-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The storm outbreak follows similar events in the area in 2020 and 2023.

-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

The firm’s external AuM has grown by 175% from 2019 to $3.3bn in 2025.

-

Secondary market pricing implies the sponsor could recoup a total of $50mn on the 2022-1 A note.

-

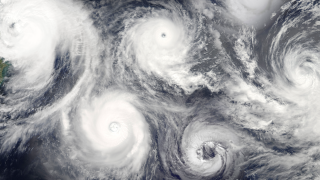

An “extraordinary” proportion of storms reached Category 5 status this year.

-

The peril has been historically difficult to model compared to others.

-

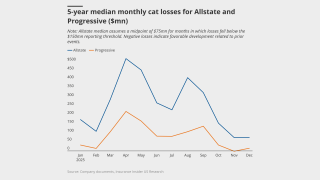

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

The shuttering of Munich Re Ventures reflected a focus on the reinsurer’s “core offering”.

-

The (re)insurer has a higher-than-average Jamaican market share.

-

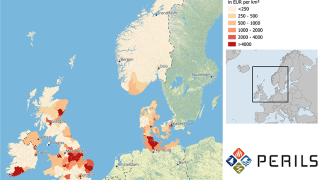

The largest net individual loss was January’s California wildfires at EUR615mn.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

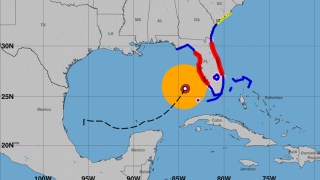

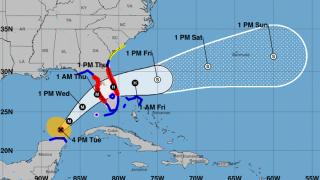

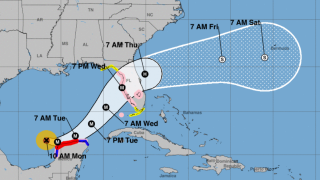

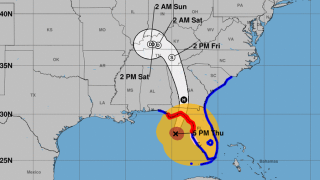

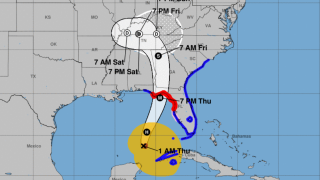

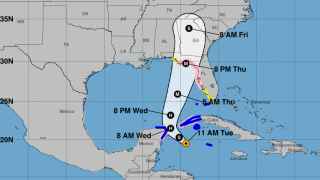

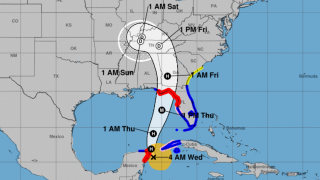

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

Widespread underinsurance and low exposures will limit losses.

-

Since 2007, the Caribbean country has received $100.9mn in payments from the CCRIF.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

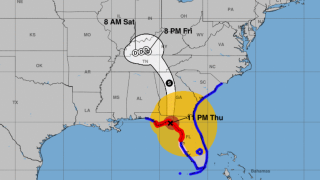

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

Central pressure of 900mb or below would trigger a full loss of the $150mn deal.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

Pricing on Friday implied a potential $45mn loss to the bond, before the storm outlook deteriorated.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The reinsurer stressed it “did not shy” from cat business in 2023.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The tropical cyclone is expected to be named Imelda.

-

Equivalent to a Category 5 hurricane, Ragasa is the world's strongest storm this year.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The major storm is set to move on to mainland China later in the week.

-

The economic loss from the event was around EUR7.6bn.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

Losses were primarily driven by personal property lines.

-

The sponsor extended two notes issued in 2022.

-

The volume of property cat aggregates placed grew 50% in 2025.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The ratings agency warned negative PYD on US casualty will likely continue.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

The firm has also updated the loss-calculation engines of existing Jeannie tools.

