-

The agency noted inflows to cat bond funds and investor interest in private ILS.

-

Dedicated reinsurance capital is on track to increase by 8% in 2025, the broker said.

-

The broker has nearly 20 years of experience in the reinsurance and retro markets.

-

The fund’s ILS portfolio is split between 70% property cat and 30% cyber risk.

-

Buyers have turned to retro markets for covers where ILW pricing is less attractive.

-

The team will focus on building out Miller’s property treaty, retro and ILS capabilities, it’s understood.

-

The broker has also hired fellow Aon broker Barry Gordon in a role trading ILWs.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

The role will focus on international treaty, specialty lines and strategic advisory.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

Neuberger Berman’s AuM stood at $3.2bn as of 1 January 2025.

-

The offering is a collaboration with Generali and parametric carrier Descartes.

-

The platform will transform ILS transactions on behalf of Jireh and SRS clients.

-

The platform will match partner capital to provide capacity for reinsurance placements.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The ILS and reinsurance broker was established last October by Raj Jadeja.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

Investment in the space comes mainly from the cat bond market, Gallagher Re said.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

Initial spread guidance for the three-year bond is set at 425-500bps.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

Tyler left Gallagher Re earlier this year.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Cat bonds, private ILS and retro were all kept at “strongly overweight”.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Collateralised reinsurance and retro are in the firing line.

-

The deal has reduced the carrier’s one-in-250-year cyber loss scenario from $651mn to $461mn.

-

The firm’s deals so far have covered cat risk, with space ILS in scope for the future.

-

The ILW specialist is believed to be exploring new opportunities.

-

The insurer said once firms give up lower attachments or aggregates they “simply do not get them back”.

-

Insurance Insider ILS reported in June that the company had bought substantial ILW coverage.

-

Cat bonds, private ILS and retro are "strongly overweight".

-

The fund follows an earlier climate change-focused ILS initiative from the firm.

-

The broker estimated ILS capacity reached a record $107bn as cat bond interest surged.

-

ILS capital so far is viewed by sponsors as strategic rather than essential.

-

The firm is the sole provider to offer index services in the US.

-

-

Concerning hurricane forecasts are among the factors driving tighter reinsurer capacity.

-

Top layer competition is an added pressure on ILS firms, but the impact can be overstated.

-

The second part of the PoleStar Re issuance takes the bond's total volume to $300mn.

-

Dan Vestergren has started investing in cat risk but the firm may look more broadly over time, sources said.

-

Rates are still materially higher than pre-pandemic and lower layers are holding firmer.

-

Gordon was set to join start-up brokerage Juniper Re last month.

-

The Mexican government’s IBRD quake bond priced 4% ahead of guidance.

-

Various trends may work together to hold the cat markets up for longer than some had feared.

-

Increased ILW purchasing reflects cash-rich funds looking to protect return levels.

-

Juniper Re Bermuda received preliminary approval from the BMA last month.

-

The state carrier is moving to redeem its 2022 Everglades issuance a year early.

-

The challenger broker is continuing to build out its presence on the island.

-

The broker platform has managed nearly $100mn of capacity.

-

Typical ILW attachment points for US peak perils have fallen from $60bn to $40bn-$50bn as the market awaits the final Hurricane Ian number from PCS.

-

The investment firm said cat bond spreads that are elevated relative to historical levels continue to offer an attractive entry point for investors.

-

The sidecars segment has been attracting inflows after returns hit a high note in 2023.

-

The deal was brokered by Gallagher Re and provides US cyber insurance event protection.

-

In its semi-annual report for the six months to 31 July 2023, the manager said the fund had returned 2.74% over the half-year.

-

The broker’s 1st View report predicted that cat bond issuance should remain elevated until at least Q2 2024.

-

Highlighting regions where the demand for SRCC products is increasing, stakeholders can tailor offerings more effectively, the PCS said.

-

The cost of maintaining a team to service institutional investors does not always weigh favourably versus bringing in ILS capital.

-

Alexander will join after his competitive restrictions are up.

-

Morrison spent four years as an underwriter at Securis before moving to Aeolus in 2018.

-

ILW limit of around $1bn could change hands depending on where the Hurricane Ian industry loss number settles.

-

The firm’s 1st View report on the July renewals also flagged that an oversupply of ILW capacity may bring down attachment points relative to early 2023.

-

The broker estimated global reinsurance capital rose by $30bn over the first quarter, with a 7% uplift in alternative capital and a 5% recovery to traditional equity.

-

The $49.4bn number remains below a critical ILW threshold.

-

The bond provides coverage for North America storms and earthquakes, as well as European windstorms.

-

Industry loss triggered deals offer a degree of simplicity to investors seeking index-linked exposure.

-

The firm noted that investor pushback at the January renewal had resulted in "the cleanest risk" being transferred to the capital markets.

-

UBS previously explored setting up an ILS offering, but instead opted to offer other firms’ products.

-

The new offering is structured to solve ongoing ILS market problems including trapped capital, extended settlement times, economic inflation, social inflation, non-modelled risks and pricing uncertainty.

-

The reinsurance and ILS leader joined the firm in 2012 during a “rollercoaster” year for industry loss warranties.

-

Reinsurers congregating in Bermuda flagged a lack of interest in helping under-capitalised Floridian insurers and under-priced diversifiers, with positive implications for ILS participation.

-

Former retro broker Erik Manning is leading the initiative having joined BMS Re in January.

-

The appointments aim to provide clients with a product-agnostic view on accessing capital in a capacity-constrained market.

-

The two top-performing funds in 2022 were interval funds.

-

The investment analysts wrote that market dislocation offered an opportunity to invest on attractive historic yields.

-

Conviction for ILS has shifted to ‘overweight’ from ‘neutral’ at the manager.

-

The former Aspen Capital Markets COO hopes to set up fronting partnerships for reinsurers wanting to build out in ILS.

-

The Swiss direct risk transfer platform will use the funds to help grow its team and develop products.

-

Their view that “investors have never had it so good” speaks of a market in an upbeat mood as of January.

-

Just over a month ago, Floir reported claims relating to Hurricane Ian worth $10.3bn.

-

The update to the October figure implies the ultimate number will comfortably breach the $50bn mark.

-

The exit highlights increasingly difficult conditions in the retro and reinsurance markets.

-

Inigo earlier trimmed the bond’s scope of perils to exclude Japan typhoon and quake.

-

The cover is triggered by PCS territory-weighted industry loss and attaches at $12.5bn.

-

The increased yield reflects the harder post-Ian market.

-

The Lloyd’s insurer is seeking $100mn from its latest issuance, which features a narrower scope of coverage, as carriers prepare for a harder reinsurance renewal.

-

For larger top-end ILW triggers, cedants may have to be pragmatic on rolling over capital.

-

Lower-attaching Florida ILWs had been more in demand at this year’s mid-year renewals.

-

The cat bond market has a high level of exposure to Florida wind risk.

-

Amid a wide range of industry loss estimates, it is clear that ILS trapped capital will be a major issue for 2023 with back-of-the-envelope calculations suggesting at least double-digit billions held.

-

Florida domestic insurers have around $2.5bn of on-risk cat bonds, with flood and other ILW based deals exposed to the storm.

-

The former Gallagher Re broker is the second departure from the firm in Bermuda since the Willis Re sale.

-

The ratings firm also predicted that ILS losses from Covid-19 would remain limited.

-

The Sompo International company was placed into run-off in June 2019.

-

The industry is sharpening its exposure forecasting capabilities in response to investor demand.

-

HSCM has had a majority stake in the company since 2020.

-

The ratings agency has given the carriers until next week to respond.

-

Kalachian moves from Allianz where he was a managing director.

-

The firm assigned a neutral outlook overall to ILS but is strongly positive on many non-life risks as it seeks diversifying strategies that can withstand inflation.

-

Its half-year gain was down slightly from 1.43% in the prior year period.

-

Sources say investor capacity may be returning to the market, but hurricane season could “make or break” the market.

-

Australia and Florida buyers faced capacity problems as inflation drives up pricing.

-

The 1 June renewal posed challenges for Florida insurers seeking reinsurance cover.

