-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

The platform will transform ILS transactions on behalf of Jireh and SRS clients.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

Tyler left Gallagher Re earlier this year.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

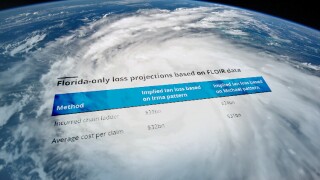

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Collateralised reinsurance and retro are in the firing line.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The firm’s deals so far have covered cat risk, with space ILS in scope for the future.

-

The ILW specialist is believed to be exploring new opportunities.

-

The insurer said once firms give up lower attachments or aggregates they “simply do not get them back”.

-

Insurance Insider ILS reported in June that the company had bought substantial ILW coverage.

-

Cat bonds, private ILS and retro are "strongly overweight".

-

The fund follows an earlier climate change-focused ILS initiative from the firm.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

The firm is the sole provider to offer index services in the US.

-

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

Dan Vestergren has started investing in cat risk but the firm may look more broadly over time, sources said.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

Gordon was set to join start-up brokerage Juniper Re last month.

-

The Mexican government’s IBRD quake bond priced 4% ahead of guidance.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

Juniper Re Bermuda received preliminary approval from the BMA last month.

-

The state carrier is moving to redeem its 2022 Everglades issuance a year early.

-

The challenger broker is continuing to build out its presence on the island.

-

The broker platform has managed nearly $100mn of capacity.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

The investment firm said cat bond spreads that are elevated relative to historical levels continue to offer an attractive entry point for investors.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

The deal was brokered by Gallagher Re and provides US cyber insurance event protection.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Highlighting regions where the demand for SRCC products is increasing, stakeholders can tailor offerings more effectively, the PCS said.

-

The cost of maintaining a team to service institutional investors does not always weigh favourably versus bringing in ILS capital.

-

Alexander will join after his competitive restrictions are up.

-

Morrison spent four years as an underwriter at Securis before moving to Aeolus in 2018.

-

ILW limit of around $1bn could change hands depending on where the Hurricane Ian industry loss number settles.

-

The firm’s 1st View report on the July renewals also flagged that an oversupply of ILW capacity may bring down attachment points relative to early 2023.

-

The broker estimated global reinsurance capital rose by $30bn over the first quarter, with a 7% uplift in alternative capital and a 5% recovery to traditional equity.

-

The $49.4bn number remains below a critical ILW threshold.

-

The bond provides coverage for North America storms and earthquakes, as well as European windstorms.

-

Industry loss triggered deals offer a degree of simplicity to investors seeking index-linked exposure.

-

The firm noted that investor pushback at the January renewal had resulted in "the cleanest risk" being transferred to the capital markets.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The new offering is structured to solve ongoing ILS market problems including trapped capital, extended settlement times, economic inflation, social inflation, non-modelled risks and pricing uncertainty.

-

The reinsurance and ILS leader joined the firm in 2012 during a “rollercoaster” year for industry loss warranties.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Former retro broker Erik Manning is leading the initiative having joined BMS Re in January.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

The two top-performing funds in 2022 were interval funds.

-

The investment analysts wrote that market dislocation offered an opportunity to invest on attractive historic yields.

-

Conviction for ILS has shifted to ‘overweight’ from ‘neutral’ at the manager.

-

The former Aspen Capital Markets COO hopes to set up fronting partnerships for reinsurers wanting to build out in ILS.

-

The Swiss direct risk transfer platform will use the funds to help grow its team and develop products.

-

Their view that “investors have never had it so good” speaks of a market in an upbeat mood as of January.

-

Just over a month ago, Floir reported claims relating to Hurricane Ian worth $10.3bn.

-

The update to the October figure implies the ultimate number will comfortably breach the $50bn mark.

-

The exit highlights increasingly difficult conditions in the retro and reinsurance markets.

-

Inigo earlier trimmed the bond’s scope of perils to exclude Japan typhoon and quake.

-

The cover is triggered by PCS territory-weighted industry loss and attaches at $12.5bn.

-

The increased yield reflects the harder post-Ian market.