-

The group claims the White House is undermining disaster preparedness.

-

The US has been lucky over recent decades to avoid a $100bn insured hurricane event.

-

The estimate covers property and vehicle claims.

-

The firm booked net losses from the LA wildfires of EUR615.1mn in the first half.

-

ILS investors have fought shy of multi-peril aggs due to low confidence in SCS modelling.

-

Both organisations still predict an above-average hurricane season.

-

The sidecar took $19mn of cat losses relating to the California wildfires.

-

The forecast has increased since the early July update due to several additional factors.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

The firm attributed a 9% drop in reinsurance NWP partly to higher cession rates.

-

Millions are evacuating after one of the strongest earthquakes in modern history.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

Insured losses produced the second highest first-half tally since records began in 1980.

-

The figure updates an April estimate of EUR696mn.

-

The firm reported a net pre-tax cat loss of $414mn from January’s LA wildfires.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

The suit claims billions of dollars are being illegally withheld.

-

The US accounted for 92% of all global insured losses for the period.

-

US events accounted for more than 90% of global insured losses.

-

State legislation has led to major strides in rate adequacy.

-

We discuss progress in collateral management with our Outstanding Contributor winner.

-

Category 4 and 5 storms could become more common and hit further north.

-

Despite predicting fewer hurricanes, the numbers are still above average.

-

The weather-modelling agency is predicting a below-normal season.

-

This comes in at the lower end of the initial spread guidance of 725-775 bps.

-

The investment consultancy said yields increased in Q2 by less than could have been expected.

-

Ex-Tropical Cyclone Alfred has been the costliest event, with A$1.36bn in losses.

-

The company said the reduction was due to years of steady improvements.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

PCS's loss estimate for the March Missouri SCS pushed the bond beyond its exhaustion point.

-

The Californian insurer had a private deal, Randolph Re, that provided pure wildfire protection.

-

In April, the loss modeller pegged losses at A$2.57bn.

-

The loss has decreased by 0.3% since the company’s third assessment.

-

The number has expanded by around 40% from an earlier update, sources said.

-

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

The executive has 15 years of experience in meteorology and cat analytics.

-

HCI secured three towers with $3.5bn in XoL coverage.

-

The $2.59bn renewal is up 45% from last year.

-

Up to nine million acres of US land are considered likely to burn.

-

Last week, TSR updated its forecast and is now predicting above-average storm activity.

-

Most of the losses are attributable to a supercell storm in Texas.

-

The company also has $100mn for US hurricane events.

-

The Floridian also secured $352mn of multi-year coverage extending to 2027.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The deals covered Euro wind and Italy quake, Florida hurricane and a retro bond.

-

Almost 50,000 people have been forced to evacuate.

-

TSR previously predicted activity slightly below the 1995-2024 average.

-

SCS can no longer be considered a "secondary" peril for the US insurance market, Steve Bowen said.

-

The agency forecasts up to five major hurricanes and 19 named storms.

-

Two large storms hit the Midwest and Ohio Valley regions on 14-17 May and 18-20 May.

-

Tornadoes have killed at least 32 people in three states.

-

The targeted uplift comes after Mercury ceded nearly $1.3bn of wildfire losses to reinsurers in Q1.

-

The revision is significantly lower than the $4.5bn October estimate.

-

Wildfire losses from fronting and ILS activities were EUR438mn.

-

Tropical Cyclone Alfred and Queensland flooding brought thousands of claims.

-

Ark's combined ratio included 25 points of catastrophe losses in Q1.

-

CEO Thierry Léger expects overall P&C pricing to be “stable” through 2025.

-

The insurer has not decided whether to sell its Eaton subrogation rights.

-

The CEO said private ILS funds can generate additional returns of 10%-20%.

-

Richard Pennay also addressed the dip in cyber ILS activity.

-

Private ILS would benefit from extension spreads to manage investor concerns, the CEO argued.