-

It is the reinsurance company’s first entry to the cat bond market.

-

Rates have climbed 20%-35% since 1 January, and 40%-50% year on year, sources estimated.

-

Some cedants remain far behind in a stressed renewal, but others are on the path to completion in a reshaped Florida market.

-

Aeolus must return the held collateral to Credit Suisse.

-

The fund’s prospectus showed 2017 was its only negative year since 2014.

-

Despite a move away from non-official indices, global ILW trading is still sometimes relying on a patchwork of triggers.

-

The 2020 start-up raised $115mn from the Montoya Re bond.

-

The feeder fund to Neuberger Berman ILS strategies took a defensive stance ahead of 2021 Atlantic hurricane season.

-

Reciprocal carriers could become more popular, but while this could better serve capital providers it does nothing to address underlying problems.

-

It will offer components for buyers looking for indemnity, parametric or blended coverage.

-

The reinsurer said it was anticipating increased volume for catastrophe bonds and collateralised reinsurance this year.

-

Greater participation of cat bond investors in the retro market has some advantages alongside the risks.

-

There is a lack of capacity for aggregate deals, and moves towards more named peril coverage.

-

Retro renewals have made major progress in early January, but programme gaps remain at some levels, with reinsurers left carrying more risk net.

-

The ILW-focused fund has continued expanding after generating 6.4% returns last year.

-

As the renewal is expected to spill over into 2022, the two-speed market will put pressure on retro-reliant carriers.

-

The listed mutual fund will be overseen by new recruit Niall MacGillivray.

-

Pricing was generally stable but investors are showing more aversion to specific climate-exposed perils, sources noted.

-

1 January renewals are running late across the board as reinsurers hold out for improved terms, but the retro segment is the most challenged for capacity.

-

Nearly three months on, the event still seems heavily stacked towards residential claims.

-

One market participant said the strategy was $250mn in size, but it is not known how much business it has so far written.

-

Overall the cat bond market will be lightly impacted by the storm, with the Swiss Re total return index down 0.35%.

-

The reporting agency for industry loss triggers has been expanding territories and natural peril coverage over time.

-

The $20bn threshold will be a key trigger for non-livecat ILW trades exposed to Ida, as buyers’ fears grew after the storm intensified.

-

There were a number of moves and new acquisitions at Aon this month, as the broker shuffled its reinsurance management team.

-

Aggregate deals remain an exposure, but overall Ida should be a more readily digested loss than surprise disaster scenarios.

-

Pre-landfall livecat ILW interest was marked by a $15bn-$20bn split in buy/sell appetite.

-

The hire comes as other challenger brokers have added ILW experts, including Price Forbes and Lockton Re.

-

The collapse of the Aon-Willis deal will have no noticeable impact on the ILS broking business, as the market waits to see what the fate of the Willis Re team will be.

-

Sources told Trading Risk that a different kind of investor was interested in ILWs compared with retro cat bonds.

-

Rates are still more than 40% ahead of the pre-Hurricane Irma trough in late 2016.

-

Richard Anson previously served as head of ceded reinsurance at Antares and reinsurance manager for Aviva.

-

May and June people moves included several former Aon retro executives taking on new roles at challenger broker Lockton Re, longtime Credit Suisse executive Marcel Grandi moving to an advisory role at Twelve Capital, and several underwriting moves in Bermuda.

-

Reinsurers are talking about a new era of elevated risks, but their behaviour may signal a more relaxed view heading into 2022.

-

Davies most recently served as head of global Re specialty Bermuda for the firm’s reinsurance division.

-

The former Peak Capital CEO has left the ILS platform he set up.

-

The fund will limit capacity to $400mn or 1.5% market share, and minimise exposure to secondary risks.

-

It will look to raise between $240mn and $300mn from the bond which was initially marketed at the bottom end of this range.

-

The carrier has shaved 50 basis points off the projected coupon for the ILW bond.

-

There is little sign of retro demand returning after buyers cut back in January.

-

Divergence between appetite for upper and lower layer reinsurance risk may drive some panel turnover, and disadvantage some segments.

-

The worldwide aggregate ILW bond covers an unusually wide range of perils for the cat bond sector.

-

The former Bermuda Brokers and JLT Re broker says ILW appetite is expected to remain strong after benefitting from pandemic trading activity.

-

The transaction takes total private cat bond issuance tracked by Trading Risk to $461mn for the year, outstripping 2020 totals.

-

ILS managers said strong appetite for more liquid investments made bondholders want to hang on to their securities in Q1.

-

The ILW deal will offer a spread of 1775-1850 basis points (bps), including a wide range of perils and notably high coupon for the ILS market.

-

The Bermuda (re)insurance firm will pay a final spread on the deal of 675 basis points (bps).

-

The spread on the aggregate ILW bond for the first-time sponsor has dropped by 7%.

-

Could investors – and ILS managers – be ready for another attempt at developing the retail ILS market?

-

The manager says cedant demand is growing for larger transactions.

-

-

State Farm has more than replaced an expiring $300mn cat bond, while Horseshoe’s platform did its second deal for the year.

-

Investment bank partner Tom Deane said that reinsurers would remain crucial to the market and that the beginnings of rebuilding were underway that could reverse some current trends.

-

Declining listed issuance volumes could be down to a growing desire for transparency and flexibility after recent loss years.

-

The firm has seen interest in non-named storm covers after last year's derecho and other loss events.

-

The investment bank is focused on developing new parametric products for the reinsurance market.

-

The broker was most recently global head of the ILW practice for Aon’s reinsurance solutions unit.

-

The start-up aims to place $1bn in capacity this year.

-

Investor interest in the asset class should continue through 2021, but the firm has stepped back its outlook from an “overweight” recommendation.

-

December and January people moves in the ILS market.

-

US contracts are still pricing at a 10%-15% premium to January 2020 levels, but excess retro capacity may impact the smaller market.

-

The retro specialist joins the firm as it prepares to expand its reinsurance interests after spinning out of Willis.

-

Quarterly report reveals that bond prices went “sideways” in Q4, but market remains hard.

-

Slew of maturities and competitive pricing environment make the cat bond market attractive for sponsors, brokers say

-

Net assets have grown 5% year-on-year to $876mn as of 31 October 2020.

-

Target investments could include cat bonds and other reinsurance, though the allocation size is unknown.

-

The InsurTech announced a partnership with Lockton Re earlier this month, and completed a fundraise in the fall.

-

The ILS manager is in cost-cutting mode as assets shrink, but the run-off may lead other ILS managers to reconsider their tactics with rated platforms.

-

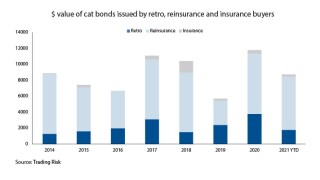

Retro deals make up a third of this year's volumes, versus a quarter in 2019.

-

The new hire comes after a slew of senior appointments made by the start-up in recent months.

-

The deal will provide the insurer with annual aggregate ILW cover.

-

Q4 issuance will likely be robust owing to new investors and increased allocations, the CEO said.

-

Industry veteran Payne was most recently at Credit Suisse Lloyd’s syndicate Arcus.

-

The fund also grew its net assets by 15% to about $142mn.

-

Chris Schaper becomes Validus Re CEO, Pat Regan suddenly departs QBE and more.

-

Enterprise and property cat reinsurance are a “must have,” chief risk officer Julia Chu says.

-

The start-up will run three auctions on Tuesday ahead of Hurricane Sally reaching the US coast.

-

The appointment follows a number of senior departures from Aon’s reinsurance ranks.

-

Total equity and debt raised this year if the $300mn target is reached would approach $1.5bn.

-

A reluctance on the part of the market to innovate on the trapped issue might lead to more investment in rated vehicles.

-

LGT ILS Partners, Swiss Re and Pool Re's Baltic Re cat bond were among the winners of the Trading Risk awards 2020.

-

People moves in the ILS marketplace.

-

ILWs at the $10bn mark failed to clear, as auction participants suggested losses would not reach the trigger.

