-

“That’s one of the things we're monitoring ... but I think there are positive signs in the marketplace that litigation is down,” Garateix told analysts on the company’s third-quarter earnings call.

-

The storm caused significant damage to homes and businesses as gusts reached over 100 mph and resulted in widespread flooding.

-

ILS Advisers Index returns 1.23% in August, taking YTD gains to 10.75%.

-

The storm caused significant wind damage and flooding across parts of Scotland and England.

-

The ILS firm reported $6.8bn of assets under management at the third-quarter mark.

-

The carrier returned $369mn of capital to third-party investors in Q3 from investors in the Upsilon and Vermeer vehicles.

-

Up-to-date building codes could reduce the amount insurers pay in the Caribbean by 18%, according to the risk modeller.

-

Verisk said the majority of the insured losses can be attributed to wind damage.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

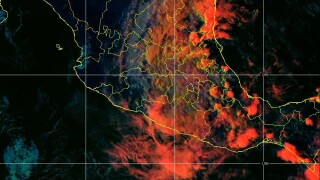

The ratings agency also said economic and insured losses caused by Otis have reached $16bn.

-

More than three-quarters of local exposure is ceded to highly rated reinsurers through excess of loss protection, according to the rating agency.

-

The firm entered new aggregate excess of loss reinsurance contracts in 2023 that have multiple layers of coverage.