-

All 29 funds tracked by the index returned a positive performance.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

Six weeks after the storm, Perils released its first industry-loss estimate at EUR619mn.

-

January’s California wildfires meant third-party investors suffered a loss of $195.3mn.

-

The storm made landfall in Queensland, Australia at the beginning of March.

-

SCS losses were also above average in Q1 due to “lingering” La Niña conditions.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

Insured losses were the second highest on record for the first quarter.

-

The industry loss data provider also increased its estimate for Hurricane Helene to $15.3bn.

-

KCC is part of the CDI’s review into creating a public wildfire cat model for insurers.

-

The sponsor is estimating a loss of ~$300mn in relation to one of last month’s US tornado events.

-

Despite wildfires, reinsurers are “well positioned to maintain strong profitability in 2025”.

-

The prediction comes after a highly active hurricane season in 2024.

-

Colorado State University is predicting 17 named storms, nine hurricanes and four major hurricanes.

-

Losses stemmed from ex-Tropical Cyclone Alfred and North Queensland flooding.

-

The carrier has received 12,300 claims as of 28 March.

-

The event has caused widespread damage in Bangkok, Thailand.

-

Cat losses last month were lighter than historical trends, but all eyes are on Q1 figures.

-

The March 13-16 storms would mark the first billion-dollar US SCS event of the year.

-

MAP’s Christopher Smelt said impact on nationwide programmes will cause risk aversion.

-

Both syndicates also reported a deterioration in their combined ratios.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

Sources warned some property XoL books are already running 50% loss ratios.

-

The cat bond manager warned of excess downside risk owing to an accumulation of losses.

-

The insurance industry has experienced mounting losses from severe convective storms.

-

Premiums ceded to the ILS vehicle increased by 76% to $433mn.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

Island appetite remains stable, but early 2025 loss activity has injected fresh uncertainty.

-

The largest individual net loss at EUR230mn was caused by Hurricane Milton.

-

The bond was trading at around 12.3c on the dollar in the secondary market last month.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

Both carriers have extensive reinsurance coverage.

-

This came as the market’s underwriting profit dipped 10% for 2024.

-

Almost 300,000 people have been left without power from the storm.

-

This loss number covers the property line of business.

-

There is the potential for cat bond H1 issuance to be a record breaking six months.

-

As of 14 February, the company received 405 claims.

-

The London D&F market will shoulder most of the losses.

-

The reinsurer pegged the market loss at $40bn.

-

The carrier pegged its LA wildfire losses at EUR140mn.

-

Dispersion of returns was high, with the range 0.87% to -3.71%.

-

The programme structure was expanded, but it is unclear what percentage was placed.

-

The cost of reinstatement was included in $170mn wildfire net loss figure.

-

Climate change and other loss impacts were not adequately incorporated, sources said.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

HCI will now consist of two operating units – the other being its four underwriting entities.

-

ILS is delivering “a growing contribution” to the group, according to CEO Cloutier.

-

State Farm General has asked California regulators for an emergency rate increase.

-

There was a slight increase in DaVinci and Fontana from 31 December 2024 to 1 January 2025.

-

The firm reported record fee income of $128.2mn in 2024, up 26%.

-

Comments came as universal reported a 4.2 CoR jump to 107.9% in Q4.

-

Hurricane Milton accounted for 60% of the firm’s Q4 large loss tally.

-

The carrier expects the market loss to land at $35bn-40bn.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The conglomerate reported after-tax cat losses of $1.2bn related to Hurricanes Helene and Milton in 2024.

-

Several Florida start-ups are poised to begin writing business this year.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

Wildfire loss ‘serves as a strong reminder not to unwind hard-fought for rates and terms’, the executive said.

-

Total combined losses for the agency’s Helene and Milton estimates stand at $31.8bn.

-

The carrier said 72% of those losses occurred in personal property.

-

A higher loss quantum will put a greater burden on retro programmes.

-

The estimate is net of its per-occurrence reinsurance program and gross of tax.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Wildfire is rarely singled out as an exposure that can shift portfolio outcomes.

