-

The catastrophe bond will provide protection for named storm, severe thunderstorm, winter storm or earthquake in eight northeastern states.

-

Allstate disclosed a $211mn catastrophe loss in February based on nine separate events.

-

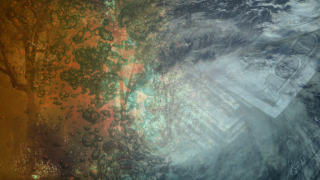

The bond will provide coverage for earthquakes affecting the Republic of Chile and its budget.

-

Investors have been experiencing inflows while new volumes in Q1 were lower than expected.

-

The bond from the International Bank for Reconstruction and Development (IBRD) will provide coverage for quakes, including resulting tsunamis, to the Republic of Chile.

-

The bond will trigger on a PCS weighted industry loss, annual aggregate basis.

-

The pricing guidance on the catastrophe bond is now 10% below initial guidance.

-

The new bond issuance attaches just short of $3bn, 35% higher than the $2.2bn on the last such issuance.

-

The casualty ILS fund has been on a hiring spree since its $75mn Series B fundraise in June last year.

-

The Chicago-based carrier is targeting $100mn of Florida named storm coverage.

-

The amount of limit purchased by the California Earthquake Authority has stepped down over the past couple of years.

-

The Florida state carrier is seeking named storm coverage for its personal lines account.