-

Buyers and sellers are eyeing a 20% RoL, but contracts have yet to trade.

-

Buyers are looking to protect against a mid-sized loss, although trades are not believed to have taken place yet.

-

Retro specialist Richard Wheeler will head the unit, which will focus on sourcing third-party capacity.

-

The $3.9mn claim followed an August revision to the PCS Irma loss estimate.

-

The broker has recruited a significant team to build out in the retro space.

-

The growth follows the reinsurer expanding its relationship with PGGM.

-

A number of major carriers have bought new catastrophe covers, but the overall gain is likely to be muted, brokers forecast.

-

The hedge fund has asked that a US court order Catco to apply a loss estimate from PCS, rather than an allegedly “inaccurate” one from Munich Re NatCat.

-

The German insurer has placed a new EUR200mn worldwide cat agg deal.

-

Reinsurance capacity has largely bounced back from an initial Covid-19 hit, but the ILS segment remains more disrupted.

-

The climate and insurance entrepreneur is considering relaunching catastrophe exchange-traded products.

-

The deal could be expanded by up to 50 percent at the top end of pricing guidance.

-

Limited mid-year trading has continued but buyers have cut back.

-

The Bermudian ILS manager closed some months ago.

-

The bond will provide second-event US wind and quake cover.

-

The bond’s spread has settled at the top of the (re)insurer's target range.

-

Trading was brought forward this year and more cedants could head to bond market.

-

The bond will renew only part of previous Blue Halo cover benefitting Nephila's fronting partner.

-

The platform said a narrowing spread between buy and sell offers on ILWs suggests more trades will clear.

-

Reinsurers have held the line on pricing as cedants seek to close out deals, with the market showing further hardening.

-

ILW volumes could grow by more than 25 percent in 2020 as reinsurers seek alternatives to indemnity retro cover, sources said.

-

The sidecar’s AuM has held steady and remains an important hedging mechanism to the reinsurer, it said.

-

The carrier flagged that it has lower quota share and ILS support this year.

-

The Markel co-CEO said the firm was warehousing retro risk until it raised capital for new platform Lodgepine.

-

The dispute centres on ILWs that used Munich Re loss estimates as their trigger.

-

The broker said Covid-19 industry claims should be manageable but the disaster makes a broader capacity squeeze more likely.

-

The marketplace said $87mn in capacity was offered in the past week's auction.

-

The fund generated more than double the return on the Swiss Re Cat Bond Index in Q4 19.

-

Tremor’s CEO said the “(re)insurance market must remain open for business” during this turbulent period.

-

Hailstorm losses have caused significant motor losses in past years.

-

-

The cat bond could help lower barriers to collateralised participation in primary business, says the ratings agency.

-

Pricing dropped 6 percent from the midpoint of the initial range to reach 9.75 percent.

-

Bermuda carrier tactics highlight increased reliance.

-

New issuances fell to the lowest level since 2011, amid an uptick in risk levels and US exposures, according to Trading Risk data.

-

Pricing on the ILW bond has dropped below the initial guidance range.

-

The average cat bond yield was 7.48 percent by year end as cat bond issuance picked up.

-

Markel is fronting the deal, which will cover insurance business transacted for Nephila by State National.

-

The retro transaction priced below the target range, according to sources.

-

The reinsurer is thought to be buying the ILW protection for its own account, sources said.

-

Insurers ceded 52 percent of gross losses in 2018, an increase of 2.4 percent on the 2017 total.

-

Sources are expecting some $5bn-trigger second-event covers to pay out as a result of the Typhoon.

-

More than $2bn of reinsurance quotes have been placed on the platform, with ILS funds among the market participants.

-

The (re)insurer had previously removed two tranches from the multi-peril transaction

-

He will have a similar mandate at New York-based One William Street as he had at recently-sold hedge fund BlueMountain.

-

The retro renewals are still in the calm-before-the storm phase but it seems that capacity limitations are set to open up more of a role for opportunistic players.

-

The aggregator will provide loss data from earthquakes, floods and extratropical cyclones.

-

Dan Bailey will join the intermediary's London office next month.

-

A PCS update on Irma had led to a full loss on two contracts, the fund said in an SEC filing.

-

Rates fell back to their Q1 levels after experiencing an uplift in the second quarter of the year.

-

The August return was significantly below the 14-year historical average of 0.63 percent, according to the Eurekahedge ILS Advisers Index.

-

Reconstruction in the ILS market continues, with ongoing concerns about investor sentiment, capacity growth and the impact of retro rates

-

The cover provided by Insurance Linked Notes is tradeable by both the buyer and seller.

-

Both LGT and Schroders have signed up to the ILS notes trading platform.

-

The lift in ILW pricing seen at mid-year has been unilateral across most products and was a further increase on the 2018 pricing correction following 2017 events, according to Aon.

-

Typhoon Faxai losses are unlikely to have a significant impact on the ILS markets, based on current industry estimates.

-

The risk modelling firm has released the highest estimate for industry losses so far and the top end of its prediction could hit some ILWs.

-

The firm’s estimate points to a higher top-of-the-range loss than early market forecasts of between $1.5bn and $5bn.

-

Former Tokio Millennium Re CEO Tatsuhiko ‘Tats’ Hoshina is now the chief commercial officer at the start-up.

-

The loss tracking agency's data has been used on $17bn of reinsurance limit in its 10 year history.

-

The executive left Aeolus last year having been with the fund manager since 2009.

-

Reinsurance conditions began moving in investors’ favour in mid-year 2019, marking a delayed reaction to 2017-2018 losses.

-

A day ago, cover that attached at $40bn was being offered at 15 percent rate on line.

-

Discussions are now being held around ILWs triggering at $30bn or $40bn.

-

The volcano cat bond is being structured so that will be open to investment from other ILS funds.

-

Activity in the first half of the year was the lowest since 2011.

-

The reinsurer’s $150mn Atlas IX Capital 2015-1 cat bond has partially triggered following an accumulation of PCS losses, sources said.

-

The Lane Financial index has returned to levels not seen since 2012.

-

The bond priced below the lowest end of the initial guidance.

-

The reinsurer is looking to pay more rate to secure retro cover in a tightening market.

-

The fund manager has previously raised capital via Bermuda share issuances under prior owners.

-

Rising Jebi losses will contribute to a squeeze on capacity.

-

The ILW-focused company plans to go public before the end of the year.

-

Nephila, historically one of the biggest buyers of industry loss warranties, has exited the market, sources have said.

-

Procter has been tasked with helping Akinova drive participation in its electronic trading platform for (re)insurance risk.

-

At 31 January this year, the fund’s net assets reached $62.4mn, almost double the $34.2mn total assets at the same point last year.

-

The MGA is aiming for more than EUR10mn of premiums for the first underwriting year.

-

New aggregate demand from Japanese cedants may also present opportunities for ILS markets.

-

The past two years challenged the catastrophe (re)insurance market more than any period since the Hurricane Katrina era in 2004-2005 – but it is far from clear what the outcome will be this time around.

-

A decrease in capacity following last year’s losses is thought to be one of the largest drivers of the rate increase.

-

The increase suggests a return to “hard market territory.”

-

Total assets have grown from $45.6mn at the end of July.

-

This publication retraces the series of loss predictions made by the manager for its listed Reinsurance Opportunities Fund over the past year.

-

The firm’s 2017 portfolio loss has risen 15.7 percent to 57.1 percent.

-

The ILS market is often presented as the player in the (re)insurance industry with the deepest pockets, with access to trillions of pension fund wealth in worldwide bank vaults.

-

The initial estimate suggests an ultimate outcome broadly in line with market expectations.

-

The industry loss warranty will trigger based on a specified number of users in a network experiencing network failure.

-

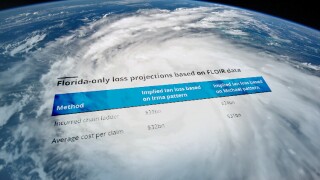

Hurricane Michael is likely to have triggered Floridian window industry loss warranties (ILWs), sources told Trading Risk. The window covers typically attach at ranges between $2bn-10bn and $7bn-15bn, covering Florida wind risks only.