-

The fall marks this the first time in 20 years the index has been negative in January.

-

More than 33,000 claims had been filed as of 5 February.

-

The firm will match segregated accounts of portfolios to investor mandates.

-

The carrier is “extremely well capitalised” to achieve its strategic ambitions.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

The company will ‘aggressively pursue subrogation’ for the Eaton Fire.

-

The LA fires ‘demonstrate the magnitude of tail events not well captured in modelling’.

-

Ultimate losses from the Palisades, Eaton and Hurst fires are estimated at $4bn.

-

The LA-based firm estimated gross cat losses in the range of $1.6bn-$2bn.

-

The role at PCS included acting as primary touchpoint for ILS.

-

The carrier’s reinsurance premiums ceded rose by 32% to $3.4bn in 2024.

-

CFP has a $900mn reinsurance attachment point and is still receiving claims daily.

-

The storm is likely to be one of the costliest weather events in Canadian history.

-

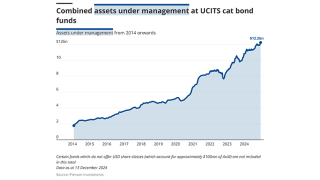

AuM remains generally flat at UCITS funds over the weeks since LA fires started.

-

FY24 disclosures show shifting fortunes at reinsurer ILS platforms.

-

Over 2024, four hurricanes added 13 points of cat-loss impact to the combined ratio.

-

But cat bonds are experiencing negative secondary market price movement.

-

The carrier is likely to exceed its Q1 large-loss budget due to the California wildfires.

-

The carrier disclosed it will book $1.1bn in net losses from the California fires.

-

The group ceded 55% more premium to Nephila over the year at $1.3bn.

-

The carrier has been reducing its presence in the state since 2007.

-

The carrier has recognised two separate losses for the Palisades and Eaton fires.

-

The company says the recent wildfires will be the costliest in its history.

-

Programs did not offer adequate risk-adjusted return.

-

Capital inflows, notably into UCITS funds, and accumulated returns supported issuance of $17.2bn in 2024.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

A negative January return will be unprecedented for ILS industry.

-

The company’s reinsurance business also has some exposure, the executive said.

-

The index delivered a total return of 1.29% for the month of December.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

Axis Capital’s fee income from strategic capital partners grew 39% to $85mn in the year to 31 December 2024, up from $61mn the year prior, the firm’s Q4 earnings release said.

-

The bond went on watch after Mercury said it would exceed its $150mn retention.

-

The Floridian also expects to report its “best earnings quarter” for Q4 2024.

-

Models will need to steepen the curve in the tail to reflect severe event frequency.

-

Non-proportional business accounted for 34% of its total.

-

-

The figure does not include specie or auto losses.

-

Secondary pricing on the carrier’s Topanga Re bond partly recovered following the guidance.

-

The carrier also has a $500mn excess $2.4bn aggregate protection.

-

The company received over 10,100 home and auto claims as of January 27.

-

Compared with its initial figure, CatIQ’s latest estimate has increased by 40%.

-

Secondary market pricing indicated anticipated California wildfire losses.

-

Guy Carpenter said personal lines exposure would account for 85% of the aggregate loss.

-

Fitch said 1Q wildfire losses could add 6% to 10% to Mercury’s CoR.

-

The industry loss number has increased threefold from an initial $5bn pick.

-

The total includes fire and smoke damage plus living expenses for evacuees.

-

The fire started Wednesday morning and is currently 0% contained.

-

Total economic losses were $368bn, 14% above the 21st century average.

-

The carrier’s Milton loss came in below expectations, but its fire claims will be “material” in Q1.

-

Losses from the larger fire will amount to $20bn-$25bn, the modeller said.

-

Most carriers paid more in homeowners’ claims than they collected in premiums.

-

Severe convective storms accounted for 41% of last year’s insured loss load.

-

Two 2021 worldwide aggregate ILW notes are also among the markdowns.