-

The Lloyd’s insurer is seeking $100mn from its latest issuance, which features a narrower scope of coverage, as carriers prepare for a harder reinsurance renewal.

-

For larger top-end ILW triggers, cedants may have to be pragmatic on rolling over capital.

-

Lower-attaching Florida ILWs had been more in demand at this year’s mid-year renewals.

-

The cat bond market has a high level of exposure to Florida wind risk.

-

Amid a wide range of industry loss estimates, it is clear that ILS trapped capital will be a major issue for 2023 with back-of-the-envelope calculations suggesting at least double-digit billions held.

-

Florida domestic insurers have around $2.5bn of on-risk cat bonds, with flood and other ILW based deals exposed to the storm.

-

The former Gallagher Re broker is the second departure from the firm in Bermuda since the Willis Re sale.

-

The ratings firm also predicted that ILS losses from Covid-19 would remain limited.

-

The Sompo International company was placed into run-off in June 2019.

-

The industry is sharpening its exposure forecasting capabilities in response to investor demand.

-

HSCM has had a majority stake in the company since 2020.

-

The ratings agency has given the carriers until next week to respond.

-

Kalachian moves from Allianz where he was a managing director.

-

The firm assigned a neutral outlook overall to ILS but is strongly positive on many non-life risks as it seeks diversifying strategies that can withstand inflation.

-

Its half-year gain was down slightly from 1.43% in the prior year period.

-

Sources say investor capacity may be returning to the market, but hurricane season could “make or break” the market.

-

Australia and Florida buyers faced capacity problems as inflation drives up pricing.

-

The 1 June renewal posed challenges for Florida insurers seeking reinsurance cover.

-

It is the reinsurance company’s first entry to the cat bond market.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

Some cedants remain far behind in a stressed renewal, but others are on the path to completion in a reshaped Florida market.

-

Aeolus must return the held collateral to Credit Suisse.

-

The fund’s prospectus showed 2017 was its only negative year since 2014.

-

Despite a move away from non-official indices, global ILW trading is still sometimes relying on a patchwork of triggers.

-

The 2020 start-up raised $115mn from the Montoya Re bond.

-

The feeder fund to Neuberger Berman ILS strategies took a defensive stance ahead of 2021 Atlantic hurricane season.

-

Reciprocal carriers could become more popular, but while this could better serve capital providers it does nothing to address underlying problems.

-

It will offer components for buyers looking for indemnity, parametric or blended coverage.

-

The reinsurer said it was anticipating increased volume for catastrophe bonds and collateralised reinsurance this year.

-

Greater participation of cat bond investors in the retro market has some advantages alongside the risks.

-

There is a lack of capacity for aggregate deals, and moves towards more named peril coverage.

-

Retro renewals have made major progress in early January, but programme gaps remain at some levels, with reinsurers left carrying more risk net.

-

The ILW-focused fund has continued expanding after generating 6.4% returns last year.

-

As the renewal is expected to spill over into 2022, the two-speed market will put pressure on retro-reliant carriers.

-

The listed mutual fund will be overseen by new recruit Niall MacGillivray.

-

Pricing was generally stable but investors are showing more aversion to specific climate-exposed perils, sources noted.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

Nearly three months on, the event still seems heavily stacked towards residential claims.

-

One market participant said the strategy was $250mn in size, but it is not known how much business it has so far written.

-

Overall the cat bond market will be lightly impacted by the storm, with the Swiss Re total return index down 0.35%.

-

The reporting agency for industry loss triggers has been expanding territories and natural peril coverage over time.

-

The $20bn threshold will be a key trigger for non-livecat ILW trades exposed to Ida, as buyers’ fears grew after the storm intensified.

-

There were a number of moves and new acquisitions at Aon this month, as the broker shuffled its reinsurance management team.

-

Aggregate deals remain an exposure, but overall Ida should be a more readily digested loss than surprise disaster scenarios.

-

Pre-landfall livecat ILW interest was marked by a $15bn-$20bn split in buy/sell appetite.

-

The hire comes as other challenger brokers have added ILW experts, including Price Forbes and Lockton Re.