-

Neuberger Berman has a diverse base of investors in areas Cartesian Re's ILS platform has not drawn from.

-

The $1bn ILW specialist will be remained NB Insurance-Linked Strategies after the sale.

-

Former Marsh broker Richard Green has joined as regional head of the alternative risk transfer business.

-

The firm's latest figure for the storm is up from a $25.7bn estimate reported by this publication in June.

-

Terms of the deal were not disclosed.

-

Insured losses from Hurricane Michael have been estimated to fall within a wide $3bn to $10bn range.

-

Appetite for last-minute cover appears muted ahead of Hurricane Michael’s landfall in Florida.

-

The two firms both have large offices on the island, which could create overlap.

-

City National Rochdale’s Select Strategies fund had posted a -3.90 percent loss at 31 January, driven by HIM.

-

Capital inflows continue to exceed loss outflows, the firm said.

-

Tullett Prebon has signed up 60 clients so far to its London-based Insurance Linked Notes (ILN) platform, which enables lower-cost and anonymous live trading of industry loss-based securities.

-

The city of Osaka sustained most of the losses.

-

The National Hurricane Center predicted catastrophic freshwater flooding as the eye of the hurricane touched down at Wrightsville Beach.

-

The broker says its platform will offer a lower-cost, anonymous alternative to other sources of hedging.

-

Former TigerRisk broker Andrew DiLoreto is joining Willis Re's Bermuda retro team while Willis' James Troughton is moving to the island as an executive vice president.

-

Heise will identify insurance marketplace pain points to assist Akinova in realising its goal of launching an electronic trading platform for (re)insurance risk, the company said.

-

The July return of the Eurekahedge ILS Advisers Index is similar to the 13-year historical average return for the month of 0.59 percent.

-

Many ILS entrepreneurs have already successfully cashed out.

-

C shareholders in the Catco Reinsurance Opportunities Fund, who are not exposed to the 2017 losses, saw a return of 6.31 percent for H1 2018 amid low catastrophic activity during the period.

-

The London-based company has appointed CEO of bond trading platform OpenDoor Trading Susan Estes as an advisor.

-

The Bermuda-based company said a smaller capital base and greater cessions to third-party reinsurers led to the decrease.

-

The latest increase in PCS figures for hurricanes Harvey and Irma means that US wind aggregate industry loss warranties (ILWs) that trigger at $30bn have been hit, Trading Risk sources said.

-

Retro purchasing rose modestly at the mid-year renewals, but this did not prevent rate increases from slowing, sources said.

-

ILS premiums steadied after a 9.5 percent drop in the first quarter, according to Lane Financial's benchmark.

-

In its 1st View report the broker said the impetus for risk-adjusted rate increases had stalled at the June and July renewals.

-

The insurance merchant bank is planning to feed most of the fund’s capital into a quota share retrocession contract with Iris Re.

-

European loss aggregator Perils has joined forces with Toronto-based analytics firm CatIQ to launch Canada’s first exposure database.

-

The fund raised an additional $10mn in the three months to 30 April 2018.

-

The fundraise comes as the firm is hiring to expand its ILS strategy.

-

Is the industry ready to accept new attempts to create live trading platforms?

-

Demand for retrocession is expected to be up slightly at the mid-year renewals, but with relatively little business concluded so far there is no clear outlook on how rates will hold up.

-

Hatteras Funds, a North Carolina-based alternative asset manager, has launched the fifth new ILS strategy this year and joins a trend of more feeder funds being set up in the asset class.

-

London-based start-up Akinova is developing an electronic trading platform for (re)insurance risk and is planning to start with listing a version of an industry loss warranty (ILWs) called an “AELO” – an Akinova Event Linked Option.

-

The concept of reinsurance market “payback” – higher premiums that follow major losses – might well be dead.

-

The alternative investment specialist has set up a new interval fund to invest in quota shares and other reinsurance instruments.

-

Rate increases have mostly been limited to low attaching Floridian wind cover.

-

The ILS market proved sceptics wrong in 2017 - the year of "the great reload" - as investors accepted claims and returned with fresh capital, Leadenhall CEO Luca Albertini said today at Trading Risk's ILS conference in London.

-

The latest PCS loss number for Hurricane Harvey has edged up to $17.1bn, from a prior figure of $15.7bn, sources told Trading Risk.

-

City National Rochdale's select strategies ILW feeder fund posted a loss of 3.90 percent in its first six months of operation, according to a Securities and Exchange Commission filing, as it benefitted from a reduction to Hurricane Irma loss estimates.

-

Lane Financial's ILS rate-on-line index dropped by 9.5 percent in the first quarter, marking a softening to the initial rating spike that took place after last year's hurricane activity.

-

Nephila's Lloyd's syndicate 2357 fell to a $120.6mn loss in 2017 as its combined ratio spiked up to 167 percent.

-

MGA Rokstone Underwriting has launched a new property treaty division with capacity from the Cayman Islands.

-

If ILS capital is designed to be the ultimate home for catastrophe risk, how far should asset managers look to hedge their investors' bets?

-

Hiscox Re has introduced the first ever cyber industry loss warranty to the ILS and reinsurance markets.

-

The second-largest ILS manager posted a $200mn incremental gain in assets under management in January as it said it chose not to draw down on some post-loss capacity.

-

Pricing for industry loss warranties is up by 15-30 percent on loss-affected covers, according to figures from brokers, as the market picks up after a slow start to the year.

-

Insurance boutique merchant bank Kingsway Financial Services hopes to raise gross proceeds of $52mn from its new ILS fund, Insurance Income Strategies, according to an updated prospectus filing.

-

Investor allocations to the ILS sector could increase in 2018 after capacity was quickly replenished following last year's losses, JLT Re said today in its Reinsurance Market Perspective report.

-

Sompo International has set up a $62mn sidecar, Blue Lotus Re, to provide cover supporting its global catastrophe reinsurance portfolio in 2018

-

The Catco Reinsurance Opportunities Fund made a worse-than-forecast 27.6 percent loss for investors in 2017 after its fund manager significantly added to its wildfire reserves in December.

-

The momentum for retro rate increases at the January renewals slowed at the end of last year, sources said, as lack of new demand and a smooth reload of lost capital meant increases fell short of expectations

-

The market's leading ILS managers grew their assets under management (AuM) by almost 10 percent in the second half of 2017, highlighting the ease of the post-loss reload

-

The value of City National Rochdale's wind ILW investments decreased by 31.4 percent between the end of July and the end of October 2017, its latest quarterly filing showed.

-

A number of outsized third quarter losses at Lloyd's insurers has highlighted the London market's concentrated exposure to the 2017 hurricanes

-

Z/Yen has launched a cyber catastrophe ILS research project as part of its two-year programme looking at how mutual distributed ledgers, such as blockchain technology, can be used across a number of fields

-

This year marked the 25th anniversary of Hurricane Andrew, a storm that would cost reinsurers $56bn if it recurred today, according to modelling company AIR Worldwide

-

A number of ILS managers stand to benefit from so-called "window" industry loss warranty (ILW) covers, which means that their recoveries may rely on limited loss deterioration.

-

Retro market sources said that capacity shortages would not be a factor in the January renewals after ILS managers reloaded lost capital, but that uncertainty over underlying reinsurance repricing was contributing to a stand-off

-

Markel Catco has said it will raise gross proceeds of $543mn by issuing new shares in its London-listed Catco Reinsurance Opportunities Fund.

-

Guernsey-based start-up Brilliant Reinsurance is aiming to provide retro cover to the Lloyd's market.

-

Data provider PCS has kept its insured industry loss figure for Hurricane Harvey largely stable at $15.9bn following its second survey of claims from the August storm, sources said.

-

The Massachusetts Pension Reserves Investment Management Board (MassPRIM) has allocated $250mn to the reinsurance sector, split between two managers, Aeolus and Markel Catco.

-

The retro spiral of the late 1980s nearly finished Lloyd's off. But those hoping that an ILW spiral might entangle and trip up the ILS market in similar complications will have to wait another day.