-

The carrier can claim separately for the Palisades and Eaton fires if necessary.

-

The carrier has received more than 3,600 claims from LA wildfires.

-

There are many unknown factors including insurance gaps, high-value property and damage to critical infrastructure.

-

The estimate has reduced slightly since the modeler’s last update in October.

-

The fund returned 15.69% in calendar year 2024.

-

The anticipated portion ceded to reinsurance may reach the mid-to-high single-digit billions, it added.

-

This will be the most expensive fire in the state’s history, it said.

-

A $30bn industry loss would use one-third of Big Four’s 2025 cat budgets.

-

ILS managers expect the losses to have some impact on future cat bond spreads.

-

The reinsurance attaches at $7bn, unchanged for the past two years.

-

Sources say the Fair Plan is under-reserved, leading to the possibility of member assessment.

-

The carrier is the largest writer of homeowners’ multi-peril in the state.

-

CEO Cerio highlighted changes that allowed the insurer of last resort to combine commercial, coastal and personal lines.

-

As fires still rage, many fear early $10bn-$20bn estimates were too optimistic.

-

The 2024 loss figure exceeded that of the previous record of C$6.2bn in 2016.

-

The Palisades fire is estimated at $9bn-$12bn, while Eaton is $6bn-$8bn.

-

The index’s performance in November was stronger than the prior year, although YTD returns are behind 2023.

-

Utilities have faced major liabilities for their involvement in starting wildfires.

-

Investigators are homing in on the likely causes of the incidents.

-

The number of structures damaged may put the event on par with the fires of 2017 and 2018.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Sources say 2025 could be as costly for wildfires as the $20bn-loss years of 2017-18.

-

Total economic and insured losses are “virtually certain” to reach into the billions.

-

AM Best said it expects insured losses from the California wildfires to be “significant”.

-

This could see it surpass the 2017 Camp Fire, which cost around $12.2bn.

-

Plenum said impact is marginal because wildfire contributes only marginally to the risk of bonds.

-

Moody’s also expects losses in the billions of dollars.

-

Six wildfires are now burning in SoCal, with the Palisades fire being the largest.

-

Six fires now cover more than 27,000 acres across Southern California.

-

Hurricane Milton resulted in the largest insured loss of the year at $25bn.

-

The fast-moving blazes have prompted evacuations across the city.

-

More than 4,000 acres are burning as thousands evacuate.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

The multi-day weather outbreak caused widespread damage from Texas to the Carolinas.

-

The largest non-US event in 2024 was the catastrophic flooding in Valencia.

-

Cat bonds were a key supply-side driver at 1 January 2025.

-

The UCITS cat bond segment has added 54% in AuM since Hurricane Ian.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

Casualty ILS made inroads, while hurricane hedging strategies came into focus.

-

The storms struck Victoria, New South Wales and Queensland.

-

Most of the industry losses occurred in Austria, the Czech Republic and Poland.

-

The company no longer has any exposure to reinsurance contracts.

-

The regulations are part of a state effort to expand wildfire coverage.

-

Overall, reinsurers accepted that rate cuts were still leaving them with strong margins.

-

The reinsurer said investors were interested in expanding after benefiting from good results.

-

The bond will provide multi-peril coverage in the US and District of Columbia.

-

TSR anticipates that next year will see an ACE value of 129 compared with the 30-year norm of 122.

-

The state reinsurer of last resort discussed options for 2025 reinsurance buying strategy.

-

Former ILS investors who left the space have looked again and re-allocated.

-

Losses are concentrated in the states of Baden-Wuerttemberg and Bavaria.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

The carrier attributed the intensification of storms this season to climate change.

-

Lloyd’s has taken around 6% of aggregate US hurricane losses in recent years, and disclosed estimated net losses from Helene and Milton of $1.8bn to $3.4bn.

-

Losses from Hurricane Milton are expected to affect only select junior structures.

-

The 2024 hurricane season stayed within predictions for high activity but lacked market-moving events.

