-

According to the reinsurer at least EUR275mn will be covered directly by CCR under public reinsurance.

-

The carrier’s combined ratio deteriorated by 10.9 points to 101%.

-

Perils estimated the loss at EU377mn six weeks after the event and at EUR488mn three months after.

-

The Zurich-based ILS manager has grown the fund by around 167% from $150mn as of mid-2021.

-

The hurricane season featured 20 named storms, seven hurricanes, three intense hurricanes and an ACE index of 146, according to Tropical Storm Risk.

-

The second iteration of the Bermuda sidecar has brought in additional investors.

-

The business will service clients in the agriculture, renewable energy and construction industries.

-

All 50 US states and the District of Columbia are covered by the bond.

-

Google DeepMind developers recently said in a peer-reviewed paper that the model "marks a turning point in weather forecasting”.

-

Analysis by Lane Financial concluded that ILS returns will likely be double-digit-to-high-teens in 2024.

-

The number of disasters costing $1bn or more during the period is the highest on record.

-

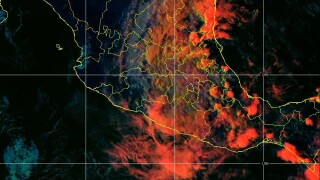

Aon-owned Mexican cat modeler ERN estimated Otis insured wind losses, excluding auto and infrastructure, at $1.2bn-$1.8bn.