-

The managers of start-up ILS fund Lutece Re said they had raised a "significant amount" of committed capital to begin underwriting at the 1 January renewals

-

The reinsurance industry will absorb 50 percent of some $90bn of Q3 catastrophe losses with the rest retained by the primary market, AM Best's chief rating officer Stefan Holzberger said at the rating agency's London market conference.

-

The 2017 catastrophe events have highlighted the extent to which ILS managers are benefiting from industry loss warranty (ILW) hedging, but market sources have questioned where the losses will ultimately fall as more clarity is gained over HIM claims in months to come.

-

Erik Manning's start-up ILS fund Lutèce Re has raised capital to begin underwriting retro business during the 1 January renewals, Trading Risk understands

-

Third quarter catastrophe losses represented a 7 to 14 percent hit to the shareholders' equity of global reinsurers, with major catastrophe writers such as Everest Re, Lloyd's of London, Lancashire and RenaissanceRe the most severely affected

-

A rating correction is widely expected in 2018 after reinsurers said they would push for increases in response to catastrophe losses that have highlighted their softer margins

-

Four of the listed Florida insurers have ceded more than $1.2bn of third quarter catastrophe claims to their reinsurers, based on estimates from their quarterly disclosures

-

The California wildfires have prompted write-downs to aggregate cat bonds covering USAA and Nationwide, although the former has revised down year-to-date catastrophe loss estimates that had suggested a payout under one of its Residential Re deals, Trading Risk understands

-

At this point there are a lot of questions being asked in the reinsurance markets and few definitive answers available. As it is a journalist's privilege to ask questions, let's go through some on the list

-

The 2017 catastrophe events have highlighted the extent to which ILS managers are benefiting from industry loss warranty (ILW) hedging, but market sources have questioned where the losses will ultimately fall as more clarity is gained over HIM claims in months to come

-

Collateralised reinsurance fund strategies took losses of 10-20 percent in September, Trading Risk understands

-

Reinsurance pricing seems to rely on a certain amount of collective signalling in as much as it does number-crunching - as underwriters gauge how far they can push rates without losing business, by looking for fear in the eyes of their opposition

-

New York-listed Blue Capital Reinsurance Holdings has reported that it expects 14 percent of its projected 1 January 2018 shareholders' equity to be locked up as a result of third quarter catastrophes

-

Blue Capital Reinsurance Holdings has reported that it expects 14 percent of its projected 1 January 2018 shareholders' equity to be locked up as a result of Q3 catastrophes, on top of reported losses.

-

Hannover Re has ceded 47 percent of its 2017 natural catastrophe losses to its retrocession partners, the firm said in its third quarter report.

-

Barbican is in the early stages of planning to raise third-party capital in order to write collateralised retro cover for Lloyd's syndicates, it is understood.

-

Barbican is planning to raise £160mn ($209mn) of capital to fund a collateralised reinsurance vehicle that provides stop-loss retro cover to Lloyd's syndicates

-

RenaissanceRe CEO Kevin O'Donnell has said that the group's gross losses of about $2.2bn from third quarter catastrophes had been slashed by two-thirds due to cessions to third party capital and reinstatement premium income

-

New York-listed Blue Capital Reinsurance Holdings reported a $51.9mn net loss for the third quarter as it took losses of $68.1mn from hurricane events in the quarter.

-

Aspen ceded more than 40 percent of its gross losses from the third quarter catastrophes to its reinsurance and retro partners, the company's executives said on an earnings call

-

Markel CatCo Investment Management has raised more than $1.8bn for its privately managed fund after the 2017 hurricane losses.

-

Insurance boutique merchant bank Kingsway Financial Services has registered a new ILS fund, Insurance Income Strategies, that it hopes to list on the New York Stock Exchange.

-

Markel Catco has today announced its intention to raise further equity capital through the issuance of up to 2 billion shares in its London-listed fund, priced at $1 a share

-

Scor's retrocession arrangements have reduced Scor's gross losses for HIM and the Mexican earthquakes by 44 percent, equity analyst Jefferies has said based on Scor's recent loss update.

-

Retro market sources have expressed surprise at Markel Catco's initial loss estimate for 2017 catastrophe events, after it said investment returns for the year could range from a 5 percent gain to a 15 percent loss.

-

Property Claims Service (PCS) will include National Flood Insurance Program (NFIP) information in its insured loss estimates disclosures for the first time

-

Marco Silva has become senior underwriter and head of UK and London market property at Scor after leaving the carrier's retro team in May

-

The roughly $5bn-$6bn industry loss warranty (ILW) market is expected to be heavily impacted by the series of 2017 hurricane losses

-

Annual aggregate cat bonds with industry loss triggers continue to raise concerns for investors as the ILS market recovers from the Harvey-Irma-Maria trio of hurricanes

-

Hurricane Maria has compounded fears about how much retro capital could be lost or trapped ahead of the 1 January renewal, when much of the roughly $15bn-$25bn market limit renews

-

Analysts have said the recent third quarter catastrophe activity could lead to double-digit rate increases in the reinsurance sector, with the impact being even more profound in the retro market

-

Data provider Property Claim Services (PCS) has released its initial view on insured losses within US territories from Hurricane Irma, putting the figure at $18.03bn, sister publication The Insurance Insider revealed

-

Hurricane Harvey is likely to produce an industry insured loss of $15.9bn, data provider Property Claim Services (PCS) said in its initial survey of claims from the August event, sister publication The Insurance Insider reported.

-

Property Claim Services (PCS) has estimated insured losses from two Turkish hailstorm and flooding events in July at $300mn.

-

Perils said limits at risk placed using its industry loss data reached $3.1bn as of 31 August, up 17 percent on $2.7bn recorded at the same point last year, due to the addition of Australia and Turkey to the database.

-

Sunday morning forecasts showed Hurricane Irma's projected path continuing to drift west, with the storm expected to brush the Florida coast near Fort Myers and passing close to Tampa before moving on towards the Panhandle and in-land towards Georgia.

-

One layer of the Citrus Re cat bonds issued by Heritage was marked down to 50c in a small secondary market trade that occurred yesterday, according to Trace records.

-

Property Claim Services (PCS) has launched a global cyber industry loss index which could pave the way for cyber risk ILWs.

-

The $430mn Spectrum Re cat bond issued in June this year by fronting carrier Tokio Millennium Re was ultimately for the benefit of Credit Suisse's ILS entities, sources told Trading Risk.

-

Demand for industry loss warranty (ILW) cover on Hurricane Harvey is moving up to higher trigger levels as fears grow over the extent of private market flooding claims.

-

JLT Re has appointed Nicolas Bardon as a partner in its Bermuda operation, reporting to head of office Guy Hengesbaugh.

-

There was some livecat industry loss warranty (ILW) trading in the run-up to Hurricane Harvey, with activity focused on trades at the $10bn loss level.

-

Markel Catco reported a 3.94 percent return for ordinary shareholders in the Catco Reinsurance Opportunities Fund for the first half of 2017, as it avoided any major claims from the year's disaster events.

-

JLT Re has appointed Nicolas Bardon as a partner in its Bermuda operation, reporting to head of office Guy Hengesbaugh.

-

Reinsurance and retro buyers obtained further rate reductions at the 1 July renewals, although Australian catastrophe losses led to isolated price increases.

-

Markel Catco Investment Management commuted part of its exposure to last year's Jubilee oil field loss in June, which it said cost it the equivalent of 1 percent of net asset value.

-

Willis Re said that retro rates on loss-free accounts dropped by 5-10 percent in the mid-year renewals.

-

Despite a softer-than-expected 1 June Florida renewal, hedging activity in the industry loss warranty (ILW) market has been slow, with buyers holding back amid a glut of capacity, sources said.

-

New York-listed Blue Capital Reinsurance Holdings said that it had deployed more capital in this year's Florida renewal than at the same time last year, binding indemnity deals that brought it $4.7mn of annual premium.

-

Catastrophe loss tracking agency Perils and the UK Met Office have released a new European windstorm catalogue showing the gust footprints of more than 200 of the largest European windstorms since 1979.