-

The Class B notes on the carrier’s debut deal attach at $500mn of losses.

-

Euler ILS Partners and Tropical Storm Risk teamed up to produce an updated version of an earlier study.

-

The bond is split into three tranches of notes.

-

The loss figure has increased 200% from the initial number provided in October.

-

Moderate impacts to ILS returns are anticipated from Hurricane Milton.

-

The association’s Hurricane Beryl net loss stood at $455mn as of 30 September.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

It is targeting $25mn GWP this year and $50mn GWP in 2025.

-

The floods add to an already historic loss tally for Canada in 2024.

-

Helene losses were spread wider than initially suggested, in contrast to Milton claims.

-

The ILS unit’s AuM was higher by $100mn compared to $1.9bn as of 30 June.

-

Twia’s SCS losses in Q1-Q3 2024 have been more than double the budgeted amount.

-

The reinsurer took $743mn of nat-cat losses in the quarter.

-

The firm recorded a 13.3% nat cat impact to the P&C combined ratio.

-

Fema's traditional reinsurance programme will attach at losses of $7bn and above.

-

The model factors in the effects of climate change to date.

-

A total of $2.1bn in Fema money has been approved for the state.

-

The reinsurer confirmed its intention to reduce the K-Cession sidecar for 2025.

-

The failure of a Jamaica bond to pay out following Hurricane Beryl damage has brought focus onto the deals.

-

The Florida carrier reported a 103.5% combined ratio in Q3.

-

In other property, Helene and Milton will assure rates remain attractive, he added.

-

The carrier said it expected its Milton losses to fall below its EUR500mn ($537mn) Helene loss.

-

Only around EUR70mn-EUR140mn will fall to private insurers.

-

The firm’s AuM in four key vehicles rose $526mn in Q3.

-

The firm sees a "robust" pipeline of potential investors ahead of the renewals.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

Ceded losses grew by 69.2% in Q3 from the prior year quarter to $44mn.

-

The combined ratio included 17 points of catastrophe losses in the third quarter.

-

CEO Adrian Cox said Beazley’s recent $290mn ILW purchase was not driven by “capital flexibility in and of itself”.

-

Most of the losses derive from France.

-

Latest pricing suggests secondary market traders are baking in further loss development.

-

The firm will provide an update on 22 November to avoid holiday season.

-

September was the strongest performing month since the index began in 2006.

-

The low PCS number is presenting a challenge for ILW buyers and sellers.

-

The firm is also integrating changes to its process to allow it to cover wider ground.

-

The commercial carrier also reported a Hurricane Milton pre-tax net loss forecast of $250mn-$300mn.

-

The estimate implies a roughly $15bn homeowners’ industry loss from the hurricane.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The figures imply first-layer reinsurance recoveries for Helene.

-

The company’s reinsurance premiums ceded fell by 58% to $149mn.

-

The NFIP’s traditional reinsurance coverage kicks in at $7bn of losses.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

Insured losses for 9M 2024 have hit $102bn, according to a report.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

The carrier’s estimated pre-tax losses from Milton are $65mn to $110mn.

-

The cyclone pool received $479mn in GWP in the year to 30 June 2024.

-

The carrier is looking at a $600-$900mn hit from Debby, Helene, Milton.

-

Pricing is expected to “stay neutral of soften” for January renewals.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

The firm still expects to deliver positive net income for Q3 2024.

-

Assuming Munich Re takes roughly a 3% market share of hurricane losses suggests a ~$20bn industry loss for Helene.

-

As a result of mostly flooding, £495mn ($644mn) of losses occurred in the UK.

-

Managers expect Hurricane Milton losses to shore up pricing.

-

Many in the ILS sector are bullish on Milton losses falling at the lower end of earnings impacts.

-

Losses from the hurricane may not significantly impact on many funds’ annual returns.

-

Earlier this week, RMS estimated insured losses for Helene and Milton at $35bn-$55bn.

