pressure on reinsurance pricing in 2025.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

Funds encompassing private ILS outperformed cat bond strategies in July.

-

Market participants have until 13 October to provide any comments.

-

A trend towards higher-risk ILW bonds helped keep yields in double-digits despite softer rates.

-

The CUO has added the role of head of private ILS, joining the executive team.

-

ILS accounted for 2.5% of the pension fund’s total AuM.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

The reinsurer’s chair said cat pricing reductions are at a “miniscule level”.

-

The yield figure comprises 6.53% of insurance discount margin and 4.28% risk-free.

-

The Texas insurer of last resort previously had to have funding for a 1-in-100 year storm.

-

The ILS Advisers Fund Index reported a profit of 1.11% in June.

-

Amid $17bn of new deals, cat bond activity included aggregate and cascading structures.

-

The bond will provide protection on an industry-loss basis, as reported by PCS.

-

The merged business of Twelve Securis ranked third among ILS managers for AuM, behind Fermat and RenRe.

-

Cat bond broking growth contributed to 6% organic growth in reinsurance.

-

The consultation period around UK ISPVs was opened in November last year.

-

Managers believed end-investors value diversification and non-correlation of cat bonds over liquidity.

-

Cat bonds remain attractive for investors seeking risk-adjusted return and diversification.

-

The PRA will also have to report on turnaround time for new approvals against 10-day and six-week targets.

-

The fund was renamed from the Pioneer Cat Bond Fund.

-

The total yield was 11.03% as of 27 June, including 4.3% of risk-free rate.

-

Some $400mn of bonds priced in the past week, after a record-setting H1.

-

The recommended “AIF lite” structure could be suited to cat bond lites.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.