-

Sources added that the company will continue to monitor portfolio performance to reopen business on a state-by-state basis.

-

The latest estimates peg the fires as the second largest loss event in the state’s history, second only to Hurricane Iniki in 1992.

-

Demex said its RCR Re platform enables cedants to buy reinsurance for secondary peril risks that aggregate over time.

-

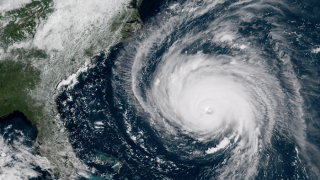

Most forecasters now predict above-average storm activity for the Atlantic as a result of record-high sea-surface temperatures.

-

Primary writers of homeowners and commercial property are exposed, while reinsurers could face wildfire losses.

-

Primary market, reinsurance and ILS will all need to prove themselves before capital flows back in, said LCM CEO Paul Gregory.

-

At least six aggregate bonds offering convective storm cover have been marked down by around an average of more than 20% on the secondary market.

-

The modelling agent estimated that the total number of buildings within the fire perimeter is approximately 3,500.

-

Thursday’s update pegs the likelihood of near-normal activity at just 25%, a decline from the 40% chance outlined in May's outlook.

-

Tens of thousands of people have been evacuated from the island, and nearly 14,000 Maui residents remain without power.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

The executive also lambasted the growing tide of corporate regulation in Germany and the EU.