-

Florida domestics, aggregate retro and flood deals were all marked down.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

HCI is estimated to incur a net expense of $125mn for Milton in Q4 2024.

-

Most of the insured loss was attributable to wind.

-

Icosa said certain cat bonds could see more than 0.2 points of price movement.

-

Twia filed for the rate hike in August after an actuarial analysis showed that rates were inadequate.

-

The company incurred $563mn of total cat losses related to the storm.

-

The bulls expect around $20bn-$30bn in Milton losses, with the bears anticipating $40bn-$50bn.

-

The estimate includes private cover for residential, commercial and industrial property.

-

RMS will issue its final loss estimates for Milton later this week.

-

Plenum said wind damage from Milton could lead to “moderate” losses for its cat-bond funds.

-

Hurricane Milton will show the ILS product behaving as investors expect it to.

-

The company is monitoring the NFIP’s flood-exposed bonds.

-

This is a far narrower drop than post Ian, when the index was lost 10%.

-

A client presentation from the broker put total insured losses at $25bn-$40bn, leaving the Citizens and the National Flood Insurance Programs clear of reinsurance impacts.

-

Milton made landfall near Siesta Key yesterday, leaving 2.7 million homes without power.

-

Losses to the NFIP-sponsored cat bonds remains a key area of uncertainty, the investment manager reported.

-

A $40bn Milton loss should barely dent many ILS returns but will trap some capital.

-

On Wednesday, the model had suggested a mean figure at $25.3bn.

-

The hurricane is likely to prevent rate reductions in property cat in 2025.

-

The event has spared (re)insurers the more extreme scenarios that were under discussion earlier this week.

-

Milton made landfall south of Tampa Bay at Category 3 on Wednesday night.

-

This is based on insured loss estimates of between $20bn and $60bn.

-

The pre-landfall figures are not an official loss estimate from the modeller.

-

The hurricane has destroyed hundreds of homes and left more than 2.7 million homes without power in Florida.

-

Milton’s center is projected to make landfall near or just south of Tampa Bay.

-

Integrity Re 2024-D and Lightning Re 2023-1A are two bonds that were marked down, although no trading has occurred.

-

The NHC storm track predicts landfall below Sarasota, south of Tampa Bay.

-

Hurricane Milton’s overall impact, based on the current pre-landfall scenario, could lead to “moderate losses” for Plenum’s funds.

-

Collateralised reinsurance and retro are in the firing line.

-

The government-backed scheme has greater take-up in areas in Milton’s path.

-

Restrengthening to Category 5 is still possible, Siffert warns.

-

Earlier this week, Moody’s RMS Event Response estimated the event would cost $8bn-$14bn.

-

Prior forecasts indicated a more northward track towards Tampa Bay and St Petersburg.

-

The storm is now predicted to make landfall south of Tampa Bay.

-

The NHC is predicting storm surge, exacerbated by the tide, as high as 15 ft for Tampa Bay.

-

The Mexican cat bond offers $125mn of protection against Atlantic named storms.

-

A hurricane warning has been issued for the east coast of Florida.

-

Most sources noted expectations of a $50bn+ event, but the range of outcomes is huge.

-

Hurricane Milton strengthened from a tropical storm on Sunday to a Category 5 storm yesterday.

-

Destructive storm surge is expected along Florida’s West Coast on Wednesday.

-

The panelists discussed the ILS reset and the path to maintaining discipline in this sector.

-

Moody’s also predicts losses to the NFIP at potentially more than $2bn.

-

The storm is packing maximum sustained winds of 175mph.

-

Milton is expected to move north of the Yucatan Peninsula today and cross the eastern Gulf of Mexico by Wednesday.

-

Parts of the Yucatan peninsula are under a hurricane warning, though the storm is expected to remain offshore.

-

The NFIP’s losses are estimated at $4.5bn-$6.5bn.

-

Experts have raised concerns over significant rainfall, record-setting storm surge and lingering Hurricane Helene debris.

-

The “exceptionally large and powerful” Category 4 storm made landfall in Florida last month.