-

The collapse of the Aon-Willis deal will have no noticeable impact on the ILS broking business, as the market waits to see what the fate of the Willis Re team will be.

-

Sources told Trading Risk that a different kind of investor was interested in ILWs compared with retro cat bonds.

-

Rates are still more than 40% ahead of the pre-Hurricane Irma trough in late 2016.

-

Richard Anson previously served as head of ceded reinsurance at Antares and reinsurance manager for Aviva.

-

May and June people moves included several former Aon retro executives taking on new roles at challenger broker Lockton Re, longtime Credit Suisse executive Marcel Grandi moving to an advisory role at Twelve Capital, and several underwriting moves in Bermuda.

-

Reinsurers are talking about a new era of elevated risks, but their behaviour may signal a more relaxed view heading into 2022.

-

Davies most recently served as head of global Re specialty Bermuda for the firm’s reinsurance division.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

The fund will limit capacity to $400mn or 1.5% market share, and minimise exposure to secondary risks.

-

It will look to raise between $240mn and $300mn from the bond which was initially marketed at the bottom end of this range.

-

The carrier has shaved 50 basis points off the projected coupon for the ILW bond.

-

There is little sign of retro demand returning after buyers cut back in January.

-

Divergence between appetite for upper and lower layer reinsurance risk may drive some panel turnover, and disadvantage some segments.

-

The worldwide aggregate ILW bond covers an unusually wide range of perils for the cat bond sector.

-

The former Bermuda Brokers and JLT Re broker says ILW appetite is expected to remain strong after benefitting from pandemic trading activity.

-

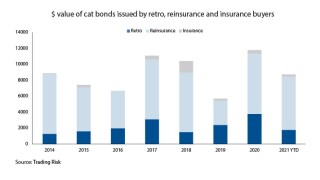

The transaction takes total private cat bond issuance tracked by Trading Risk to $461mn for the year, outstripping 2020 totals.

-

ILS managers said strong appetite for more liquid investments made bondholders want to hang on to their securities in Q1.

-

The ILW deal will offer a spread of 1775-1850 basis points (bps), including a wide range of perils and notably high coupon for the ILS market.

-

The Bermuda (re)insurance firm will pay a final spread on the deal of 675 basis points (bps).

-

The spread on the aggregate ILW bond for the first-time sponsor has dropped by 7%.

-

Could investors – and ILS managers – be ready for another attempt at developing the retail ILS market?

-

The manager says cedant demand is growing for larger transactions.

-

-

State Farm has more than replaced an expiring $300mn cat bond, while Horseshoe’s platform did its second deal for the year.

-

Investment bank partner Tom Deane said that reinsurers would remain crucial to the market and that the beginnings of rebuilding were underway that could reverse some current trends.

-

Declining listed issuance volumes could be down to a growing desire for transparency and flexibility after recent loss years.

-

The firm has seen interest in non-named storm covers after last year's derecho and other loss events.

-

The investment bank is focused on developing new parametric products for the reinsurance market.

-

The broker was most recently global head of the ILW practice for Aon’s reinsurance solutions unit.

-

The start-up aims to place $1bn in capacity this year.

-

Investor interest in the asset class should continue through 2021, but the firm has stepped back its outlook from an “overweight” recommendation.

-

December and January people moves in the ILS market.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

Quarterly report reveals that bond prices went “sideways” in Q4, but market remains hard.

-

Slew of maturities and competitive pricing environment make the cat bond market attractive for sponsors, brokers say

-

Net assets have grown 5% year-on-year to $876mn as of 31 October 2020.

-

Target investments could include cat bonds and other reinsurance, though the allocation size is unknown.

-

The InsurTech announced a partnership with Lockton Re earlier this month, and completed a fundraise in the fall.

-

The ILS manager is in cost-cutting mode as assets shrink, but the run-off may lead other ILS managers to reconsider their tactics with rated platforms.

-

Retro deals make up a third of this year's volumes, versus a quarter in 2019.

-

The new hire comes after a slew of senior appointments made by the start-up in recent months.

-

The deal will provide the insurer with annual aggregate ILW cover.