-

As 1 June Florida renewal negotiations come to a head in the next fortnight, there are a number of dominant themes influencing discussions.

-

Pricing transparency in the ILS markets is deteriorating as the collateralised reinsurance market has ballooned, Lane Financial suggested in its latest annual ILS report

-

JLT Re has taken up a licence to facilitate industry loss warranties (ILWs) using PCS loss estimates as triggers, PCS parent Verisk announced.

-

Blue Capital Reinsurance Holdings (BCRH) has reported net income of $14.3mn for 2016, a 31 percent decrease from the $20.7mn profit recorded a year earlier, as it suffered from higher claims.

-

Rates on loss-free retrocession programmes fell between 2.5 to 5.0 percent at the start of 2017, JLT Re estimated in a retrospective report on the 1 January renewals period released today.

-

Twelve Capital has completed a $19.45mn Dodeka XI cat bond lite deal, according to a Bermuda Stock Exchange listing

-

Hannover Re's Kaith Re segregated cell platform listed a $9.99mn transaction on the Bermuda Stock Exchange on 30 December, taking annual cat bond lite volumes to $213mn.

-

Cat bond premiums remained relatively stable in Q4 after falling 11 percent in the third quarter, according to Lane Financial's rate-on-line index.

-

Industry loss warranty (ILW) purchasing by ILS funds has helped to drive incremental volumes in the niche sector in 2016, market participants said.

-

The Open Protocol Working Group has released a proposed reporting template for insurance funds and is seeking industry feedback on the initiative by the end of January 2017.

-

The volume of livecat trading of industry loss warranties (ILWs) prompted by Hurricane Matthew may have reached up to $150mn-$200mn, according to sources contacted by Trading Risk.

-

Cat bond premiums fell by 11.3 percent during the third quarter, according to Lane Financial's rate-on-line index.

-

Hurricane Matthew has prompted the most active livecat trading of industry loss warranties (ILWs) since Superstorm Sandy.

-

Insurers are preparing to pay out under business interruption (BI) policies in place to cover repairs to a production vessel owned by Tullow Oil, the company confirmed.

-

CEA grows; Fema flood buy; Scales launch; Italian earthquake; Wildfire losses ease; Auto flood losses; Legacy deal for CPPIB

-

Specialist investors continue to dominate the ILS landscape but hedge funds have increased their participation after buying new issuance in the past year in response to higher-yielding deals on offer, Aon Securities said in its annual review of the sector.

-

Markel Catco said August returns for the Catco Reinsurance Opportunities Fund would be impacted by a loss from the Jubilee oil field event totalling a 3.5 percent hit to net asset value (NAV).

-

Aon Securities said that it expected cat bond issuance in the second half of 2016 to be similar to recent years after a slower first half, forecasting total volumes for this year of $5bn-$6bn.

-

Weather risk has come back into the ILS spotlight with the launch of a Market Re private cat bond that uses a parametric trigger to cover a warm European winter event.

-

Allianz Risk Transfer's latest Market Re private cat bond has fallen behind schedule as the company looks to raise weather reinsurance from the ILS market for the first time since 1999, Trading Risk understands.

-

The Blue Capital Global Reinsurance Fund reported an 0.2 percent drop in net asset value per share in the first half of 2016, excluding the impact of dividends, after taking $7.4mn of catastrophe losses in the period.

-

Validus recovered $81mn of its Canadian wildfire and Jubilee oil field losses from the retro market in the second quarter, including via a non-elemental marine industry loss warranty

-

Beach & Associates has signed up for a Property Claim Services license for industry loss warranties (ILWs).

-

Hedge fund re model cracks; ILS rates gain 1.6%; US June storms cost $350mn; PCS cat index; Gen Re partners with TransRe; CSU lifts storm forecast; Gator Re value; China cat insurance

-

ILS rates rose 1.6 percent during the second quarter, following a much stronger 7.5 percent gain in Q1, according to Lane Financial's rate-on-line index.

-

The use of PCS loss index triggers increased 27 percent in the second quarter to make up $1.7bn of cat bond volumes, and represented nearly 70 percent of all North American issuance, the firm said (6 July).

-

May catastrophe events, including the Canadian wildfires and US and European storms, are expected to cost (re)insurers at least $7bn, Impact Forecasting said in its monthly cat report

-

A downturn in industry loss warranty (ILW) pricing has limited cat bond lite issuance activity in 2016, with a couple of recent deals breaking the dearth of activity

-

Allianz Risk Transfer lifted the target on its Blue Halo Re cat bond to $185mn from $150mn, as pricing on the high-risk transaction moved toward the upper end of forecasts, Trading Risk understands

-

PCS has released its initial estimate of industry losses from the Alberta wildfires that engulfed Fort McMurray, putting the cost at C$4.6bn ($3.5bn), Trading Risk understands.

-

Allianz Risk Transfer, the fronting carrier for Nephila Capital, is looking to raise $150mn of reinsurance cover from the cat bond market, Trading Risk understands.

-

Catastrophe data specialist Perils said the volume of on-risk European (re)insurance limits that use its industry loss data as a trigger fell by more than 20 percent in the year to March.

-

Demand for Florida retro has been quieter leading into the 1 June renewal season this year, as the growth in reinsurance demand slows.

-

The Fort McMurray wildfire is set to become Canada's most expensive natural catastrophe event, but overall losses for the reinsurance industry are still expected to be modest.

-

Demand for Florida retro has been quieter leading into the 1 June renewal season this year, as the growth in reinsurance demand slows.

-

Reinsurer quota shares and the industry loss warranty (ILW) market are the most likely source of claims for ILS investors from the Fort McMurray wildfire

-

TigerRisk's capital markets arm has received regulatory approval to open a secondary trading desk covering a range of ILS products, which will be headed by Patrick Gonnelli

-

Property Claim Services (PCS) in collaboration with Wood Mackenzie has tailored a new type of industry loss index for the offshore energy sector, which takes into account oil rig values to reduce the basis risk of using ‘cat in a box' structures.

-

The Lane rate-on-line index rose from 86.6 to 93.1 over the last quarter, indicating that rates have firmed since December, according to Lane Financial's latest quarterly report on the ILS market.

-

Seven of the nine cat bonds that came to market during Q1 had exposure to North America, showing that cedants were once more looking to secure deals ahead of the North Atlantic hurricane season on 1 June.

-

Industry loss warranty (ILW) broker Stefano Nicolini has joined the New York office of Beach & Associates after six years with BMS, according to his LinkedIn profile.

-

A $50.2mn cat bond lite issued on Kane's segregated cell platform has been de-listed from the Bermuda Stock Exchange after the notes were redeemed early.

-

Independent London broker Alston Gayler (AG) has added a PCS Turkey licence to facilitate industry loss warranty (ILW) trading of the risk

-

Aon Benfield Global ReSpecialty CEO Bob Bisset says retro products can flex further still...

-

Aon Benfield estimated that the indemnity retro market would expand by 6 percent in 2016 based on growth in the January renewals.

-

The London-listed Blue Capital Global Reinsurance Fund posted a total return of 9.6 percent including dividends for 2015, up from 8.8 percent in 2014.

-

The Tianjin port explosion may cause insured losses of $5bn-6bn of which half is likely to fall under marine claims, according to the International Union of Marine Insurance (IUMI)

-

The industry loss warranty (ILW) market witnessed rate reductions of about 5 percent in the January renewals, Guy Carpenter said in a client report obtained by Trading Risk.

-

Mortgage credit expansion; Perils releases Desmond estimates; Australian cats cost A$458mn; Twelve backs Eurovita debt raise; Fermat diversifies; Cat losses in 2015; £20bn longevity forecast

-

Gross catastrophe bond yields ended 2015 up almost 10 percent from December 2014, according to RMS data.

-

Lane Financial analysts Morton Lane and Roger Beckwith said that ILS prices are likely continue to "wander sideways" in the absence of any shock events, as the firm's rate-on-line index finished 2015 up just under one percent from a year earlier.

-

PCS is investigating the possibility of structuring a parametric trigger for terrorism industry loss warranties (ILWs), the agency revealed in its 2015 ILS market report released today (6 January).