-

Rising sea levels and ocean warming were likely factors in Helene’s strength.

-

The figure does not include NFIP losses.

-

Most of the estimated insured losses will be retained by insurers.

-

The loss estimate covers Czechia, Poland and Austria.

-

Key floods this year outside of the US include the Rio Grande do Sul.

-

The biggest limitation to growth is supply, given ILS capital “reticence” after the 2016-22 years.

-

Praedicat CEO Bob Reville outlined the firm’s approach to "casualty cat" as liability risk modeling continues to mature.

-

The numbers will be refined further to arrive at an industry loss estimate.

-

Moody’s described Hurricane Helene as “like Idalia but worse”.

-

The storm made landfall as a major hurricane in Florida’s Big Bend region.

-

The ratings agency expects insured losses of around $5bn for Helene.

-

The manager is hopeful of closing all contracts by the end of 2024.

-

Tallahassee avoided a major hit – but flood and storm-surge losses remain unknown.

-

The NFIP has a higher take-up rate in Tampa Bay, which experienced record coastal storm surge.

-

Helene is expected to become a post-tropical low later today.

-

Aon estimated losses for the Czech Republic at EUR775mn, Austria EUR555mn, Poland EUR285mn and Slovakia EUR33mn.

-

More than one million Floridians are without power after the storm hit.

-

Additional strengthening is expected before Helene makes landfall in Florida tonight.

-

Only three storms have impacted a larger area than Helene since 1998.

-

An unexpected shift east towards Tampa could push losses beyond $10bn.

-

TSR predicts Atlanta, Georgia, could face Cat 1 windspeeds as the storm moves further inland.

-

The storm is expected to make landfall in Florida’s Big Bend coast on Thursday evening.

-

Helene is currently a Category 1, but rapid strengthening is anticipated over the next day.

-

The ILS manager expects “minimal, if any, losses” to bonds in its funds.

-

In the best-case scenario, a Big Bend-landing storm could cost $3bn-$5bn, Howden Re said.

-

A hurricane warning is in effect from the Anclote River to Mexico Beach, Florida.

-

A storm surge warning is in effect from Flamingo to Indian Pass.

-

The storm could become a major hurricane by Thursday.

-

July and August floods and fires caused the bulk of the insured loss burden.

-

Severe convective storms accounted for 60% of H1 global cat losses.

-

The system is forming in the same area as 2022’s Hurricane Ian.

-

The ETF format provides for publication of a daily NAV.

-

Fifteen events caused estimated losses of $306mn.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The broker replaces Goldman Sachs on the business after the bank ceased offering ILS services.

-

Moody’s also predicts losses to the NFIP at less than $200mn.

-

The effort will draw from California’s research and higher education communities.

-

The estimate is like others in the market, suggesting a relatively small loss from the event.

-

The hurricane has led to a “surge” in insurance claims related to floods, according to the IBC.

-

The ratings agency said companies focused on growing business in Gulf Coast states, however, would face a “key test” as claims materialised.

-

A sub-$3bn industry insured loss event would be similar to estimates for hurricanes Beryl and Debby.

-

Francine has been the eighth Category 2 or larger storm to make landfall in Louisiana since 2000.

-

The sponsor has kept $25mn of principal in extension for any further loss development.

-

The storm is expected to weaken to a post-tropical cyclone later tonight.

-

Kin’s reinsurance structuring means the bond’s losses will be kept to a minimum.

-

‘Life-threatening’ storm surge and hurricane-force winds expected for the state, according to the NHC.

-

Francine is expected to make landfall in Louisiana tomorrow.

-

The estimate from the Perils-owned company does not include any losses from Hurricane Debby.

-

A hurricane watch is now in effect for the Louisiana coastline.

-

Most of the ILS capital was attracted to the cat bond market.

-

Cat bond funds continue to draw interest as private ILS more challenged.

-

Some Canadian cedants have approached the market for top-up cover.

-

The loss has increased by 1.4% since the company’s first assessment.