-

The CEO and president said he expects to shrink the portfolio for retro-focussed sidecar Upsilon.

-

Performance declined at the reinsurer’s third-party ventures owing to Q3’s big cat events.

-

The two parties had previously negotiated a $9bn deal for the reinsurer last year, which was later scrapped.

-

The broker forecast ‘continuing growth momentum’ in the ILS market.

-

Cat losses have highlighted the importance of modelling for secondary perils, but there is room for optimism in the industry, panellists said at Trading Risk’s London ILS event.

-

Daniel Butzbaugh will work at the company’s New York office and lead its cat and industry loss warranty transactions.

-

The new generation of vehicles is driven by a lively legacy market and innovations in structuring deals for long-tail risk.

-

The state body supporting earthquake cover has seen risk transfer requirements swell over the past decade.

-

The Zurich-based ILS manager expects to be underwriting some specialty business from 2022.

-

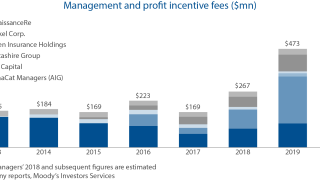

The convergence of traditional reinsurance and ILS has seen reinsurers’ fee income rocket over the past three years.

-

The lack of modelling expertise for higher-frequency, secondary ‘all peril’-type losses is putting a rosier tint on catastrophe bonds

-

Retro rates were in some cases falling by mid-year, ahead of the recent losses.