-

Loss reporting agency Perils has extended its coverage to include Turkey, the company announced today (25 November).

-

Retro and ILW executive Nick Duffin has transferred from the London office of JLT Re to join JLT Bermuda Ltd. as a partner, the reinsurance broker announced today (24 November).

-

The growth of the "cat bond lite" market provides a blueprint for potential uptake of exchange-traded risk, ISO/Verisk executive Tom Johansmeyer argued at last week's ILS Bermuda Convergence 2015 conference.

-

The founder of the Chicago Climate Exchange, Richard Sandor, has said he believes the time is right for the reinsurance market to make another attempt at trading risk as a commodity.

-

Rates for US all natural perils (ANP) industry loss warranties (ILWs) have fallen by an average 12 percent from their mid-year peak, according to data from broker BMS.

-

Florida managing general agency New Paradigm Group has expanded its parametric product offering to target (re)insurers as well as ultimate buyers.

-

The Swiss Re Cat Bond Price Return Index has almost reached the values recorded at the start of 2015 after posting a 1.7 percent upswing since mid-July.

-

Liquidity in the burgeoning market for private cat bonds and cat bond lite instruments remains limited, but commentators are hopeful that the situation should improve.

-

Lane Financial's ILS rate-on-line index dropped 9.9 percent over the third quarter, eroding a brief gain recorded in the second quarter, as average expected returns reached a new low.

-

TigerRisk CEO Rod Fox said an "anomaly" in retro markets, in terms of high prices and a limited number of sellers, presented opportunities to retro writers.

-

Xchanging has enhanced its reinsurance placement platform, newly branded as X-gRm, to offer a live marketplace for indexed products including ILWs.

-

Aspen Re has hired Christian Dunleavy from Axis Re to become head of global property catastrophe effective immediately, the company announced today (8 September).

-

Guy Carpenter has estimated that total insured losses from the Tianjin port explosion could range from $1.64bn to $3.25bn, according to a client report obtained by sister title The Insurance Insider.

-

Consolidation in the reinsurance industry is contributing to an uptick in demand for retro cover in 2015, although the impact is expected to be short-lived.

-

ILS funds gained an average of 0.4 percent in July, lagging the 10-year monthly average of 0.62 percent, according to the Eurekahedge ILS Advisers Index.

-

Swiss private bank Banque Heritage and London-based ILS fund manager Coriolis Capital are setting up a UCITS catastrophe bond fund, Heritam Equinox, the companies confirmed.

-

Insured losses from the Tianjin port explosions that occurred last week (13 August) could be in the region of $1bn-$1.5bn, with the marine (re)insurance market potentially on the hook to pick up a significant portion of claims.

-

Catco said that it expects its 2015 returns to come in ahead of the 14 percent gain reported in 2014, after running free of claims in the first half

-

Nephila Capital was among the new participants on the reinsurance panel for the African Risk Capacity (ARC) initiative this year, the fund manager announced.

-

Allied World increased property catastrophe reinsurance coverage for its 1 May programme, buying additional cover for world-wide and North American perils as well as purchasing new industry loss warranty cover.

-

Property catastrophe rate reductions continued to slow in the 1 July renewals, with collateralised reinsurance markets one driver of the slowdown in peak zone softening, according to Willis Re.

-

The average ILS expected return recovered to 3.66 percent by June 2015, from a low of 2.36 percent in September 2014, according to secondary market data compiled by Lane Financial.

-

M&A activity has taken off in the reinsurance market over the past year - with integration at some merged companies well underway while the fraught battle between Axis and Exor for PartnerRe continues

-

Lane Financial's ILS rate-on-line index has continued its upward trend in 2015, increasing by 7 percent in the second quarter after its 1 percent climb in the first quarter.

-

US wind industry loss warranty (ILW) prices hardened over June this year, driven by increased demand from ILS funds and traditional reinsurers, according to Willis Re's 1st View report

-

Swiss investment manager Twelve Capital has issued its latest Dodeka cat bond lite, worth $19.1mn.

-

Nephila Capital is among the new buyers that have been trying out the indemnity retro market during the mid-year renewals, Trading Risk understands

-

Guy Carpenter said that the ILS market stabilised during the 1 June renewals, while rate reductions on traditional property catastrophe reinsurance slowed to the high single-digit range.

-

Guy Carpenter has unveiled two digital placement solutions on its new platform GC Exchange, which will target both the traditional and alternative reinsurance markets and government and public entities.

-

Omers to buy up to 29.9% of Brit; ABR Re launched at $800mn; Fidelis targets hybrid model; Hilti questions ILS expansion; Sola and Pennay platform live; Nephila to write $200mn premium; Below-average hurricane season forecast; Syndicate 2357 boosts premiums; Niklas costliest Q1 cat; Industrial loss index potential; Alternative backers for Icat SPS; Hannover Re lists $3.75mn lite bond; Refocus on risk mitigation

-

The technology-focused catastrophe broking and structuring firm Rewire Holdings, started by Stefano Sola and Richard Pennay, has launched its electronic platform Rewireconnect today (14 April).

-

The ILS market is sending signals that catastrophe rates have stopped falling and may be rising, Lane Financial said in its latest quarterly report on the market.

-

Nephila's Syndicate 2357 declared a profit of $7.9mn for 2014 following its first full year of underwriting, according to its annual results posted at Lloyd's.

-

The indemnity retro market is expected to supply about $12bn-$12.5bn of limit in 2015, which would be about $1bn higher than last year, market sources said

-

Catco hopes to release at least $12mn in capital set aside last year to cover potential hailstorm losses by the end of the first quarter of 2015, as the retro manager released its annual report for the Catco Reinsurance Opportunities Fund.

-

Two higher-risk deals from Scor and Catlin have taken total 2015 catastrophe bond volume to $824mn, in a more controlled start to the year than in 2014.

-

The Micrix industry loss warranty (ILW) index gained 12.3 percent over the course of 2014, falling behind the 2013 gain of 15.8 percent.

-

Retro writer CatCo recorded 14 percent growth in net asset value (NAV) last year for its London-listed fund.

-

Within the retro market, industry loss warranty (ILW) rates have been pared back to the point that many non-US contracts are now being quoted below expected loss cost using RMS-modelled figures, various market participants said.

-

Bermudian retro writer CatCo has made a 14 percent return over 2014 despite having reserved for a small loss due to US storm events in the second half of the year

-

Lane Financial's ILS rate-on-line index slipped by 1 percent during the fourth quarter, finishing 2014 at 86 - a drop of 7 percent from the 92.9 recorded a year earlier.

-

Barbican group CEO David Reeves said the Lloyd's insurer and the Credit Suisse ILS team may apply for full syndicate status for their newly approved special purpose syndicate (SPS) 6120

-

In a memorable year for the cat bond market, 2014 brought forth both the largest ever transaction and the lowest coupon deal amid a number of other milestones.

-

Canopius expects to recoup $10mn from a marine industry loss warranty (ILW) that will pay out after the total loss reserve for the Costa Concordia sinking nudged past the $2bn threshold, it is understood.

-

Canopius expects to recoup $10mn from a marine industry loss warranty (ILW) that will pay out after the total loss reserve for the Costa Concordia sinking nudged past the $2bn threshold, it's understood.

-

Independent (re)insurance broker Alwen Hough Johnson (AHJ) has received authorisation from the UK's Financial Conduct Authority for its new capital markets unit AHJ Capital Markets, according to an announcement today (20 November).

-

No hurricane options in 2014; Life expectancy changes to drive pension de-risking

-

Amid a very quiet third quarter for new ILS issuance, average premiums in the ILS and industry loss warranty (ILW) markets dropped by 9.5 percent, according to Lane Financial's rate-on-line index

-

A greater focus on parametric cat bonds could help make the ILS market more robust and avoid the problem of investors selling on risk, AIG's chief reinsurance officer Samir Shah suggested at the Trading Risk Monte Carlo roundtable.

