-

The LA wildfires resulted in the largest insured loss of the year, at $40bn.

-

November hailstorms and current storms and bushfires racked up claims.

-

The event is the second billion-dollar SCS event to hit the country within a month.

-

The influx of capital, combined with a quiet wind season, led to favorable conditions for cedants during 1.1 renewals.

-

Cedants pursued property renewals “aggressively” amid excess reinsurer capacity.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

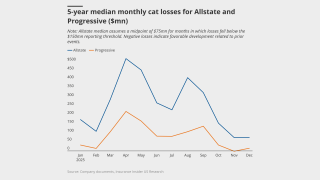

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Widespread underinsurance and low exposures will limit losses.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

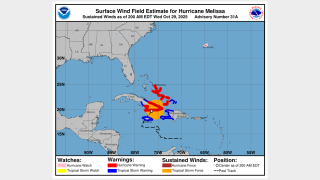

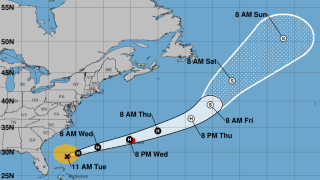

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Losses were primarily driven by personal property lines.

-

The sponsor extended two notes issued in 2022.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The figure updates an April estimate of EUR696mn.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The company said the reduction was due to years of steady improvements.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

Almost 50,000 people have been forced to evacuate.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

Tropical Cyclone Alfred and Queensland flooding brought thousands of claims.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

All 29 funds tracked by the index returned a positive performance.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Insured losses were the second highest on record for the first quarter.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

KCC is part of the CDI’s review into creating a public wildfire cat model for insurers.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The prediction comes after a highly active hurricane season in 2024.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The carrier has received 12,300 claims as of 28 March.

-

The event has caused widespread damage in Bangkok, Thailand.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Both syndicates also reported a deterioration in their combined ratios.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.