-

The volumes of US-linked industry loss warranties (ILWs) traded in the first half of 2014 came to about $800mn as suppliers broadened the terms of their cover, according to estimates from Aon's Global Re Specialty unit

-

Average premiums in the ILS and ILW markets dropped by 9.5 percent during the third quarter, according to Lane Financial's rate-on-line index, as the market began softening again after just one quarter's respite from the downward trend.

-

Pioneer Investment Management has launched a new ILS fund offering that will invest in cat bonds and reinsurance quota share vehicles, according to Securities and Exchange Commission (SEC) filings.

-

The volume of Perils-based limits at risk has fallen 14 percent over the past year to $3.7bn, primarily due to a weaker trading environment of industry loss warranties, the European loss reporting agency said today (14 September).

-

Average ILS fund returns totalled 0.4 percent in July, the Eurekahedge ILS Advisers index shows.

-

Brit has expanded its catastrophe reinsurance in the first half of 2014 even as it cut back its spending on cover by 5 percent year-on-year to £152.6mn.

-

The Caribbean Catastrophe Risk Insurance Facility (CCRIF), through the World Bank, was one of eight new sponsors to come to the cat bond market in the first half of 2014, pushing total issuance volumes above $6bn

-

Average risk-adjusted premiums in the ILS and industry loss warranty (ILW) markets rose in the second quarter of 2014 following five consecutive quarters of reductions, broker dealer Lane Financial estimated in its latest market report.

-

Alleghany reinsurance subsidiary Transatlantic Holdings (TransRe) and the Pillar executive management have increased their respective stakes in Bermudian ILS manager Pillar Capital Management to 50 percent each.

-

Nephila Capital co-founders Frank Majors and Greg Hagood, along with long-time colleague Barney Schauble, were named the Outstanding Contributors of the Year at the 2014 Trading Risk Awards in London last night (19 June)

-

Bermudian reinsurers have taken advantage of falling rates and ceded a significantly higher proportion of their business to retro writers in the first quarter of 2014, according to analysis from sister publication Inside Data.

-

Florida reinsurance programmes renewed on average between 12.5 percent and 20 percent below 2013 levels, with retro rates falling by 15-20 percent, according to Guy Carpenter.

-

Swiss-based insurance investment manager Twelve Capital has issued its fourth cat bond lite, the $28mn Dodeka IV deal, including a tranche of risk exposed to Gulf of Mexico wind losses.

-

Montpelier Re's London-listed Blue Capital Global Reinsurance fund delivered an 0.47 percent increase to net asset value (NAV) over the first quarter of 2014, according to its latest interim management statement.

-

The Corporation of Lloyd's said in its latest three year plan that it will embrace the trend for growth in the convergence market, but that its presence in the property catastrophe reinsurance market could shrink in the future.

-

The Blue Capital Global Reinsurance Fund delivered an 11.8 percent increase in net asset value per share over the course of 2013, the company said as it released its annual results today.

-

Japanese earthquake industry loss warranty (ILW) covers have softened by 25 percent year-on-year at the $10bn trigger level, according to pricing sheets obtained by Trading Risk.

-

As the Australian state of Queensland braces itself ahead of Cyclone Ita, which is expected to hit its far north coast tomorrow (11 April), ILS investors are putting in opportunistic bids on some of the three cat bonds with potential exposure to the storm, Trading Risk understands.

-

ILS Advisers will launch a new public fund-of-funds in the ILS market tomorrow (1 April) with $21mn of commitments, the firm told Trading Risk.

-

A number of Bermudian reinsurers have significantly reduced their net probable maximum loss (PML) figures for major catastrophe events as of 1 January 2014 after topping up on retrocession cover, analysis by sister publication The Insurance Insider's Data Room shows.

-

JLT has completed the tie-up of its Bermudian reinsurance broking arms following the acquisition of Towers Watson's reinsurance broking business last year.

-

Swiss insurance investment manager Twelve Capital announced that it has issued its second cat bond lite, the $25mn Dodeka II deal

-

Axis Ventures, the new asset management unit formed by Axis Capital late last year, raised $50mn of third-party capital by the end of 2013.

-

ILW index posts 15.8% gain in 2013; Cavanagh calls for deeper derivatives; 2013 returns best since 2010; Falcon adds higher-return cat bond fund; Kane lists $50mn cat bond lite; Eskatos adds European exposure; Nephila 2357

-

Munich Re has projected that alternative reinsurance capital will grow from $44mn in 2012 to $59mn this year and up to $75mn by 2016 - representing annual growth of 14 percent over the four-year period

-

The reinsurance sector needs to develop a deeper synthetic market, Willis Re CEO John Cavanagh said this morning (6 February) at the InsiderScope London conference hosted by sister publication The Insurance Insider.

-

Kane's segregated accounts company has issued its largest private cat bond to date in a $50.12mn transaction, the company confirmed today.

-

London-listed ILS fund DCG Iris reported a total return of 2.2 percent in the six months to 30 November 2013, as the fund's manager said that it had boosted results by shifting into private reinsurance deals and reducing its cat bond holdings.

-

Lloyd's chairman John Nelson has said that the Lloyd's market can work with an influx of new investors to the (re)insurance market, so long as it keeps evolving its business model.

-

Centrum seeks ILS decoupling; Plenum leverages; Credit Suisse caution; Stone Ridge gains; Cat bond lite focus

-

Average premiums in the ILS and industry loss warranty (ILW) market continued to tumble in 2013, falling during the fourth quarter to levels last seen in 2005, according to broker-dealer Lane Financial.

-

Average premiums in the ILS and industry loss warranty (ILW) market fell below levels last seen in 2005 during the fourth quarter of 2013, according to broker-dealer Lane Financial.

-

Twelve Capital is set to launch its first private cat bond, Dodeka I, a $25mn US multi-peril deal that is expected to generate double-digit returns.

-

Three cat bond deals used data from the PCS Canada service in 2013, which demonstrated a surge in interest in Canadian risk on the ILS market, the loss compilation agency said in its latest market report.

-

Retrocession rates fell 25 percent at the 1 January renewals as the sector bore the brunt of pressure from an oversupply of reinsurance capital, Guy Carpenter said at a media briefing in London today (6 January).

-

Adam Beatty will take on the role of active underwriter for Nephila Capital's Syndicate 2357 at Lloyd's from 1 January, the company announced.

-

Early indications suggest that international property catastrophe reinsurance prices will soften by an average of 10-15 percent at the 1 January renewals.

-

Lloyd's insurer Catlin is returning to the cat bond market for the first time since 2008 and hopes to raise $175mn of aggregate industry loss-based cover from its new Galileo Re transaction, Trading Risk understands.

-

PCS and the Cayman Islands Stock Exchange have collaborated on a new project to trade industry loss warranty products.

-

Montpelier Re is seeking to list Blue Capital Reinsurance, a newly formed Bermudian company that will write collateralised reinsurance, in New York and Bermuda.

-

Securis Investment Partners has hired former Execution Re partner, Neil Strong, to head up business development in a drive by the fund manager to expand its global investor base.

-

DCG Iris Limited, the London-listed ILS fund, made a total return of close to 5 percent in its first year, as a strategic shift out of a softening catastrophe bond market helped offset modest losses from Superstorm Sandy and the 2012 US drought

-

Alternative capital inflows of almost $10bn have contributed 37 percent of the growth in global deployed reinsurance capital in the last 18 months, Guy Carpenter vice chairman David Priebe said as the 2013 Monte Carlo Rendez-Vous gets set to open tomorrow morning.

-

Lloyd's carrier Brit says it may seek opportunities in the convergence market through its newly launched branch office in Bermuda.

-

Lloyd's of London chairman John Nelson has warned that the influx of alternative capital could cause systemic problems in the insurance industry similar to those in the banking sector which sparked the financial crisis.

-

Independent (re)insurance broker BMS has appointed former Aon Benfield executive Romulo Braga to lead its new capital markets division BMS Capital Advisory in the US

-

Listed ILS fund DCG Iris reported an active month for cat bond trading in June as it moved out of several positions in order to lock in mark-to-market profits, according to its latest monthly report

-

The volume of industry loss warranties (ILWs) placed in the first half of 2013 fell by about 15-20 percent from 2012, Aon Benfield Securities estimated

-